Reviewing Select Cities’ Use of Transient Guest Tax Revenues

Introduction

Representative Sean Tarwater requested this audit, which was authorized by the Legislative Post Audit Committee at its April 24, 2024 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- Did select cities spend transient guest taxes appropriately in recent years?

The scope of our work included reviewing transient guest tax expenditures from 2021-2023 for 3 cities. These cities were Manhattan, Overland Park, and Wichita. We only audited the cities’ transient guest tax funds. We did not audit the other funds that cities transferred a portion of transient guest tax revenue to (for example, a debt service fund).

To conduct this work, we reviewed each city’s relevant ordinances, resolutions, and contracts. We did this to determine how transient guest taxes can be used in each city. We then reviewed general ledger entries of transient guest tax expenditures for each city from 2021-2023. We did this to determine how each city spent their guest tax revenue. To verify that general ledger entries were accurate, we also reviewed additional documentation, such as invoices and receipts, for a small, judgmental sample of each city’s expenditures.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Audit standards require us to report our work on internal controls relevant to our audit objectives. They also require us to report deficiencies we identified through this work. In this audit, we reviewed basic internal control processes for a sample of expenditures from each city. This included checking documentation like invoices or receipts as well as verifying that the appropriate individuals signed off on expenditures. We identified a couple of minor deficiencies in the sample of expenditures we checked for Manhattan and Wichita, which we communicated to the cities in a separate letter. Manhattan paid the incorrect amount to an entity it contracts with because of a mistake in their documentation and monitoring process. Wichita lacked information about the final use of transient guest tax revenue in its general ledgers.

Our audit reports and podcasts are available on our website www.kslpa.gov.

From 2021 – 2023, Manhattan, Overland Park, and Wichita appeared to use most of their transient guest tax revenue appropriately, but a small portion was inappropriate or unclear.

Background

Kansas statute allows cities and counties to charge guests at hotels or other short-term lodgings a tax (called a transient guest tax), which local governments can then use to fund tourism-related expenditures.

- State law (K.S.A. 12-1696 et seq. and K.S.A. 12-1692 et seq.) allows cities or counties in Kansas to levy transient guest taxes. Businesses collect guest taxes if they provide short-term lodging for their guests. Examples of these businesses are hotels, motels, or entities providing short-term rentals (such as an Airbnb). The businesses must have 3 or more rooms where guests stay for no more than 28 days. However, if a guest stays at a short-term rental through a business like Airbnb, the business should have 2 or more rooms.

- The tax rate should not exceed 2% of a business’s gross receipts for sleeping accommodations as required by state law. To levy a transient guest tax, the city council or county commissioners must pass an ordinance (for cities) or resolution (for counties). The primary focus of this audit is a city’s use of transient guest taxes. As such, the use of these taxes by counties is not discussed in this report.

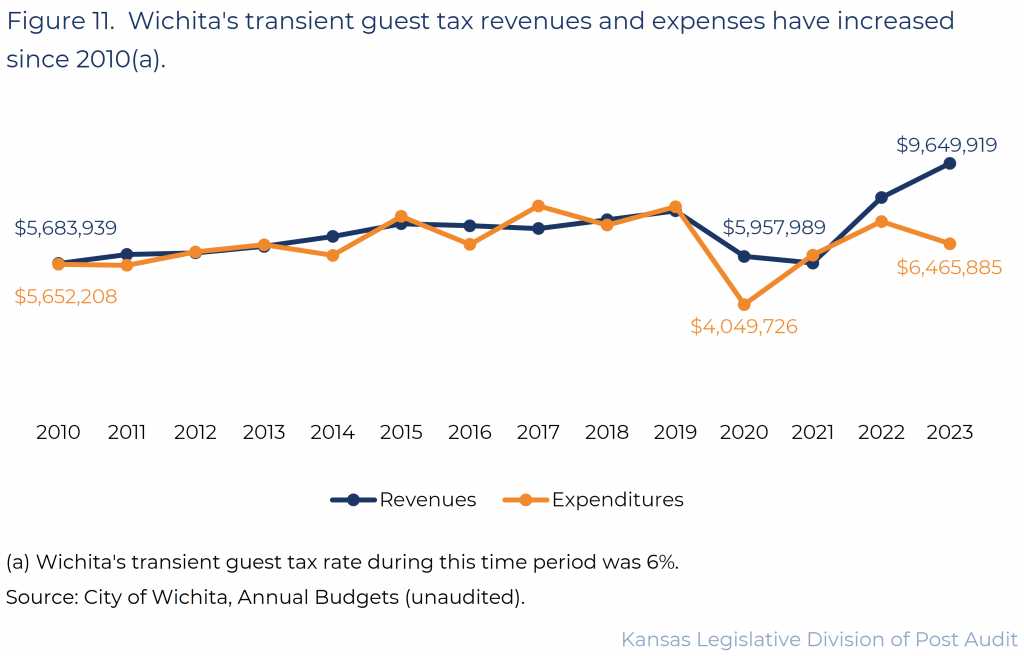

- Figure 1 summarizes how transient guest taxes are collected and processed. As the figureshows, guests pay transient guest taxes to businesses as part of their final bill, in addition to state and local sales tax. Businesses generally remit those taxes to the Kansas Department of Revenue (KDOR). Then, the State Treasurer’s office returns 98% of the total collected to the local government. The other 2% is credited to the state general fund.

- State law allows cities and counties to use transient guest tax revenue for tourism and convention promotion, activities and organizations that attract overnight guests, and specific bond repayments. Examples of these types of allowable expenses include travel advertisements, festivals and museums. It can also include tax increment financing (TIF) or sales tax and revenue (STAR) bonds.

Most cities with a transient guest tax charge more than the 2% rate in statute because they use the home rule provision in the Kansas Constitution to exempt themselves.

- Article 12, Section 5 of the Kansas Constitution grants a “home rule” privilege to Kansas municipal governments. This home rule privilege allows cities to exempt themselves from certain provisions of state law. This includes laws that allow cities to levy specific taxes. To exempt themselves, cities must pass a charter ordinance. It must spell out what statutes they’re exempt from and what requirements apply instead.

- This exemption is allowed when state law does not apply in the same way to all cities. For example, the guest tax statutes do not allow a city to charge a transient guest tax if the county already charges the tax. As such, not all cities can levy the tax. In this situation, a city can apply a home rule to exempt themselves from state law, allowing them to collect the transient guest tax.

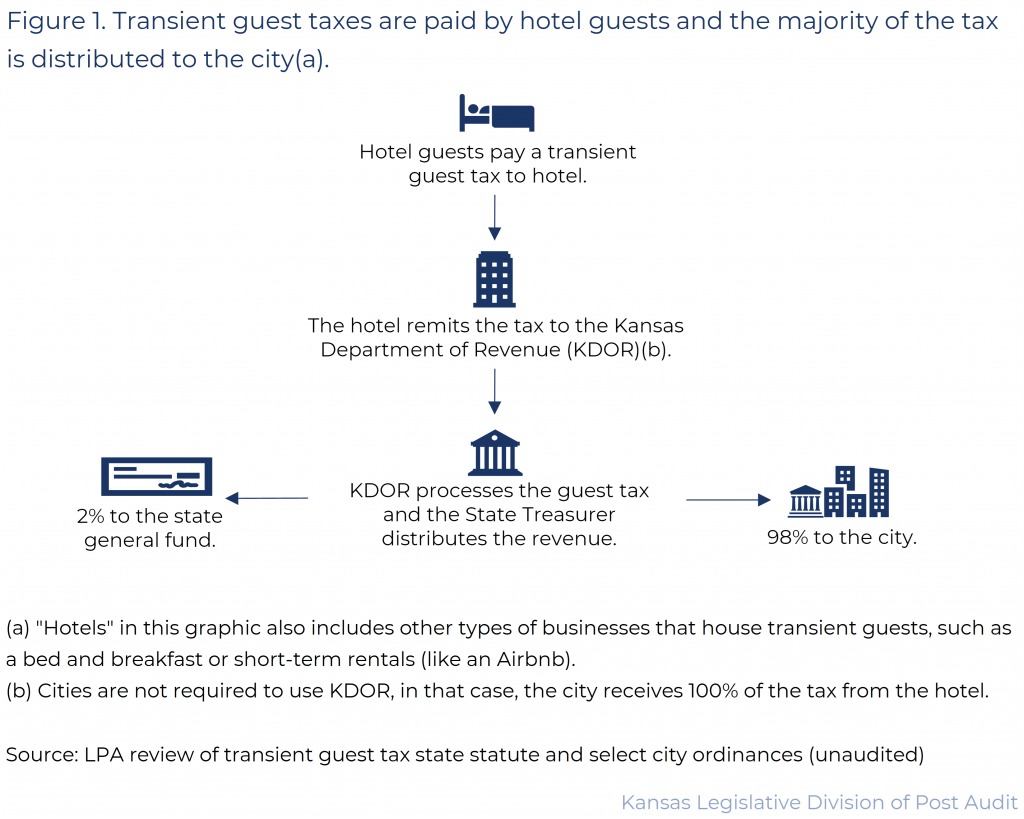

- Figure 2 shows the number of cities that charge various transient guest tax rates. As the figure shows, at least 102 cities are exempt from state law and charge a guest tax rate of more than 2%. According to KDOR’s records, 107 cities charge a transient guest tax. However, there are likely more cities charging this tax because cities do not have to use KDOR to collect their guest taxes if they apply home rule. KDOR officials told us they knew of 2 cities that collected the tax directly.

