Evaluating Whether the Department of Commerce’s Economic Development Transparency Database Includes the Required Information and Functionality (Limited-Scope)

Introduction

Senator Mike Thompson, Senator Caryn Tyson, Representative Kristey Williams, and Representative Sean Tarwater requested this limited-scope audit, which was initially authorized by the Legislative Post Audit Committee on July 6, 2023 and re-authorized at its April 24, 2024 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- Does the Department of Commerce’s economic development transparency database meet the requirements in state law?

To answer this question, we reviewed state statutes to understand the information that’s required for the transparency database. We then reviewed the transparency database to determine whether it met these requirements. Specifically, we evaluated whether the database included all expected functionality and economic development programs. For 5 judgmentally selected programs, we also evaluated whether the database contained 11 statutory program-level requirements. For 4-5 selected entries for each of the 5 programs, we reviewed whether the records contained 8 statutory recipient-level requirements. Lastly, we met with Department of Commerce officials to ask them about the preliminary findings we had identified. More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

The department updated the database at various points during our review period (September 24 through November 7, 2024) and may have updated it since. For that reason, some of the results of our work may no longer reflect the current state of the database.

We had 2 recommendations for this audit, 1 of which was directed at the Department of Commerce. The department rejected this recommendation.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on the audit objectives. Audit standards require us to report limitations on the reliability or validity of our evidence. In this audit, we were not asked to verify the accuracy of the information on the transparency database since this was a limited-scope audit. As a result, we cannot comment on the accuracy of the database.

The Department of Commerce’s transparency database does not contain some required economic development programs and is missing certain program and recipient-level information.

Background

The Department of Commerce is responsible for developing and maintaining the economic development transparency database.

- In 2019, the Kansas Legislature passed legislation for the creation of an economic development incentive program database. This database is commonly known as the “transparency database.” It must contain information about numerous economic incentive programs and recipients in Kansas. The intent of the transparency database is to provide the public with information about economic development programs and recipients.

- The Department of Commerce is responsible for developing and maintaining the transparency database. The law requires the department to collect certain data from economic development incentive programs for the database. It must update the database annually to include new information about incentive programs and recipients. The department also must report to various legislative committees regarding the database and its programs annually.

- The Department of Commerce does not administer all of the economic incentive programs required for the database. Some programs, like tax credits, are administered by other state agencies like the Department of Revenue or the Kansas Insurance Department. Regardless, the Department of Commerce is responsible for including and maintaining all required incentive programs in its transparency database.

The database must include information about numerous economic development incentive programs.

- K.S.A. 74-50,226 requires the transparency database to include information about economic development incentive programs. This includes economic programs administered by the Department of Commerce, tax credit programs administered by other state agencies, and other programs such as property tax exemptions and revenue bonds. We will refer to these as “incentive programs” for the remainder of this report.

- The law does not require programs providing less than $50,000 in annual incentives to be included in the database. Similarly, there are exemptions for specific tax credit programs known as “social and domestic” tax credits.

- Statute outlines several pieces of information that the database must include for each incentive program. This includes program purposes and goals, history, applications, total incentives, return on investment, and more.

There are additional statutory requirements for information about incentive program recipients.

- K.S.A. 74-50,227 requires the transparency database to include information about individual incentive program recipients. This includes names, addresses, and the amount of the awarded incentive for each recipient. The database also must provide the benchmarks the recipients are measured against and their progress towards those benchmarks, among other things.

- The law provides for certain confidential information to be withheld. This includes, but is not limited to, names or personal identifiable information of individuals or businesses that have made contributions to receive a tax credit.

The law requires the transparency database to have certain functional features.

- K.S.A. 74-50,227 requires the database to be accessible to the public in an online, digital format. It also must be prominently displayed on the Department of Commerce’s website homepage.

- Information in the database must be searchable and printable. Further, this information must be accessible either directly in the database or through a link that allows the user to access the information.

- Statute requires information for both the individual incentive programs and the individual recipients of the programs. All of this information must be made available in the transparency database.