- Additionally, cities may change the requirements for how transient guest tax revenue can be used. We don’t know how many cities have exempted themselves from the use requirements included in state law. That’s because it would require us to review the ordinances for all cities that levy a guest tax. Officials at the League of Kansas Municipalities told us they think most cities still require transient guest tax revenue to be used on tourism-related expenses. However, we saw in our work that cities may add more details or uses, like expanding allowable uses to economic development or requiring a certain percentage of revenue to go to the local chamber of commerce or visitors bureau.

Cities’ Appropriate Transient Guest Tax Expenditures

The 3 cities we reviewed spent transient guest revenues differently from 2021 to 2023 but most of their spending appeared to be appropriate.

- To conduct our audit work, we judgmentally selected 3 larger Kansas cities that charge the tax: Manhattan, Overland Park, and Wichita. To make our selection, we considered the size of the city, variety in geographic location, and the amount of transient guest tax revenue they collected in calendar year 2023. As such, our findings apply only to the cities and years that we reviewed.

- The amount of transient guest tax revenues and expenditures cities receive and use varies widely based on things like the number of hotels a city has and the transient guest tax rate they charge. The 3 cities we reviewed reported that they received between $7.6 million (Manhattan) and $28.1 million (Overland Park) in transient guest tax revenues from 2021 – 2023. During those same years, the cities spent between $5.6 million (Manhattan) and $25.8 million (Overland Park).

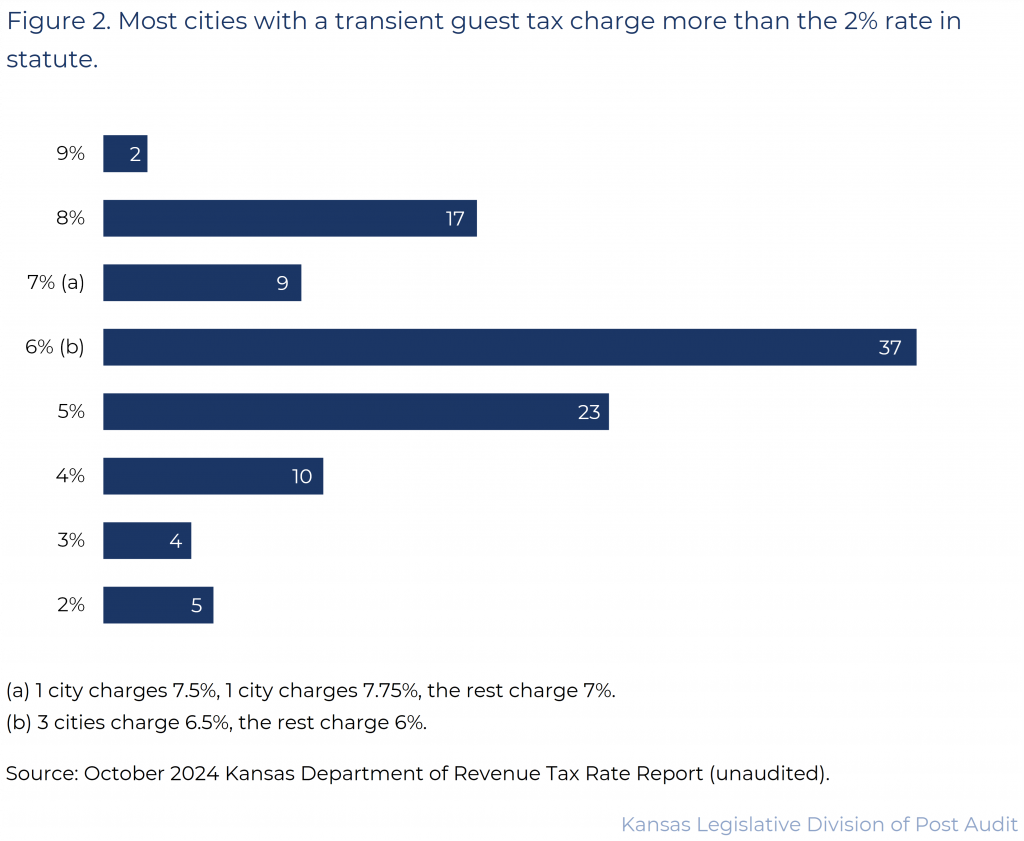

- Figure 3 shows the different ways Manhattan, Overland Park, and Wichita used their transient guest tax revenues. As the figure shows, the 3 cities all spent guest tax revenues on tourism-related activities but did so in different ways.

- To determine how cities spent transient guest tax revenues, we requested and reviewed the general ledger for each city’s transient guest tax fund for calendar years 2021, 2022, and 2023. We also talked to the cities’ financial officials. Finally, we reviewed documentation for a small judgmental sample of general ledger entries to verify their descriptions and that expenditures were disbursed as reported. Our selection included entries from each year of our review and each type of transaction the sample cities made. We did not review supporting documentation for each expenditure.

- To determine if the cities we reviewed used their transient guest tax revenue appropriately, we reviewed city resolutions, ordinances, and contracts to determine what was allowed. All 3 cities allowed transient guest tax revenue to be used for tourism and convention related expenses. Overland Park and Wichita also had requirements about what order to apply the revenues.

- We determined the 3 cities used their transient guest tax revenues appropriately for payments made directly from their transient guest tax funds. In other words, the expenditures from their transient guest tax fund aligned with the allowable uses defined by that city.

- Further, we determined the 3 cities appeared to use most of their transient guest tax revenues appropriately for payments made from other city funds but with an important caveat.

- Each city transferred some transient guest tax revenue into funds that also contained different revenue streams. Once transient guest tax revenue is placed in one of these funds, it is combined with that other revenue.

- We could verify that a payment was made from the fund with other revenue streams, but we could not verify whether or what portion of the payment came from guest tax revenue. This would require us to audit each fund that the guest tax revenue was transferred into, which was outside the scope of this audit. For example, if guest tax revenue was transferred into a city’s general fund, we could verify that the city paid for the tourism-related expense identified in the city’s general ledger. However, we could not verify if or how much of the payment came from guest tax revenue or other revenues deposited in the general fund.

- In these instances, we concluded that transient guest tax revenues appeared to be used appropriately. That’s because we could verify with documentation that the described payment was made for a sample of expenditures and that the payment exceeded what guest tax revenue could cover on its own.

- Appendix A includes further details about each city’s transient guest tax rate, revenues, expenditures, and allowable usage.

All 3 cities used transient guest tax revenues to pay the local convention and visitors bureaus to promote tourism, which is an appropriate expense.

- Tourism and convention promotion is the marketing effort made to showcase each city as a place to visit. This might be through leveraging websites, developing advertising campaigns, or fostering relationships with different groups that could help drive tourism to the city (such as tradeshows, conventions, sports events, hotel industry officials, or private trip planners).

- Manhattan, Overland Park, and Wichita allow transient guest tax revenues to be spent on tourism and convention promotion in their charter ordinances.

- To promote their cities as tourist destinations, all 3 cities contract with the local convention and visitors bureaus. These organizations then do this work on behalf of the cities.

- For example, Manhattan contracts with Visit Manhattan. In their 2023 contract, some of Visit Manhattan’s responsibilities included attracting conventions, meetings, leisure travelers, and sporting events to the city. Visit Manhattan’s responsibilities also included encouraging the development of new tourism venues to the city. Visit Manhattan outlined strategies to achieve these goals. Examples of strategies included partnering with related organizations, hosting sporting events, advertising to various markets, and developing both print and digital promotional materials.

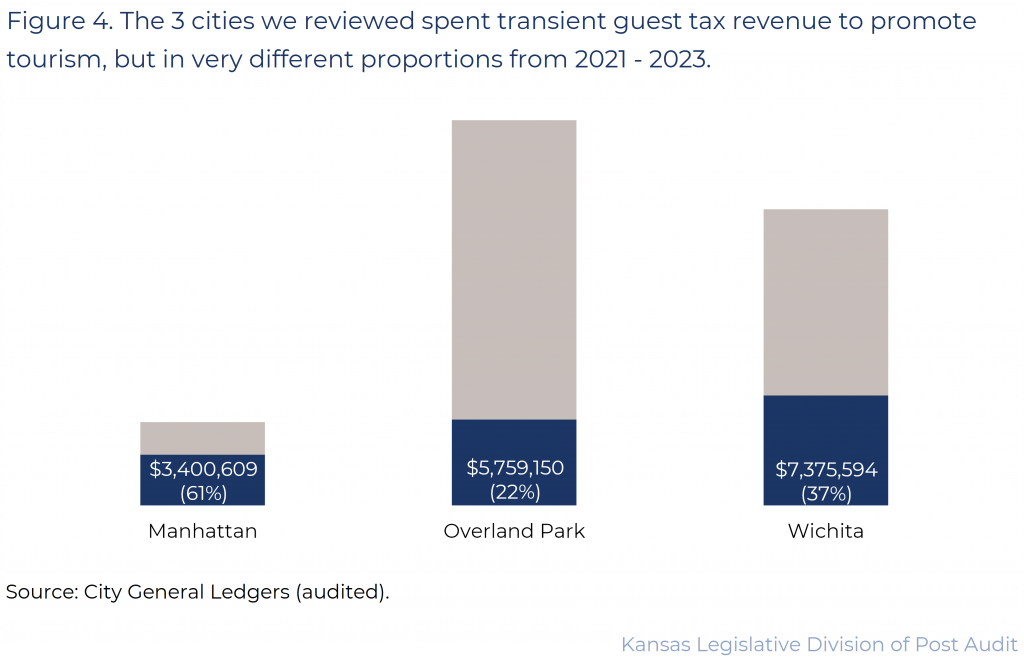

- Figure 4 shows the amount each city spent on tourism and convention promotion expenses from 2021 – 2023 and the percentage that amount is of the city’s total transient guest tax expenditures. As the figure shows, the 3 cities varied in what amount and portion of their guest tax revenues they spent on tourism and convention promotion. Wichita spent more revenue on tourism and convention promotion than the other cities. However, Manhattan spent a larger portion of its revenue on tourism and convention promotion than either Overland Park or Wichita.

All 3 cities appeared to use transient guest tax revenues to finance tourism and convention related bonds, which is an appropriate expense.

- Tourism and convention related bonds are used to finance projects that support or draw visitors to a city. These might include a convention center, hotel, sports facility, or tourist attraction.

- All 3 cities’ charter ordinances allow for repayment of tourism and convention related bonds.

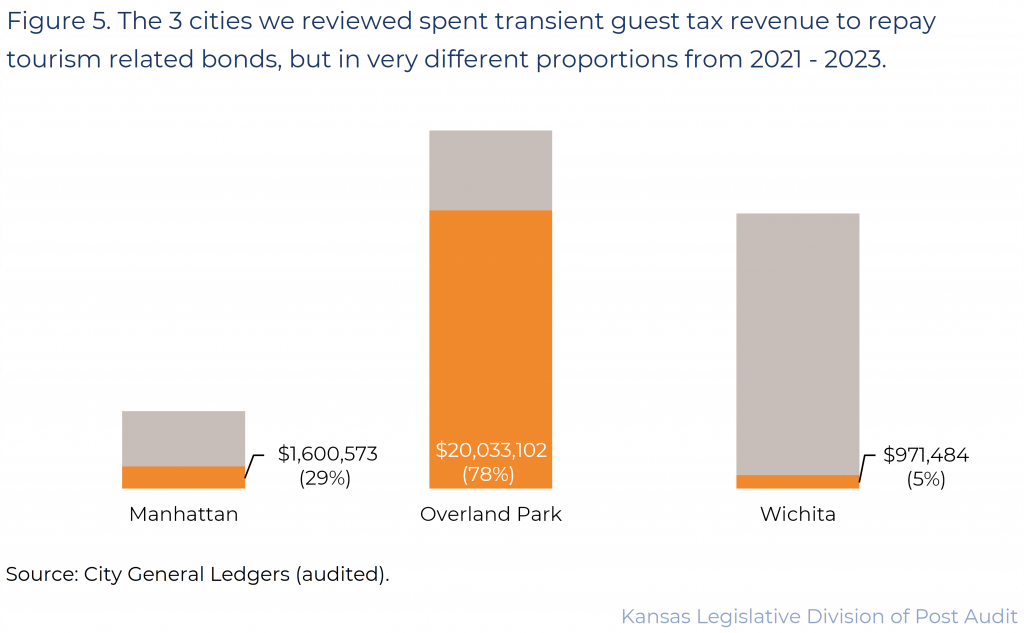

- Figure 5 shows the amount each city spent on tourism and convention related bond payments from 2021 – 2023 and the percentage that amount is of the city’s total transient guest tax expenditures. As the figure shows, the 3 cities were very different in how much of their guest tax revenue was applied toward bond repayment. Overland Park spent more than $20 million, or 78%, of its transient guest tax revenues during those years on tourism and convention related bond payments. Manhattan and Wichita both spent closer to $1.0 million to $1.6 million on such expenses during that time.

- Manhattan’s bond payments included $751,000 to repay their conference center bonds, $670,000 to repay bonds for a local sports complex toward what officials said was a turf installation project, and $180,000 to repay bonds for the Flint Hills Discovery Center STAR bond project.

- Overland Park’s bond payments included $17.3 million to repay bonds used to construct a hotel that’s next to the convention center. The hotel is owned by the Overland Park Development Corporation, a component unit of the city. They also spent another $2.8 million toward repaying bonds for their soccer complex and convention center. Appendix A provides more information about these bonds and the Overland Park Development Corporation.

- All of Wichita’s bond payments supported by transient guest tax revenue were for a downtown hotel.

- It is important to note that Manhattan and Wichita placed 100% and Overland Park placed 11% of transient guest tax revenues used to repay bonds into a fund with more than one revenue stream. As such, we could not verify what portion of the bond payments were from guest tax revenue, but we did see enough documentation to provide us with reasonable assurance the payment was made.

Wichita appeared to use transient guest tax revenues to maintain and operate existing tourism facilities, which is an appropriate expense.

- Wichita owns the Century II Convention Center and other facilities, like Wichita’s Old Cowtown Museum and the Wichita Art Museum. This requires the city to maintain the buildings and provide for operations of the facilities.

- Wichita’s charter ordinance allows for their transient guest tax revenue to pay for city-owned convention and tourism facilities. This includes debt repayment, obligations, maintenance, contracts, and operational deficits for those facilities.

- From 2021 – 2023, Wichita was the only city that spent its transient guest tax revenues for these types of expenses. Wichita appeared to spend $11.2 million (or 56% of its total transient guest tax expenses) on operational costs or capital improvement projects related to its convention center and city-owned attractions.

- However, there are important caveats. Wichita applied $9.5 million of the $11.2 million spent on this category to projects for maintenance and operations of tourism facilities. We cannot determine whether the individual expenses making up the projects were appropriate. We can only determine that they were appropriate at the project level. The other $1.7 million was paid directly to the contractor operating the Century II Convention Center, which is an allowable expenditure.

- Additionally, that $9.5 million for projects also passed through funds with different revenue streams. As such, we could not verify what portion of the project costs were from guest tax revenue, but we did see enough documentation to provide us with reasonable assurance the project costs were paid.

Manhattan and Wichita used transient guest tax revenues on direct grants or sponsorships for tourism, which is an appropriate expense.

- Direct grants or sponsorships for activities and attractions that draw tourism include a couple different items. They can be events that draw people from other cities to visit, like festivals or golf tournaments. They may also be permanent attractions that draw tourists, like art museums or downtown areas.

- Support for these types of activities and attractions fall within Wichita’s and Manhattan’s allowable uses. Wichita’s charter ordinance allows for support of cultural activities and organizations that encourage an increase in hotel stays. Manhattan allows their guest tax revenue to be used for programs, projects, and activities that promote, enhance, advance, or retain tourism and conventions.

- From 2021 – 2023, Manhattan and Wichita had only a small amount of expenditures to pay for grants or sponsorships for tourism activities and attractions.

- Manhattan provided about $482,000 (or 9% of its total transient guest tax expenses) in grants to local attractions or organizations that draw tourists. For example, they provided $109,000 over the 3-year time-period to the Manhattan Arts Center. The attraction has an art gallery and events like an Arts and Music festival with artists, food trucks, and live music.