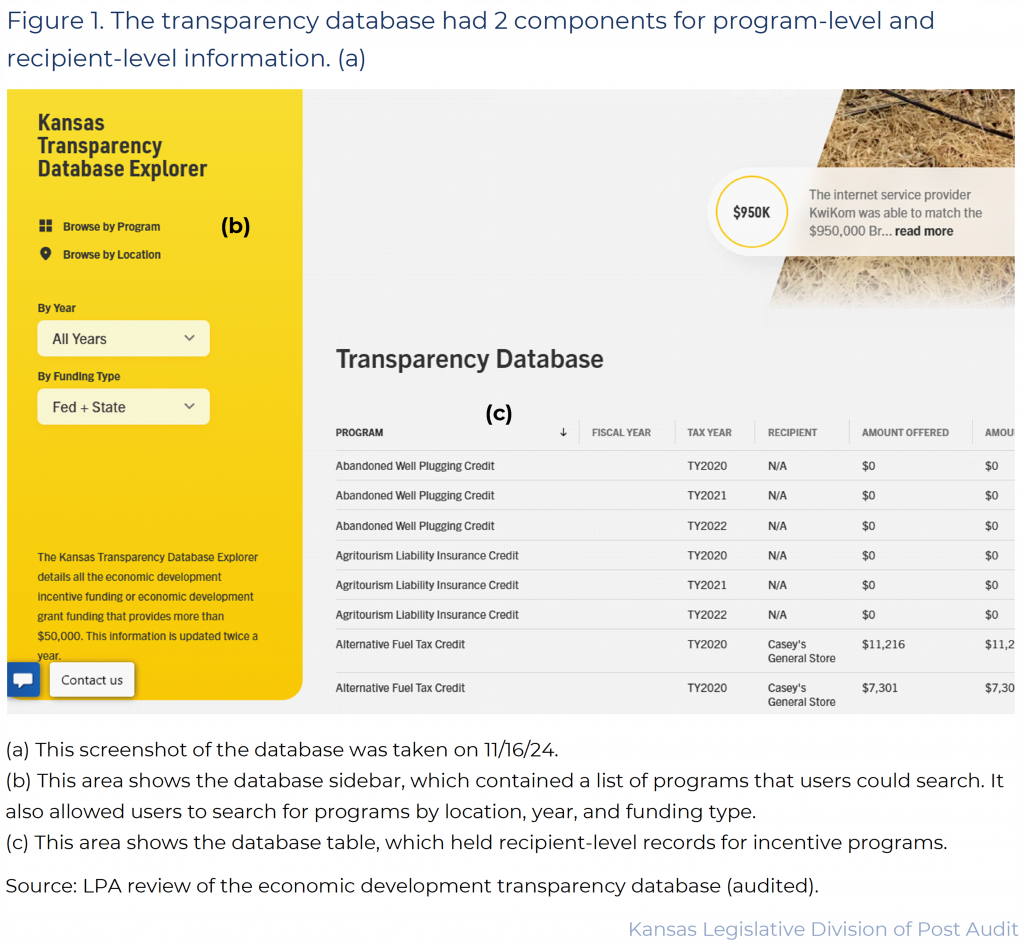

- At the time of our review, the transparency database could be found at https://www.kansascommerce.gov/dataview/transparency-explorer-home/. Figure 1 contains a screenshot of what the database homepage looked like during our audit. As the figure shows, the database consisted of 2 components:

- A sidebar that contained a list of programs and links to program information. It also allowed the user to search for programs by location (city or county).

- A spreadsheet-like table that contained recipient-level records for incentive programs. A search bar located in the top right corner of the table also allowed users to search for specific information in the table.