- Wichita spent $299,000 (or 2% of its total transient guest tax expenses) to support several activities through sponsorships or loans. For example, Wichita sponsors activities, such as Riverfest. This is a days-long event with concerts, contests, food, and other activities. It also forgave the remaining balance of a loan to the National Baseball Congress Foundation for its help with the Wichita Baseball Museum.

Cities’ Unclear or Inappropriate Transient Guest Tax Expenditures

In 2023, Manhattan transferred $100,000 of its transient guest tax revenue to the general fund, but we could not determine if it was used appropriately because of a lack of documentation.

- In 2023, Manhattan transferred $100,000 of transient guest tax revenue to the City of Manhattan’s general fund without clear guidance for its usage. This was 5% of Manhattan’s $2.2 million in guest tax expenditures in 2023. Officials told us this transfer was to go toward beautification of areas in the downtown. The city commission approved the general fund transfer in the city’s 2023 budget. However, nothing in Manhattan’s budget documents indicated how the money should be used.

- Because the city has restrictions on the use of transient guest tax revenue, we would expect evidence to show the money was used for tourism-related purposes as approved by the city commission. City officials provided documentation that guest tax revenue was transferred to the general fund, which is a fund with different revenue streams. They explained that the guest tax revenue was used to reimburse the general fund for tourism-related work done by the city’s parks and recreation department. However, the city was unable to provide documentation showing what expenses the guest tax revenue was ultimately used to offset. Officials told us that there was no good way to track the $100,000 to specific work because the city doesn’t code inventory and staff time to specific jobs or work.

- This likely occurred because Manhattan’s charter ordinance is broad. It allows the city commission to determine if the expenditures are related to the promotion, enhancement, advancement, or retention of tourism and conventions in Manhattan.

- This transfer without explanatory documentation creates a risk that guest tax revenue was not used as the commission intended. It also means we cannot verify that guest tax revenue was applied toward appropriate tourism-related expenditures.

Wichita spent $16,000 of guest tax revenue from 2021 – 2023 to cover city administrative and audit fees, which is inappropriate because the expenses are not related to tourism and conventions.

- Wichita uses transient guest tax revenue to pay for a portion of city administrative and audit fees. Officials told us they assess these fees to all city funds to cover the costs of managing the funds and conducting the city’s yearly audit.

- Wichita’s charter ordinance allows spending for tourism or convention promotion, bonds, activities, attractions, or facilities. It does not include fees for routine administrative and financial services as an allowable use.

- This occurred because it is standard practice in Wichita to divide the city’s administrative and auditing costs across their funds. Officials told us this was done for every fund in the city. All guest tax revenue is deposited into the city’s tourism and convention fund, and thus, they took these small fees from the fund’s transient guest tax revenue. The split is based on the size of the fund and the cost of auditing and administering the accounts.

Other Findings

When cities’ transient guest tax ordinances are different from state law, it creates a risk that the Kansas Department of Revenue may not collect the tax correctly.

- As of October 2024, KDOR collected transient guest taxes for 107 cities in Kansas. Most of those cities (102 of 107) used home rule to opt out of some state laws related to transient guest taxes. Cities can opt out of any transient guest tax laws. For example, they could opt out of the laws related to cities’ transient guest tax rates, the allowable uses of guest tax revenues, or definitions for which hotels and short-term lodgings assess the tax.

- When cities use home rule to establish collection requirements that are different than state law, it is difficult for KDOR and cities to ensure that the taxes are collected correctly. That’s because KDOR reported that they collect transient guest taxes in alignment with state law, not individual city ordinances. This risk is further amplified over time if state law changes.

- For example, if several cities used home rule to change which hotels and short-term lodgings assess transient guest taxes, KDOR would have to create different collection processes for each city to ensure the correct businesses are assessing the tax.

- Conversely, if the legislature changes which hotels and short-term lodgings assess transient guest taxes and cities don’t update their ordinances to match, then KDOR would collect taxes in a way that aligns with state law but not the cities’ ordinances.

- This issue was partially addressed in a 1982 Attorney General Opinion (No. 82-17). The Attorney General determined that cities that apply home rule for transient guest taxes may not impose administrative duties on a state agency such as KDOR.

Since 1992, KDOR may have collected, and Wichita may have received transient guest tax revenues from guests at some hotels and other lodging entities that aren’t authorized in Wichita’s charter ordinance.

- Wichita’s ordinance levies a transient guest tax on guests staying in businesses with 9 or more bedrooms. Its ordinance does not authorize the city to levy a transient guest tax on guests who paid for sleeping accommodations through entities like Airbnb or Vrbo.

- However, KDOR officials told us they collect transient guest taxes as defined in state law, not as defined in Wichita’s ordinance. This means KDOR collects guest taxes through Wichita businesses with 3 or more rooms and from accommodations brokers (like an Airbnb or Vrbo).

- There is nothing that clearly establishes whose responsibility it is to provide a solution for the conflicting definitions in a city’s ordinance and state law.

- KDOR officials told us that they aren’t sure what statutory authority they have to resolve the conflict between their collection process and Wichita’s ordinance because of the home rule provisions.

- KDOR officials told us that there was not a written agreement between their agency and other cities about the collection of guest taxes to establish clear expectations or parameters.

- Wichita officials told us it is KDOR’s responsibility because state action (a change in law) in 1992 and 1997 triggered conflicting definitions.

- It appears this issue happened because neither Wichita nor KDOR have processes in place to review state law and city ordinances for potential conflicts.

- We don’t know how much in transient guest tax revenues KDOR may have collected or Wichita may have received that didn’t align with Wichita’s ordinance. That’s because neither KDOR nor Wichita were aware of the issue until we notified them during our audit work. Since 1992, guests staying in Wichita at businesses with less than 9 bedrooms or at accommodations brokers may have paid taxes that were not owed. KDOR estimated that of the 106 accounts that submitted transient guest tax collections from Wichita businesses in September through November 2024, around 5% of the accounts had less than 9 rooms. KDOR told us they also collect from at least 2 accommodations brokers.

- KDOR and Wichita officials told us there may be a way for affected consumers to receive a refund through the business where they stayed. However, KDOR also said there is a 3-year statute of limitations that would apply.

- This was not an issue for Manhattan or Overland Park. We reviewed both cities’ charter ordinances for differences in definitions compared to state law.

- Manhattan used the same definition in state law.

- Overland Park used a slightly different definition. It levies a transient guest tax on guests at all short-term rentals instead of limiting it to rentals with 2 or more rooms. However, Overland Park officials notified accommodations brokers impacted by the difference. This means that accommodations brokers should have the information they need to correctly comply with the ordinance. Overland Park also worked with KDOR on the difference.

Manhattan did not complete their annual comprehensive financial report timely in 2022 or 2023.

- State law (K.S.A. 75-1124) requires a city’s annual comprehensive financial report (ACFR) to be completed and turned into the Kansas Department of Administration within one year of the fiscal year’s completion, which for cities is Dec. 31. For example, when the 2025 fiscal year is complete, a city is expected to complete and turn in their report by December 31, 2026. An ACFR is a set of financial statements that meet the Governmental Accounting Standards Board reporting requirements. It includes audited expenditure and revenue information, statistical information, and financial trends.

- Manhattan completed their 2022 ACFR 10 months late (in October 2024) and their 2023 ACFR 2 months late (in February 2025). The city’s bond ratings were downgraded by Moody’s in part because of the delinquent reports. Issuer and general obligation ratings were downgraded from Aa3 to A1.

- Lower bond ratings indicate a higher risk for investors and may also mean higher interest rates for the city on future projects, which in turn may also increase the overall cost of those projects. Additionally, the lack of timely audit reports means city officials may not have important financial information.

- Manhattan officials told us that the city administration was understaffed by about 5 people as of January 2025 and that the city’s finance department has been short-staffed since 2019. They said that they particularly have had difficulty hiring accountants and financial officers. As such, this is likely contributing to late filings. Manhattan officials told us that to address challenges of having insufficient staff, they supplement their accounting staff by hiring an external accounting firm to ensure financial statements are ready for external auditors.

Conclusion

Transient guest taxes are a revenue source that local governments can use to fund local tourism-related events and facilities. Transient guest taxes are authorized by statute, but the purposes are defined very broadly. Additionally, local governments can exercise home rule that exempt cities from certain transient guest tax requirements in state law. This gives cities wide discretion in crafting their local ordinances related to allowable spending of guest tax revenue for tourism purposes. As such, most of the tourism-related spending appeared appropriate for the 3 cities we reviewed from 2021 to 2023. This included tourism promotion such as contracting with local convention and visitors bureaus, financing bonds related to convention and tourism facilities, and direct grants for festivals and tourist events. However, we noted two exceptions. One city used some of the tax for administrative fees, which is not allowed. Another city transferred a portion to the general fund with no notation of what it was for. Finally, we identified an important disconnect between the local ordinance in one city and state practices regarding which businesses collect transient guest taxes. There is a risk this may affect other cities as well.

Recommendations

1. Wichita should stop charging administrative and audit fees to their tourism and convention fund or update their charter ordinance to include these fees as an allowable expense.

- City of Wichita Response: The City of Wichita appreciates the work done by the Legislative Post Audit staff, and understands the basis for the recommendation. Staff anticipate presenting to the governing body recommendations to amend the City’s charter ordinance to clarify the use of the tourism and convention fund to finance audit fees and administrative charges.

2. Wichita and the Kansas Department of Revenue should develop a plan to resolve conflicting statutory and city ordinance definitions. This could include:

- Wichita revising the business definitions in its ordinance to align with state law.

- Wichita collecting its own transient guest tax revenues rather than using KDOR to collect them.

- KDOR and Wichita developing processes for periodically comparing ordinances to state law to ensure they align as intended.

- City of Wichita Response: The City of Wichita understands the challenges faced by the Kansas Department of Revenue in collecting the transient guest tax. Staff anticipate presenting to the governing body recommendations to amend the City’s Charter Ordinance to align business definitions with the current state statute. Additionally, the City would welcome the opportunity to coordinate with the state staff to facilitate efficient collection of the tax revenues.

- KDOR Response: The Kansas Department of Revenue has encouraged the City of Wichita to amend its current local ordinance to align ordinance definitions with statutory definitions within the Transient Guest Tax Act. If amendments or revisions are not made, the Department will inform the City of Wichita that the City will be responsible for the administration of the imposed transient guest tax.

3. The Kansas Department of Revenue should develop written agreements or contracts with the cities they collect transient guest taxes for that clarify the department’s role in the collections process. The clarification should include what each party is expected to do to ensure state law and charter ordinances regarding guest tax collections align.

- KDOR Response: Formalizing the roles and responsibilities of both the Department and local governments is a worthy objective. These agreements could delineate the Department’s role in tax collection and the local government’s role in tax administration. Clearly identifying each party’s responsibility and respecting home rule authority will help ensure the effective and efficient administration of the transient guest tax.

Initially, the Department will prioritize creating such agreements when transient guest tax is imposed by a city or county for the first time. It will then systematically develop written agreements for the more than 150 transient guest tax systems currently in place by local governments. This effort will be both time and labor intensive as all of the agreements will not necessarily be uniform among the local units.

4. The Kansas Department of Revenue should include language in their transient guest tax guidance documents that clarifies business’ responsibility to track differences between state law and city charter ordinances and which one applies in the event of a conflict.

- KDOR Response: The Department will review and update any guidance documents to include information on these distinctions. We hope to work with local governments when such differences arise, so that we can jointly provide consistent direction to retailers collecting the transient guest tax.

5. Manhattan should monitor and coordinate with their contracted external accounting firm to ensure their annual comprehensive financial reports are completed on time.

- City of Manhattan Response: As of the finalization of this report, the City of Manhattan’s 2023 audit has been completed and received an unmodified opinion. The City is working with Allen Gibbs & Houlik, L.C. (AGH) to assist with the preparation of audit workpapers and has created a schedule with our accounting firm BT&Co. PA for the timely completion of the annual audit.

Agency Response

On April 25, 2025, we provided the draft audit report to Manhattan, Overland Park, Wichita, and the Kansas Department of Revenue (KDOR). Because we did not make any recommendations to the City of Overland Park, their written response was optional and they chose not to provide one.

Manhattan, Wichita, and KDOR provided responses, which are included below. The City of Wichita and the Kansas Department of Revenue generally agreed with our findings and conclusions. However, the City of Manhattan expressed concerns about 2 of our findings. We carefully reviewed the information officials provided and made a minor adjustment to clarify our intent, but we did not change our findings for the following reasons:

- The City of Manhattan contends our methodology is flawed due to the small number of cities we reviewed and because we didn’t review convention and visitors bureaus’ financial records. We agree the results of our work are not projectable to all Kansas counties or other organizations’ use of transient guest tax revenues. However, we clearly described those limitations in the report and worded our findings accordingly. Additionally, reviewing how organizations spent transient guest tax revenue that they received from cities was beyond the scope of the audit. Furthermore, all 3 cities described having oversight mechanisms for the respective convention and visitors bureaus that they contract with.

- The City of Manhattan contends we incorrectly asserted that they use annual comprehensive financial reports to prepare budgets for future fiscal years. We did not conclude on whether or how the city used annual comprehensive financial reports. However, we made a minor change to one sentence to clarify our intent about the potential effects of untimely audit reports.

City of Manhattan Response

Dear Ms. Smith:

This letter serves as the requested response of the City of Manhattan to the Legislative Post Audit draft audit report on the use of transient guest tax funds in 2021-2023.

The City of Manhattan is concerned with the narrow selection of 3 communities for this effort. According to the Kansas Department of Revenue website, there are currently 153 cities and counties with transient guest tax rates. The Legislative Post Audit was directed by the committee to audit 3 or 1.96% of these communities. This cannot be perceived as a representative sample. The City of Manhattan is also concerned by the nature of the audit, given most cities have chartered out from underneath the state statute since the early 1980s. Most cities and counties have adjusted their rate multiple times, with a majority making an adjustment even within the last 10 years. This data is also available on the Kansas Department of Revenue website.

The audit focused on having a “receipt” for the committed dollars. Scrutiny and attempts to uncover misuse were highlighted throughout the effort. The City of Manhattan administration and elected officials spent hours discussing and deciding how to use these funds openly at public meetings in 2021-2023. The Commission approved the recommendation of City Administration to use $100,000 for tourism purposes performed by the Parks and Recreation Department. The General Fund had been paying people in the Parks & Recreation Department to provide upkeep, maintenance and installation of multiple plantings, trees, flower beds, and streetscape within our downtown and Aggieville districts. The transfer of $100,000 of transient guest tax dollars to the General Fund assisted with the compensation of these city employees and the materials purchased to accomplish this mission.

The audit acknowledges the transfer of $100,000 to the General Fund for tourism purposes is an appropriate use of transient guest tax dollars. However, the audit criticizes the city for not having a “receipt” for the city employees and resources it used to make Manhattan more attractive. If the city had used a private contractor and provided an invoice, it does not appear this would even be called out in this report.

If the intent of the report was to identify how these 3 cities utilized and spent transient guest tax funds, it fails to fully address how all the transient guest tax funds were spent in each community. The report only reviewed how transient guest tax funds were spent by the cities for their respective purposes. The City of Manhattan does not believe this is a comprehensive review and audit of how transient guest tax dollars are used by communities.

Finally, there was mention of the delayed audit reports by the City of Manhattan in 2022 and 2023. The City does not use “audited financials” from 3 years prior when preparing for the next fiscal year budget. For example, in May of 2025, the City is preparing for the 2026 fiscal year budget to be adopted in September of 2025. The claim made by Legislative Post Audit assumes the 2022 audited financials would have been used to assist with the preparation of the 2025 fiscal year budget. That is simply not the case. As a side note, the 2022 and 2023 audits were completed in October 2024 and March 2025, respectively, well-before the release of this audit report. None of these audited financials differed from the expenses/revenues provided during budget discussions and considerations. The 2024 audit is currently on track to be completed by September 2025.

Respectfully submitted,

Danielle Dulin

City Manager

City of Wichita Response

Chairman Francis and Members of the Committee:

The City of Wichita appreciates the opportunity to provide a formal response to the Legislative Post Audit report entitled “Reviewing Select Cities’ Use of Transient Guest Tax Revenues.” The Transient Guest Tax is an important resource for the City of Wichita, funding convention and tourism promotion, as well as capital and operating costs of convention and tourism facilities. City staff look forward to clarifying certain provisions of the City’s charter ordinance based on recommendations from the report.

Sincerely,

Robert Layton

City Manager

KDOR Response

Dear Post Auditor Clarke:

Thank you for the opportunity to comment on the audit findings in the “Reviewing Select Cities’ Use of Transient Guest Tax Revenues” audit report. The Kansas Department of Revenue (Department) commends the Legislative Post Audit (LPA) staff for their work in conducting this important audit.