Program-Level Information

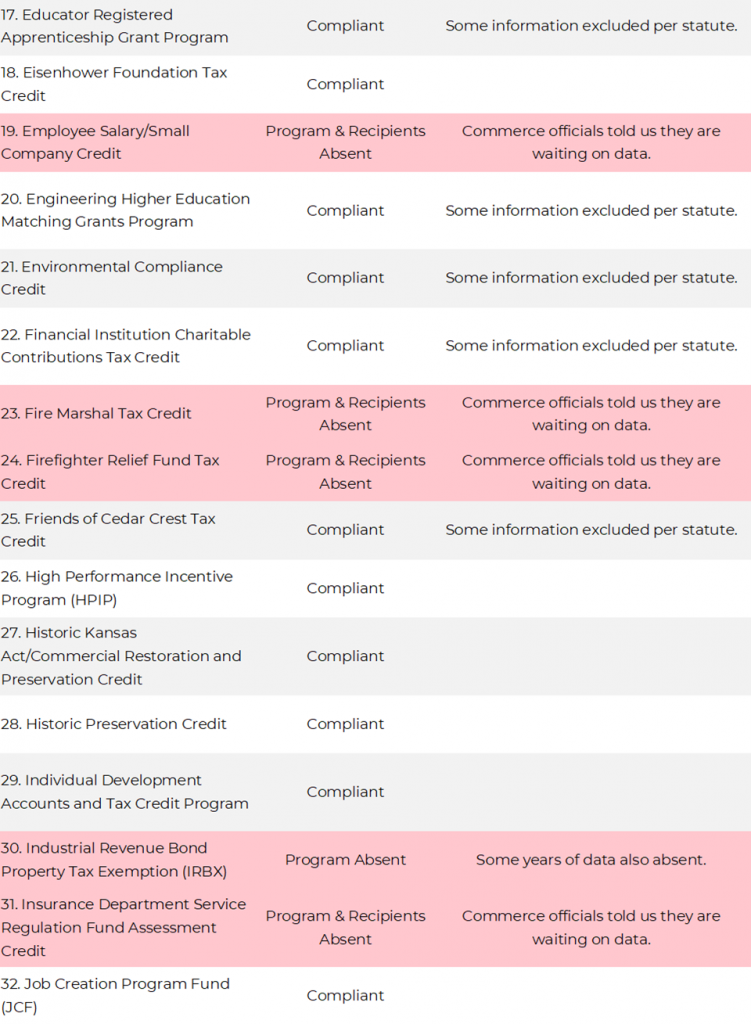

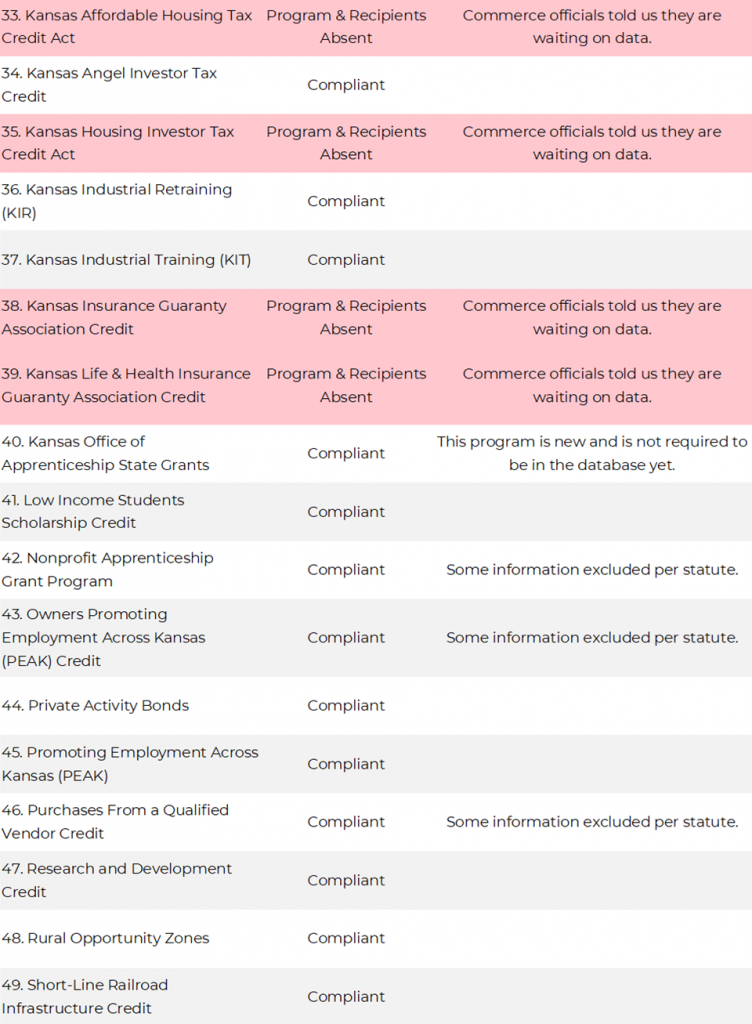

13 of 60 incentive programs we expected to find were missing from the transparency database.

- Statute does not list all incentive programs that must be in the database. LPA’s economic development team had previously identified a list of 61 programs that met the statutory definition of economic development incentive program. Due to time constraints, we decided to use this list as part of our database evaluation. We determined 2 of the programs overlapped significantly enough to be considered a single program. As a result, we used a list of 60 incentive programs for our review. There are additional incentive programs in the transparency database that we did not evaluate.

- We reviewed the database to determine whether the database contained these programs, either as part of the program list on the sidebar or the table of recipient records.

- In total, 13 of the 60 incentive programs (22%) we evaluated were absent from the database because they were missing from the program list, the recipient table, or both. These included programs such as the Fire Marshal Tax Credit and the Economic Development Initiatives Fund.

- 10 programs were not in the program list and did not contain any records in the recipient table. As a result, we were unable to see program information or records of individual recipients for these programs.

- 1 program was in the program list but did not have any records in the recipient table, even though there should have been recipient data listed.

- 2 programs had records in the recipient table but were not included in the program list.

- In the case of the STAR bonds program, statute specifically requires that information about STAR bonds be included in the database. When we conducted our review, the STAR bonds program did not have any records in the recipient table. However, after our work was complete, we noticed the database homepage included separate buttons that took users to a STAR bonds overview page and a static PDF. That PDF contained a list of projects with certain information, such as principal officers. However, STAR bonds still lacked other statutorily required information, such as program history. Because it was not contained in the database, we did not evaluate it further.

- We initially identified several additional programs as missing from the database. However, after explanation from department officials, we determined that these other programs were justifiably excluded from the database. That’s because some did not have at least $50,000 in annual incentives. Others contained confidential information. For this reason, we considered these programs compliant.

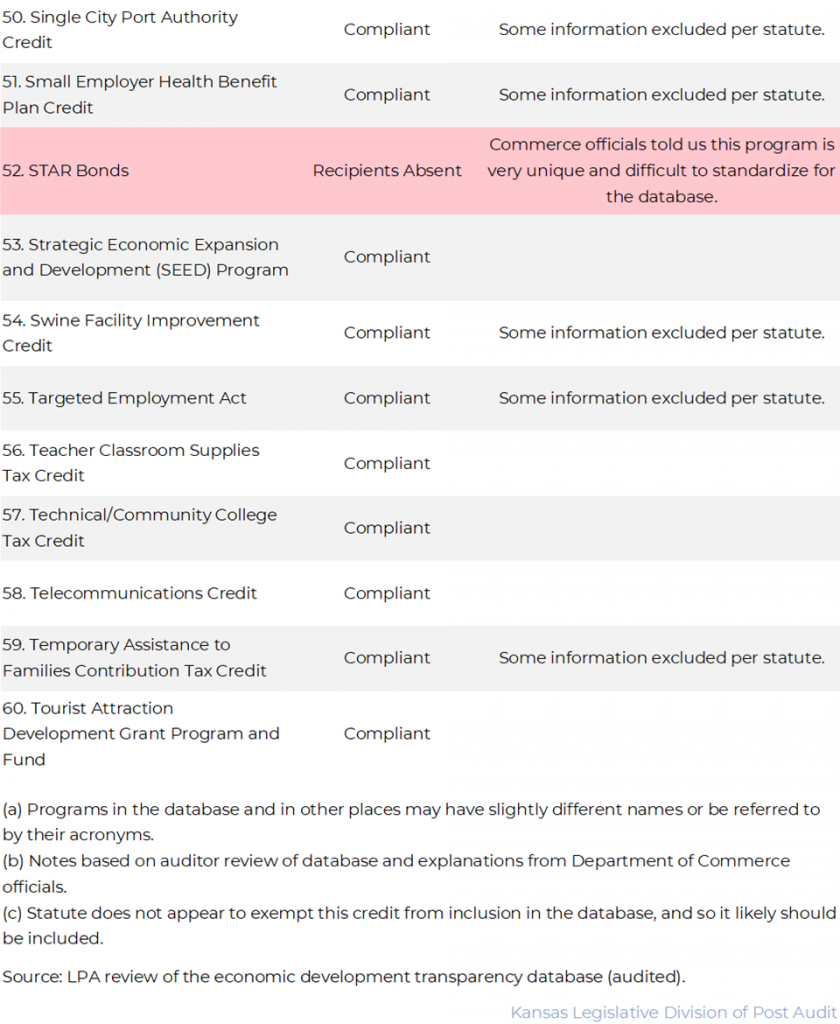

- • We asked department officials about the 13 programs we determined to be absent in some capacity from the database. In some cases, such as for the Employee Salary/Small Company Credit, officials told us they were waiting on data from other agencies before adding it to the database. In other cases, such as for STAR bonds, officials told us they believed the program was unique and difficult to standardize into the recipient table format, shown in Figure 1. A table showing our determinations for all 60 programs can be found in Appendix A.

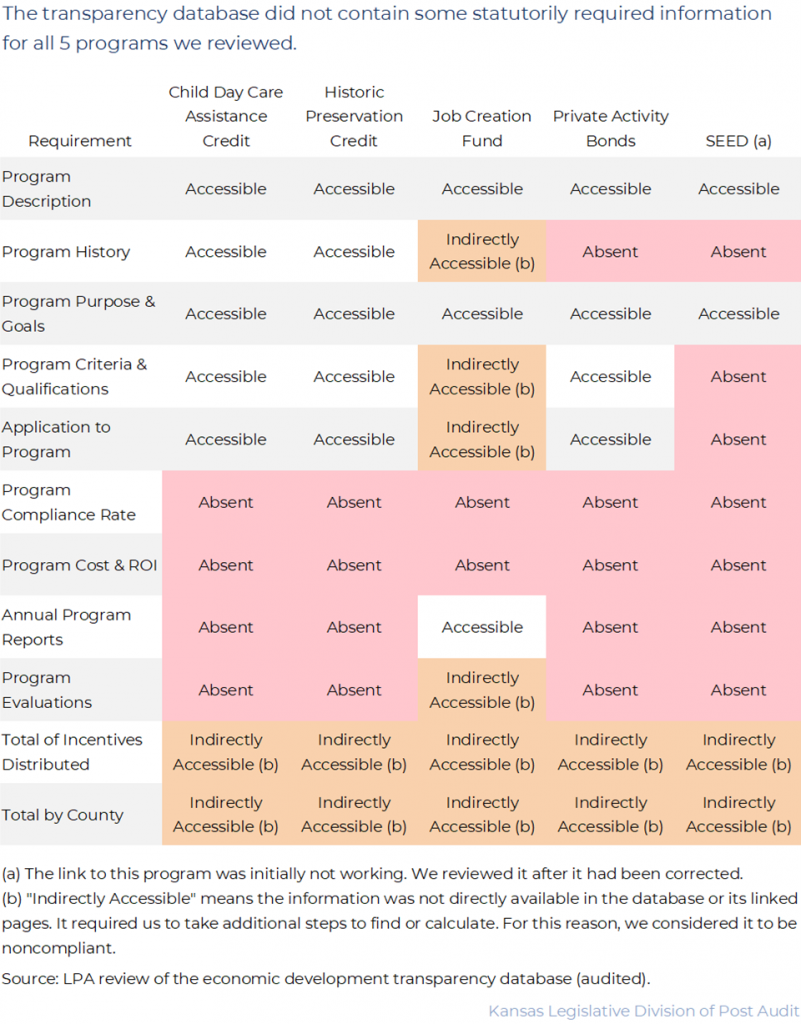

The transparency database lacked about half of the 11 statutorily required program-level pieces of information for the 5 incentive programs we reviewed.