The transient guest tax was first enacted in 1975, allowing the levy of a transient guest tax only by Sedgwick County and by the cities in Sedgwick County (K.S.A. 12-1692 through K.S.A. 12-1695). In 1977 the transient guest tax was expanded to allow the levy of a transient guest tax by any county or city in Kansas. (K.S.A. 12-1696 through K.S.A. 12-16,101). Thus, there is some duplication in statute.

In addition, Attorney General (A.G.) Opinion No. 82-17 concluded that the provisions of K.S.A. 12-1696 through K.S.A. 12-16,101 are non-uniform and cities may elect to exempt themselves from any part of those statutes and substitute new provisions under home rule power. A.G. Opinion 82-17 also held that after exempting itself from the state statute, a city may not require the Department of Revenue to administer its version of the transient guest tax. These findings were widely considered to also apply to Kansas counties, which was later confirmed by A.G. Opinion 2024-2.

It became commonplace for local governments to exercise home rule authority to 1) increase the rate of local transient guest tax imposed and 2) change certain rules in state statute about how local governments could use the transient guest tax revenue. These particular changes did not impose significant burdens on the Department of Revenue’s ability to administer the tax. In most cases, it serves the public interest for the Department to continue to administer taxes altered in these ways. However, this framework does increase the risk of discrepancies.

Although the transient guest tax law has undergone amendments over the years, it has not kept pace with changing times and is now outdated, requiring attention and possible revision. The presence of outdated statutes and concomitant inconsistencies has made the law increasingly difficult to administer effectively. In addition, changes in the lodging industry have incentivized local jurisdictions to create new definitions or expand existing ones in attempts to capture additional revenue from new types of lodging sales. As a result, LPA has identified some discrepancies and issues within the existing statutory framework.

The first recommendation for the Department encouraged the City of Wichita and the Department to develop a plan to resolve conflicting statutory and city ordinance definitions.

The Department is currently working with the City of Wichita to resolve these differences. The Department has encouraged the City of Wichita to amend the city ordinance to align ordinance definitions with statutory definitions within the Transient Guest Tax Act. Should appropriate changes not be made to the city ordinance, the Department will inform the City of Wichita that the City will be responsible for the administration of the imposed transient guest tax.

The second recommendation provides the Department develop written agreements or contracts with the cities for which it collects transient guest taxes. These agreements should clearly define the Department’s role in the collection process and outline the responsibilities of both parties to ensure alignment with state law and applicable charter ordinances.

Formalizing the roles and responsibilities of both the Department and local governments is a worthy objective. These agreements could delineate the Department’s role in tax collection and the local government’s role in tax administration. Clearly identifying each party’s responsibility and respecting home rule authority will help ensure the effective and efficient administration of the transient guest tax.

Initially, the Department will prioritize creating such agreements when transient guest tax is imposed by a city or county for the first time. It will then systematically develop written agreements for the more than 150 transient guest tax systems currently in place by local governments. This effort will be both time and labor intensive as all of the agreements will not necessarily be uniform.

The final recommendation to the Department emphasized the need to clarify, within transient guest tax guidance documents, the business’s responsibility to identify and track differences between state law and local city or county charters, ordinances, or resolutions.

In response, the Department will review and update any guidance documents to include information on these distinctions. Department subject matter experts will work with local governments when such differences arise, so that consistent direction can be jointly provided to retailers collecting the transient guest tax.

The Department appreciates the recommendations outlined in the audit and will take appropriate steps within our means to ensure the proper imposition of the transient guest tax.

Sincerely,

Mark A. Burghart, Secretary

Kansas Department of Revenue

Appendix A – City Fact Sheets

This appendix includes fact sheets about the 3 cities we reviewed in this audit. The sheets include information on each city’s transient guest tax rate, how they are allowed to use the revenue, as well as information on their transient guest tax revenue and expenditures since 2010.

Manhattan

Rate History

- Manhattan’s governing body authorized a 1.5% transient guest tax in 1978, gradually raising it to the current 7.5% rate in 2019.

Allowable Expenses

- Manhattan requires that transient guest tax revenue be spent on the promotion, enhancement, advancement, or retention of tourism and conventions to Manhattan as determined by their city commission. This might include programs, projects, activities, municipal services, or public improvements. Manhattan can also spend guest tax revenue on financing these projects through bonds or other debt tools. However, the use of these funds must also be approved by the Manhattan City Commission.

Revenues and Expenditures

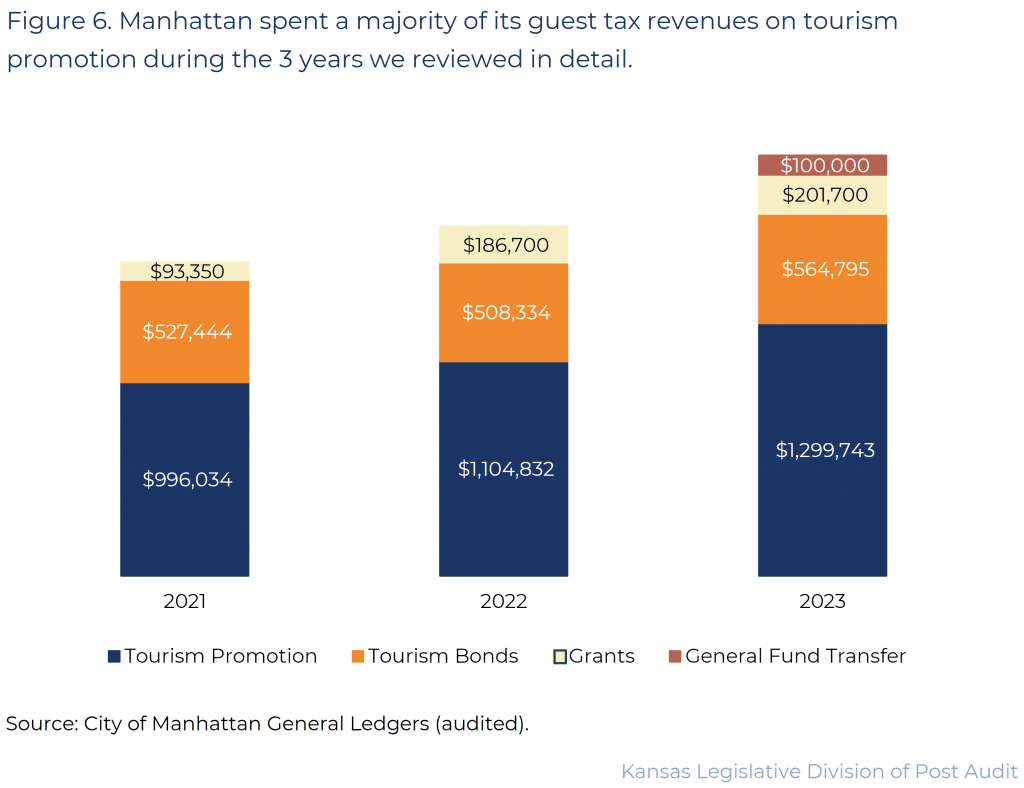

- Figure 6 shows Manhattan’s transient guest tax expenditures from 2021 – 2023. As the figure shows, Manhattan has primarily used its transient guest tax revenue for contracted services for tourism promotion through the convention and visitors bureau, Visit Manhattan. The next largest use of transient guest tax revenue was bond debt repayment. Manhattan has repaid debts related to various projects such as the city’s airport control tower, installing turf at their Anneberg Sports Complex, as well as paying for Flint Hills Discovery Center STAR bonds. Additionally, the city also provides grants and funding to organizations like Downtown Manhattan Inc., the Aggieville Business Association, and the Manhattan Arts Center. This is how Manhattan has used a large percentage of its transient guest tax revenue since 2010.