- We judgmentally selected the following 5 programs from the database: Child Day Care Assistance Tax Credit, Historic Preservation Tax Credit, Job Creation Fund, Private Activity Bonds, and Strategic Economic Expansion and Development (SEED). We selected these programs in a way that gave us a mix of incentive programs administered by the Department of Commerce and other agencies. We also selected a range of large and small programs in terms of benefits awarded. Because this is a judgmental sample, results cannot be projected to the program population. However, we believe our work was sufficient and appropriate to answer the audit objective. It should be noted, however, that our review represents a snapshot in time and may not reflect the current state of the database.

- We evaluated whether the 5 programs contained 11 statutorily required program-level elements, including program purposes and goals, history, applications, total incentives, return on investment, and more.

- 5 of the statutorily required elements were absent from all 5 programs: compliance rate, return on investment, evaluations, total incentives by program, and total incentives by county. 1 additional requirement, annual reports, was missing for 4 programs. In cases where we determined that information was absent, the database lacked explanations as to why that information was not included.

- For some requirements, the user had to take several steps to find or calculate the information for the 5 programs we reviewed. Incentive totals by program and by county could be obtained only by downloading the table of recipients into Excel. The user would then have to use formulas or other means to sum the awarded amounts by program and county. In other cases, information was only available by clicking through several links and searching for it manually or by downloading and searching a PDF document. Because the law requires that the information either be included directly in the database or available via a link, we considered this to be noncompliant.

- Statutorily required information for program description as well as purpose and goals was generally included and accessible for all 5 programs. Other pieces of information were included for some programs but not others. For example, we were not able to find criteria and qualifications for the SEED program, but we were able to find it for the other 4 programs. For the Job Creation Fund, several requirements such as history, criteria and qualifications, and applications required the user to follow several links and then find the information in an annual report that could be downloaded. For the Job Creation Fund’s evaluation component, a link pointed to the LPA website homepage. The user would have to know and search for particular audits related to that program. Because this required several steps, we considered this to be noncompliant.

- A table showing our evaluation of the 11 statutory information requirements for all 5 sampled programs can be found in Appendix B.

Department officials explained they could not include some program-level information because the information didn’t exist or was incompatible with the database structure.

- We met with department officials to discuss the results of our review. We also asked them why some program-level elements were absent from the database.

- Department officials explained that some of the required information is not applicable to some programs. In these cases, they said they cannot include that information in the database. For example, they said there is no return on investment that they can calculate for tax credit programs like the Historic Preservation Credit. Officials said that’s because these kinds of programs do not have traditional monetary costs or benefits that the department can track. Further, the cost or return on investment may be a very difficult calculation that requires data or resources that the department does not have.

- Officials noted some programs are unique enough that some statutory requirements are not applicable. For example, they said the applications requirement was not applicable for the Job Creation Fund because it is not open to an application process like other programs.

- Lastly, officials explained that technical hurdles sometimes make it difficult to provide certain statutorily required program information. For example, they explained that the reason why the total amount of incentives by program is not directly provided in the database is because the coding requirements are very prohibitive. They said the database is a very complex application and adding new functionality takes a lot of time and resources.

- Although these points may have merit, we believe the database should at least include those explanations to help users understand why some information does not appear. Without such explanations, users may be confused because the information may appear to be missing without reason.

- Commerce officials told us that some things had been or would be updated after our review. Therefore, some of our results may no longer apply to the database in its current state.

Recipient-Level Information

The transparency database contained most statutory information for the 24 recipient records we reviewed, but benchmark information was inadequate.

- We reviewed a total of 24 recipient records across the 5 sampled programs. These programs were the Child Day Care Assistance Tax Credit, Historic Preservation Tax Credit, Job Creation Fund, Private Activity Bonds, and Strategic Economic Expansion and Development (SEED). We randomly selected 4-5 records per program but also substituted entries to get better location or recipient variety. Our findings from this work are not projectable to the individual programs or other programs.

- The law requires recipient-level information to contain the following 8 pieces of information: (1) the name of the incentive recipient, (2) the address of the recipient, (3) the county in which the recipient is located, (4) the year the incentive was awarded, (5) the amount of funds the recipient claimed or received, (6) the amount of funds left to be distributed to the recipient, (7) the benchmarks for the incentive, and (8) the recipient’s progress toward those benchmarks.