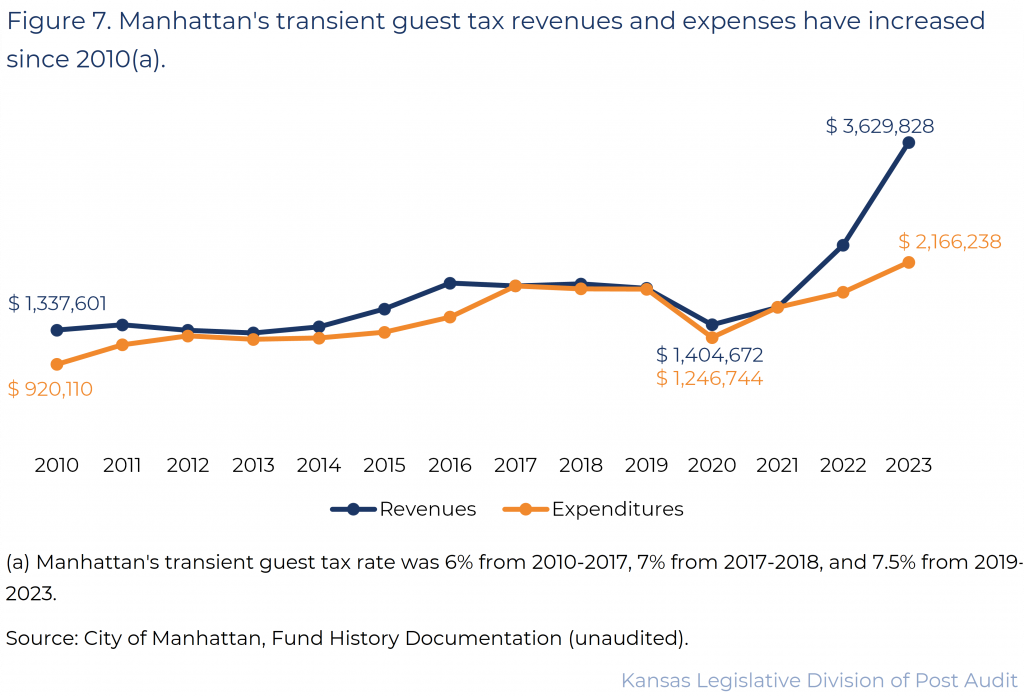

- Figure 7 shows Manhattan’s transient guest tax revenues and expenditures since 2010. As the figure shows, Manhattan’s transient guest tax revenues and expenditures have increased over time. However, in 2020 the city experienced decreases in revenues and expenditures, likely due to the impacts from the COVID-19 pandemic. The following years, the city experienced large increases in both revenues and expenditures.

Overland Park

Rate History

- Overland Park’s governing body authorized a 1% transient guest tax in 1982, gradually raising it to the current 9% rate in 2007.

Allowable Expenses

- General: Overland Park requires that transient guest tax revenue be spent on convention and tourism facilities and promotion. Facilities include things like hotels or convention centers that increase visitors to the city. Promotion includes things like advertising, trade shows, corporate meetings, and festivals that increase visitors to the city. Overland Park can also spend this revenue on the financing costs associated with convention and tourism facilities, such as bond principal and interest and leasing costs. The city’s charter ordinance also allows for paying for economic development of up to $50,000 per year.

- Specific: Ordinance and contracts further specify how transient guest taxes are to be used. Of the 9% transient guest tax:

- Up to 6% may be used to repay the Overland Park Development Corporation bonds per the debt service support agreement.

- 2% must be used to support Visit Overland Park’s tourism and convention activities per the Visit Overland Park contract.

- 1% may be used for other capital projects related to tourism and convention promotion activities, such as improving, maintaining, or operating a convention center, recreation complex, or entertainment district as allowed for in ordinance.

Revenues and Expenditures

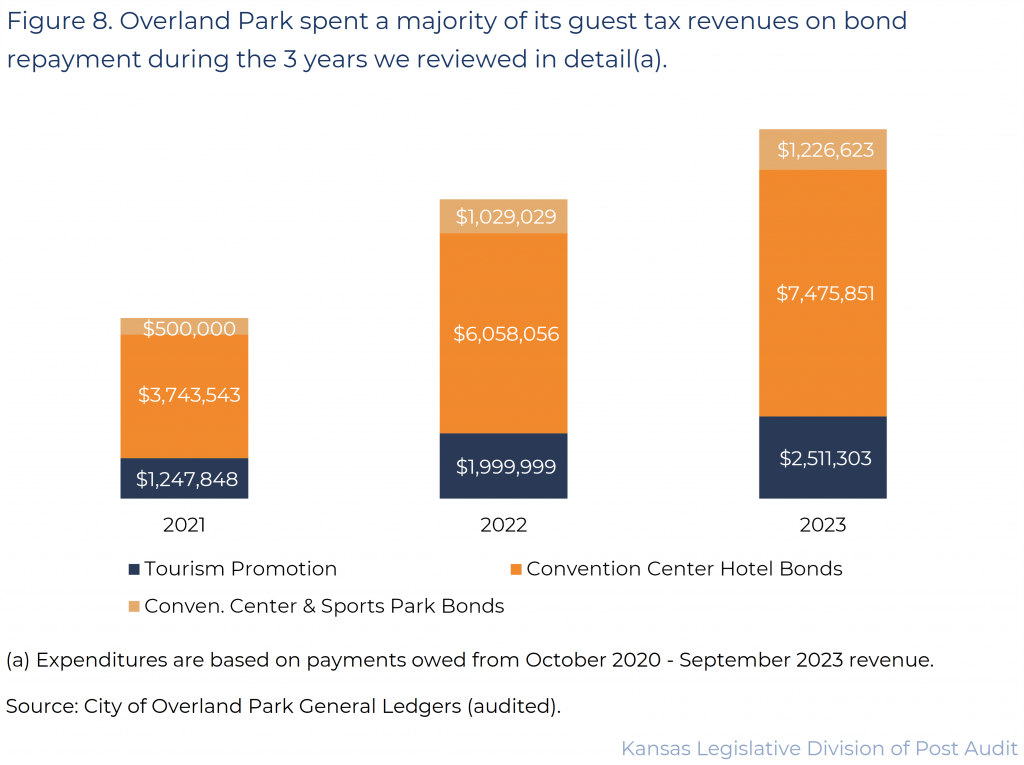

- Figure 8 shows Overland Park’s transient guest tax expenditures from 2021 – 2023. As the figure shows, the city used most of its transient guest tax revenue during this time to repay bonds issued to finance a hotel adjacent to the city’s convention center. This is how Overland Park has used the largest percentage of its transient guest tax revenue since 2000.

- This hotel is owned by the Overland Park Development Corporation (OPDC), a not-for-profit corporation. It was formed in 2000 to facilitate the financing, construction, and ownership of a convention center hotel. Although the OPDC is a distinct entity, it is considered a component unit of the City of Overland Park. This is because the OPDC board of directors is comprised solely of 6 city council members who are appointed by the mayor and approved by the city council. Under its debt service support agreement with OPDC, the City of Overland Park pays up to 2/3 of its transient guest tax revenue toward OPDC’s bonds for the convention center hotel debt.

- In 2000, the OPDC issued about $92 million in bonds to finance the construction of the convention center hotel. Including interest, the total cost to repay the bonds through 2032 would have been$278 million.

- As of March 2025, the OPDC has $139.7 million remaining in bond debt related to the hotel. This amount covers costs related to the original bond, interest payments, and financing updates to the hotel.

- In 2007, the OPDC refinanced their bond debt by issuing refunding bonds at a lower interest rate. The OPDC’s 2007 financial audit reported that the refunding bond saved $20.4 million in interest over 25 years.

- The OPDC issued about $90 million in bonds in 2019. These were a combination of refunding bonds (for the 2007 bonds) and bonds for hotel improvements. These improvements involved renovations of 322 guest rooms for updates to flooring, furniture, and bathrooms. The new bonds provided a slightly lower interest rate, but officials told us they primarily issued refunding bonds to better align their debt service payments with expected transient guest tax revenue.

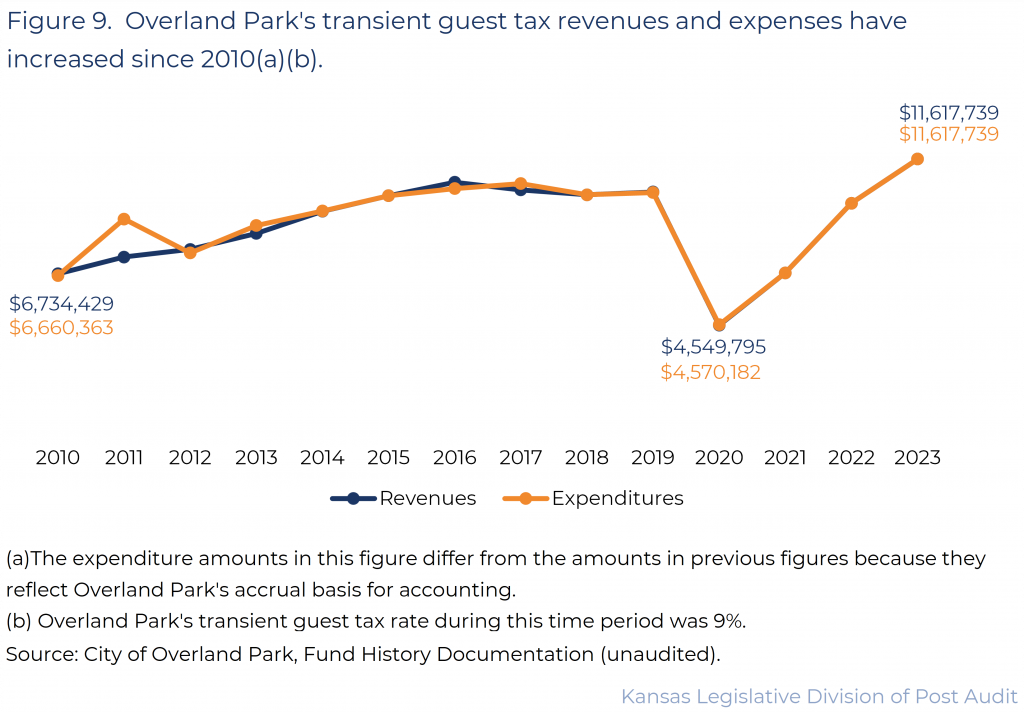

- Figure 9 shows Overland Park’s transient guest tax revenues and expenditures since 2010. As the figure shows, their revenues and expenditures have generally increased over time. The exception was 2020 and 2021 when revenues and expenditures decreased likely due to impacts from the COVID-19 pandemic.