- The 24 recipient records we reviewed all contained the first 6 of 8 required pieces of information. We determined, however, that most of these recipient records did not contain sufficient information about the final 2 requirements: benchmarks and benchmark progress.

- 2 programs (the Child Day Care Assistance Tax Credit and the Historic Preservation Credit) did not contain any information about benchmarks or benchmark progress. This may be because these programs are tax credits and do not have any applicable benchmarks. However, the database did not provide any explanations regarding the absence of benchmarks for these programs.

- 3 programs (Private Activity Bonds, SEED, and the Job Creation Fund) had benchmarks that were vague or difficult to decipher. For example, there were multiple benchmarks for the Job Creation Fund labeled as “includes one or more of the following: jobs, payroll, and capital investment per individual agreement.” The benchmark for Private Activity Bonds was labeled as “Financing for eligible activities per section 146(C) of the internal revenue code,” with options of “achieved” and “n/a”. These benchmarks were vague or confusing, and they did not provide specific information about what the recipient had to do to accomplish or meet these benchmarks. As a result, we determined the benchmarks for these 3 programs to be noncompliant.

- Benchmark progress information was also difficult to decipher. For example, the benchmark progress for all 5 of the Private Activity Bond recipients was labeled “achieved” with a status of “closed” for 4 recipients, and “n/a” with a status of “open” for the 5th. Benchmark progress for Job Creation Fund recipients included multiple fields that appeared to be inconsistently labeled as “achieved” and “not yet met” for each recipient, even though these benchmarks had the exact same labels. It was unclear why some fields were labeled differently than others.

- Statute (K.S.A. 74-50,227) requires the database to contain information such as number of jobs or amount of capital improvement specific to the recipient, if applicable. Because of this language, it appears the legislative intent for benchmarks was to provide recipient-level specific information. As such, benchmark labels of “includes one or more of the following: jobs, payroll, and capital investment per individual agreement” with progress labels such as “not yet met” with no further specificity are likely not meeting that intent. Commerce officials told us the complexity of having specific, custom benchmarks for each recipient may make it difficult to provide such benchmark information in the database.

- Furthermore, recipient-level information was completely missing for programs that were missing from the database table of recipient records, such as the Economic Development Initiatives Fund. That’s because these programs did not have any recipients recorded. In these cases, all recipient information is missing.

- The reader should be aware we checked the database to determine whether each piece of required information was included in some capacity. The database doesn’t contain information prior to FY2019, and some information may not be included because it is said to be confidential. Due to time constraints, we could neither evaluate the accuracy nor the completeness of the recipient-level data.

Functionality

The transparency database contained 3 statutorily required functionalities.

- We evaluated the database to determine whether it contained 3 statutorily required functionalities. The database must be accessible from a prominent link on the department’s main website, searchable, and printable.

- Accessibility: Our review of the department website homepage on September 24 confirmed that there were links to the database in the dropdown menu at the top as well as the footer at the bottom of the homepage. Both components of the database (sidebar program list and table of recipient records) were available through those links. We noticed, however, that these links were updated several times during our audit. At one point, the links were missing but then reappeared.

- Searchability: Our review of the database confirmed that the transparency database contained a search bar that we could use to search for specific programs, locations, recipients, and other information. As Figure 1 on page 5 shows, the database sidebar also had filter buttons that allowed users to search for information by year or funding type. This fulfills the statutory requirement.

- Printability: The transparency database webpage included a button that allowed us to download all program recipient data to a .csv file. Once we downloaded this file, we could print it. Users may find these additional steps inconvenient or difficult. However, statute does not specify how the database should be printed.

Recommendations

- The Legislature should consider amending K.S.A. 74-50,227(b) to clarify what elements of required economic incentive program information should be included in the transparency database itself, and what elements would be acceptable to be available outside of the database, via links to other sources of information.

- The Department of Commerce should ensure that the transparency database contains all statutorily required programs and information. If there is any information that cannot be measured or included, the department should include an explanation on the database for why that information does not appear.

- Agency Response: Currently, the database provides a short explanation as to why specific programs are not included in the table. This information can be found at the bottom of the homepage. Additional information for some programs can be found through various links and reports. Lastly, the database indicates “not applicable” when a metric cannot be measured. The statute does not speak to “an explanation”; therefore, Commerce does not agree with this recommendation.

- LPA Response: The department is correct that some programs included disclaimers about why they weren’t included in the database at the time of our review. We also agreed with the department that some programs did not need to be included in the database because they were too new or met the confidentiality exemption. In those cases, we categorized programs as compliant. As a result, our findings regarding missing programs, program information, and recipient information were accurate at the time of our review. Our recommendation speaks to programs, program information, and recipient information that was lacking without explanations or applicable exemptions. Our recommendation attempts to bridge the statutory requirements with the difficulties officials have expressed in obtaining or inserting such information in the database. Including the explanations would help the user know the information isn’t inadvertently left out of the database.

Agency Response

On November 20, 2024, we provided the draft audit report to the Department of Commerce. We made several minor changes to our findings and recommendations in response to the agency’s technical feedback. The department’s formal response is below. In its response, officials disagreed with our findings and conclusions on 3 major issues. We carefully reviewed the information agency officials provided but did not change our findings or conclusions for the following reasons:

- Commerce contends our evaluation misinterpreted statute and relied on arbitrary assumptions. By the department’s own admission, K.S.A. 74-50,226 and K.S.A. 74-227 lack specificity. The law does not provide a specific definition for “economic development incentive program” or a list of such programs. Because this was a limited-scope audit, we relied on a preexisting list of programs that meet this broad, statutory definition. This list was developed by LPA’s economic development team, which has worked closely with and reported on these kinds of programs for several years. LPA applied the broad statutory language in our evaluation of the information in the database. We did not create unknown standards or make assumptions. In some cases, information displayed in the database was vague or difficult to access, which we believe to be contrary to the explicit requirements and intent of statute. In other cases, information was missing completely. The department noted that some statutorily required data fields do not apply to some programs. While this may be true, a note or explanation as to the irrelevance of a piece of information would be information in and of itself and helpful to users. Without the required information or any such explanation as to its absence, the database is not compliant with statute.

- Commerce contends that our sample review of programs and recipients was insufficient and arbitrary. This was a limited-scope audit with a cap of 100 hours. The report clearly describes our methodology for taking a small sample of programs and recipients. It clearly explains that our sample is not projectable. This methodology was not arbitrary but instead a prudent way to allow us to answer the audit objective within the time constraints. We believe the report also clearly describes our sample results given these limitations. Further, because the statute defines incentive programs broadly, it includes programs like the “Fire Marshal Tax Credit” and the “Credit for Taxes Paid to Another State.” These programs therefore belong in the overall list of 60 programs we evaluated.

- Commerce contends they have fulfilled statutory requirements by providing information in other places on the website. The statute is clear as to what incentive program components must be contained within the transparency database (or via a link within it). The department’s transparency database has 2 components: the sidebar with a list of programs and links, and the spreadsheet-like table of recipient records. The department provided some required information outside of the database for programs such as STAR Bonds on their webpage. However, we only evaluated whether the database itself (or a link within it) contained the information because that is what is required by statute. The inclusion of information in various forms and places on the department’s website does not appear to fulfill the statutory requirements.

Department of Commerce Response

December 3, 2024

Legislative Post Auditor

Ms. Chris Clarke

800 SW Jackson, Suite 1200

Topeka, KS 66612

Dear Ms. Clarke:

The Department of Commerce (Commerce) has reviewed the Performance Audit Report titled, “Evaluating Whether the Department of Commerce’s Economic Development Transparency Database Includes the Required Information and Functionality.” The audit objective was to evaluate if the economic development transparency database meets the requirements of the state law. Specifically, the audit team evaluated whether the database included all expected economic development programs and functionality.

The Department of Commerce has continually worked to be transparent and has taken that responsibility seriously. The agency has worked diligently to create and maintain a database that is easy to use, contains an abundance of information and is compliant with the law. Additionally, we have been dedicated to sharing information related to grants, incentive agreements, contracts and other key aspects of the agency.

We have worked hard to maintain a database that is compliant with the law and in many ways we have done so. Unfortunately, K.S.A. 74-50,227 lacks the specificity and clarity needed for our agency to truly meet these goals. Without that clear statutory guidance, Legislative Post Audit (LPA) has developed new unknown standards and made certain assumptions in areas where the statute is too broad. Furthermore, the situation is worsened as the legislature only partially funded our enhancement request to update and expand the functionality of the database. The most recent updates to the database have been completed through a private grant.

Most notably, the audit findings produced by LPA were insufficient and not all encompassing.

- The audit only arbitrarily reviews 60 incentive programs when the database contains information regarding 106 programs.

- LPA randomly selected a small grant program for an in-depth review, while ignoring and not including more than 40 other grant programs.

- The report analyzes incentive programs that should not have even been considered such as the “Credit for Taxes paid to another State”.

- The report finds that STAR Bonds and EDIF are not in compliance. When in fact, the database provides MORE information for those programs than what is statutorily required.

- APEX, HPIP, PEAK and KIT/KIR programs were found to be compliant with the statute. This positive information was omitted in the main audit and can only be found in Appendix A.

- The audit reviewed 24 recipient records, which is less than .001% of the recipient records in the database.

- In an obscure position in the report, the audit indicated that the database meets all necessary statutory functions. The data is searchable and can be filtered by program, county, city, recipient and funding type. The information can be downloaded for further analysis and printable.

- The audit does not share the database is updated twice a year, which exceeds the statutory requirement.