Wichita

Rate History

- Wichita’s governing body authorized a 2% transient guest tax in 1975, gradually raising it to the current 6% rate in 1990.

Allowable Expenses

- General: Wichita requires that transient guest tax revenue be spent on convention and tourism facilities and promotion. Facilities include things like hotels, convention centers, and museums that increase visitors to the city. Promotion includes things like advertising, trade shows, corporate meetings, and festivals that increase visitors to the city. Wichita can also spend revenue on the financing costs associated with convention and tourism facilities, such as bond principal and interest and leasing costs.

- Specific: The city’s charter ordinance requires Wichita to use guest tax revenue in the specified order of priority:

- Bond, lease, or obligations that existed at the time the ordinance was passed that were related to conventions or tourism facilities.

- Future obligations related to the Century II Convention Complex.

- Future obligations related to the maintenance, modification, expansion or new construction of a convention or tourism facility.

- Deficits incurred in the operation or maintenance of any city owned convention or tourism facility.

- Convention and tourism promotion.

Revenues and Expenditures

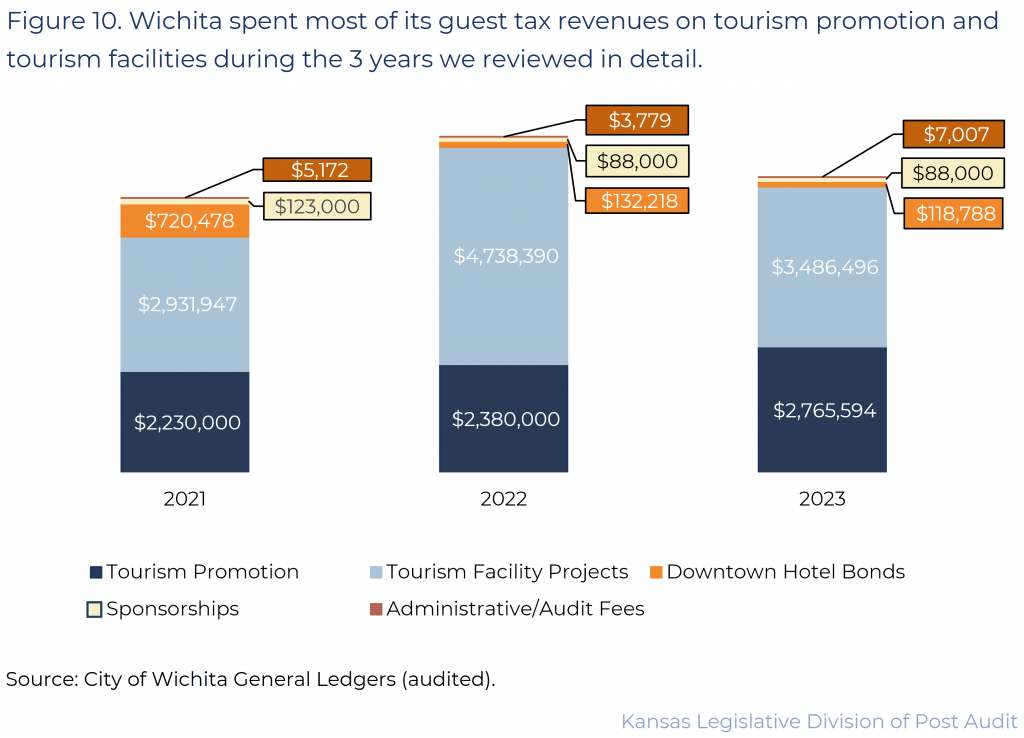

- Figure 10 shows Wichita’s transient guest tax expenditures from 2021 – 2023. As the figure shows, the city used a large portion of its transient guest tax revenue during this time on tourism facilities. This includes updating, operating, or maintaining facilities like the Century II Convention Center as allowed for in priorities 1 – 4 of Wichita’s Charter Ordinance. Additionally, another large portion was spent on the contract for tourism promotion with Visit Wichita, as allowed for in priority 5 of their charter ordinance. This is how Wichita has used a large percentage of its transient guest tax revenue since 2010.

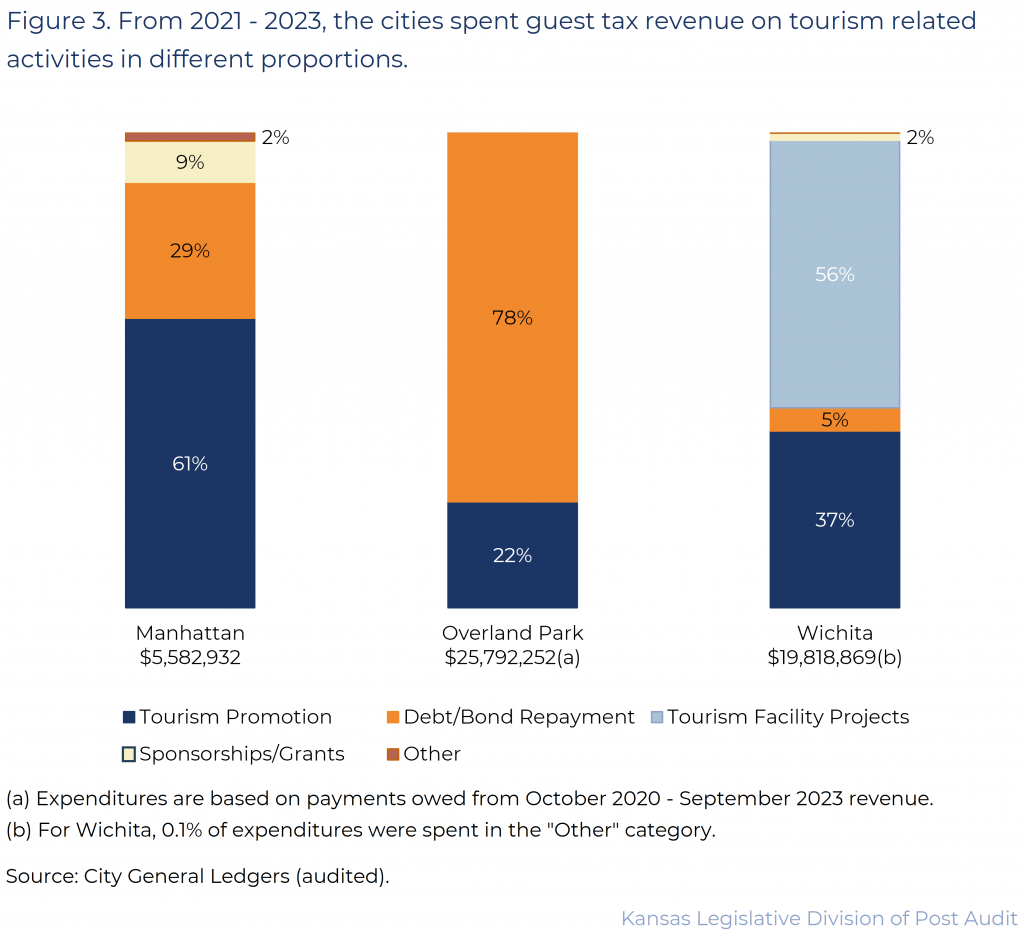

- Figure 11 shows Wichita’s transient guest tax revenues and expenditures since 2010. As the figure shows, Wichita’s transient guest tax revenues and expenditures have generally increased over time. The exception was 2020 when both revenues and expenditures decreased, likely due to impacts from the COVID-19 pandemic.