Available Data for Economic Development Programs

Currently, a mega spreadsheet with over 13,000 rows and nearly 225,000 cells of data populate the database. Commerce has partnered with four different agencies to gather the needed data and works to update the database at least twice a year. This is more than is statutorily required since our agency is only obligated to update the database once a year. All this work is manual and incredibly time consuming. However, that voluminous amount and quality of information is not noted in the report produced by LPA. The report speaks very little to the amount of information that is available, searchable and detailed in the database. Our transparency database website includes information on 106 programs with data spanning three years. Not only is the website organized for a member of the public to browse by program and by city or county, but it also offers a person the ability to search within our database table for a specific program, year, and recipient. Our website offers anyone the ability to narrow or broaden their search and download the data for more user customization within Microsoft Excel.

Rather, the report arbitrarily selects 60 “incentive programs” and makes certain findings about those programs. While this arbitrary list contains more than half of the programs, it omits 46 additional grant programs, which skews the audit results. For example, LPA arbitrarily chose to consider the SEED grant program both as one of the “60” and again for part of its in-depth review. Not only is SEED a relatively

minor program, but the real point is LPA ignoring 46 other grant programs administered by Commerce. While actual grant programs administered by Commerce were disregarded by LPA, it focused on several “incentive programs” that shouldn’t even be considered for review. It was unreasonable to assume that the “Credit for Taxes Paid to another State” or the “Fire Marshal Tax Credit” would be considered “incentive programs” required in the database. Those programs simply do not meet the definition or spirit of “incentive programs”. Those are just two examples from the “incentive programs list” that the LPA found to be not

compliant.

LPA appears to have deliberately understated the number of incentive programs. Nowhere in the report does LPA share that the database provides information for 106 programs including STAR Bonds and EDIF. Misleadingly, the report finds that both STAR Bonds and EDIF were not in compliance. In actuality, the agency provides MORE data than statutorily required related to both of those programs. Anticipating that STAR Bonds would receive more scrutiny than other programs, the agency worked to provide MORE information about the program and STAR Bond districts than other incentive programs. In the database, STAR Bonds is located on the homepage with a video that speaks to the history and goals of the program, annual reports and compliance audits (conducted by LPA) and its own specific program table with information about the bonds and remaining bond amounts. The amount and depth of information in the database regarding EDIF is comparable. Not only are the annual EDIF reports for the Kansas Legislative Research Division shared, so is data on all (as compared to an arbitrary list) of the grant programs Commerce administers that are funded from EDIF including the needed recipient information.

With no specificity in the statute, the audit team compiled an arbitrary incentive list. The audit team did include our agency’s primary incentive programs, which are APEX, HPIP, PEAK and KIT/KIR. All these programs were found to be compliant. However, the only place in the report where one can find that information is in Appendix A. The audit team only selected one grant program to review, SEED, when the agency administers over 40 grant programs. The audit does not include anything regarding broadband and ARPA related grants, which allocate hundreds of millions of dollars and are included in the database.

The report highlights the need for more information related to benchmarks, compliance rates, return on investment and evaluations. To come to this determination, the audit team reviewed 24 recipient records. Again, the database contains more than 13,000 recipient records. Essentially, the audit team evaluated less than .001% of recipient records to come to this determination. Further, the statutorily required data fields simply aren’t pertinent to many programs. Consequently, Commerce is held to an unreasonable standard.

For example, within those recipient records, benchmark information varies greatly. Therefore, to put this information into a standard format with consistent, digestible language for all users is impossible. What is a “benchmark” or “return on investment” for a historic tax credit or other tax credit program? There is no way to include all this data in the table, which is why the database contains multiple other pages of

information for each program with details related to these elements. LPA contends that the statute only allows for a single link to additional information. This cannot be the intent of the legislature and again impractical to implement.

The report states that no data prior to FY 2019 is available on the database. While this finding is technically accurate, the law doesn’t even require or address information prior to FY 2019.

Functionality of the Database

Although it is mentioned in a less prominent part of the report, the most meaningful components of the database meet all requirements. The audit indicates that the database does meet the three statutorily required functionalities. The information is accessible, searchable and printable. The agency agrees with this assessment.

The database can easily be found from the Commerce website homepage. The data is searchable and can be filtered by program, county, city, recipient and funding type. The information can also be downloaded for further analysis and printable. Given the amount of data, this is a significant accomplishment.

In conclusion, transparency will always be a priority for the agency. The database has been a work in progress as we navigate a broad statute that attempts to use a cookie cutter approach to a wide variety of programs and does not contain adequate definitions. We will continue to improve the database as we work to provide more data, move to a more “live” reporting interface and showcase the information in more innovative and digestible ways.

Though the audit did not give the agency credit for the significant, meaningful data that the transparency database provides in easily searchable and usable ways, we value ongoing discussions regarding our transparency database and anticipate collaborating with the legislature to clarify the statute to ensure we are clearly meeting expectations.

Sincerely,

Rachel Willis

Director of Legislative Affairs

Department of Commerce

Appendix A – Program Review Results

This appendix includes a table showing the detailed results of our program review.

Appendix B – Sample Review Results

This appendix includes a table showing the detailed results of our sample review.