Reviewing Tax Credits Awarded and Used through the High Performance Incentive Program and the Kansas Affordable Housing Tax Credit (Limited-Scope)

Introduction

Senator Caryn Tyson requested this limited-scope audit, which was authorized by the Legislative Post Audit Committee at its May 12, 2025 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- What is the total amount of High Performance Incentive Program (HPIP) and Kansas Affordable Housing Tax Credit (KAHTC) tax credits the state awarded and businesses used in the last 5 years?

Our method included reviewing data from the Department of Revenue (KDOR) and the Kansas Housing Resources Corporation (KHRC). We reviewed HPIP data from KDOR to try to determine how many HPIP credits were earned and used by businesses in tax years 2019 through 2023. We reviewed KAHTC data from KHRC to determine how many KAHTC credits they awarded since the KAHTC was created in 2022. We also interviewed agency officials to learn how the tax credits work, whether the KAHTC has been used yet, and what the agencies do to monitor their potential costs.

Ultimately, we did not report the amounts of HPIP tax credits businesses earned and used. That was because of reliability issues with KDOR’s HPIP data. KDOR provided inconsistent datasets during the audit and we couldn’t verify the accuracy of them due to the time constraints of a limited-scope audit. Our scope of work also did not include a review of the effectiveness of, or return on investment, for either tax credit.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Our audit reports and podcasts are available on our website www.kslpa.gov.

Data limitations prevented us from reporting how much HPIP credits businesses earned and used, but the state has awarded almost $73 million in KAHTC tax credits since 2023, none of which has yet been used.

HPIP Tax Credits

The High Performance Incentive Program (HPIP) incents businesses to make capital investments through state income tax credits.

- HPIP encourages businesses to make capital investments, pay higher than average wages, and provide training to their employees. In exchange, businesses may earn state tax credits. State tax credits reduce taxpayers’ state income, privilege, or premium tax liabilities dollar-for-dollar. Businesses can also receive sales tax exemptions for specific projects. In this audit, we focus only on state tax credit awards. We don’t discuss sales tax exemptions granted under HPIP because they’re outside the scope of the audit.

- To qualify for HPIP, a business must meet certain criteria:

- It must be for-profit.

- It must be subject to state taxes.

- It must be in a qualifying industry (e.g., manufacturing) or a corporate headquarters or back-office of a national corporation. Some industries must get more than 50% of their gross revenues from sales to Kansas manufacturers or customers outside the state.

- And it must pay above average wages for similar industries in the area or be the only business in the industry in the area.

- Businesses can earn a tax credit equal to 10% of qualifying capital investments. Investments must exceed $1 million in Douglas, Johnson, Sedgwick, Shawnee, or Wyandotte counties. Investments must exceed $50,000 in other counties. A business earns the tax credit on the part of its investment that exceeds the $50,000 or $1 million threshold. There is no cap on how much credit a business can earn. If a business doesn’t have enough tax liability to use all of its credit, it can carry the unused credit forward for up to 16 years. To use credit it has carried forward, a business has to meet program criteria in the year it wants to use the credit. Finally, a business can transfer up to 50% of its credits to other Kansas taxpayers in a single year for investment projects placed into service on and after January 1, 2021.

- Businesses can also earn a tax credit equal to their employee training and education expenditures. Such expenditures must exceed 2% of their payroll at a specific worksite. A business earns the tax credit on the expenditures that exceed the 2% of payroll threshold. A business is limited to earning $50,000 per year of the training tax credit. Training credits can’t be carried forward or transferred. Training credits also aren’t refundable.

- Businesses that participate in HPIP may also participate in other economic development incentive programs. HPIP rules don’t prohibit businesses from participating in other programs. However, other programs may include prohibitions on participating in HPIP. For example, under state law, a business that participates in the Attracting Powerful Economic Expansion (APEX) program can’t also participate in HPIP.

The Departments of Commerce, Revenue, and Insurance administer HPIP.

- The Department of Commerce certifies whether businesses qualify for HPIP. A business can’t earn an HPIP tax credit unless Commerce certifies it. Commerce also recertifies businesses that want to use credits they’ve carried forward from prior years.

- The Department of Revenue (KDOR) administers program benefits (e.g., by processing tax credits) for most businesses.

- The Insurance Department administers program benefits for insurance companies.

HPIP has changed since its creation in 1993.

- The legislature established HPIP in 1993. The program has changed in a few key ways since then.

- In 2000, Commerce became responsible for certifying businesses’ eligibility for HPIP.

- In 2011, the carry forward period for capital investment tax credits increased to 16 years. The previous carry forward period was 10 years.

- In 2013, businesses in Douglas, Johnson, Sedgwick, Shawnee, and Wyandotte counties were required to make capital investments exceeding $1 million to earn the capital investment tax credit. Previously, businesses in those counties could earn the credit on investment amounts in excess of $50,000.

- In 2021, businesses were no longer required to participate in the Kansas Industrial Training or Retraining programs, or the Lifelong Learning Program to qualify for capital investment tax credits under HPIP. Additionally, taxpayers were allowed to transfer capital investment tax credits for projects placed into service on and after January 1, 2021.

Reliability issues with KDOR’s HPIP data prevented us from determining how much HPIP credit businesses earned and used.

- We reviewed 3 HPIP datasets from KDOR as part of this audit. The datasets showed the amount of HPIP tax credits businesses earned and used each tax year. KDOR provided 2 of the datasets during this audit and 1 of the datasets during a previous economic development incentive evaluation audit. We compared all 3 datasets for the same years to determine if the data was reliable.

- All 3 datasets provided by KDOR were inconsistent with each other. The amounts of HPIP credits businesses earned and used differed by tens to hundreds of millions of dollars within a single year. For example, the 3 datasets varied greatly for the single tax year 2019:

- One dataset showed 313 filers earned about $900 million in HPIP credit and used about $90 million. KDOR officials said this dataset included both investment and training credits.

- Another dataset showed 483 filers earned about $230 million in HPIP credit and used about $110 million. KDOR officials told us this dataset included only the investment tax credit. It didn’t include the training tax credit.

- A third dataset showed 333 filers earned about $160 million in HPIP credit and used about $100 million. KDOR officials said this dataset included both investment and training credits.

- Because the datasets were inconsistent, we can’t say how much HPIP credit businesses earned and used in any particular year or over time. KDOR officials told us they were confident the most recent dataset they provided was reasonably close to the actual amounts earned and used. However, they said they were continuing to review the HPIP data. This could result in additional changes. Therefore, we couldn’t verify the accuracy of the data within the 100-hour limit of this limited-scope audit. It would take a full audit to adequately review KDOR’s HPIP data for accuracy. We identify this as an issue for further consideration later in the report.

- Because KDOR is responsible for administering HPIP tax benefits, we expected them to have complete and accurate data about the amounts of HPIP credits earned and used. Having complete and accurate data is important to the abilities of KDOR and the legislature to monitor HPIP.

KDOR officials told us the data inconsistencies were caused by issues in their processes for tracking HPIP credits businesses have carried forward because of the complexity of HPIP program guidelines.

- KDOR officials told us they have been reviewing their HPIP data to ensure its accuracy. They said the review process identified that KDOR’s tax processing system, ATP, was double-counting credits some businesses earned and subsequently passed through to their owners or shareholders. KDOR officials also told us one dataset likely included HPIP credit businesses carried forward in addition to the credit they newly earned each year. Officials said their review is ongoing, but that they plan to have it done by January 2026.

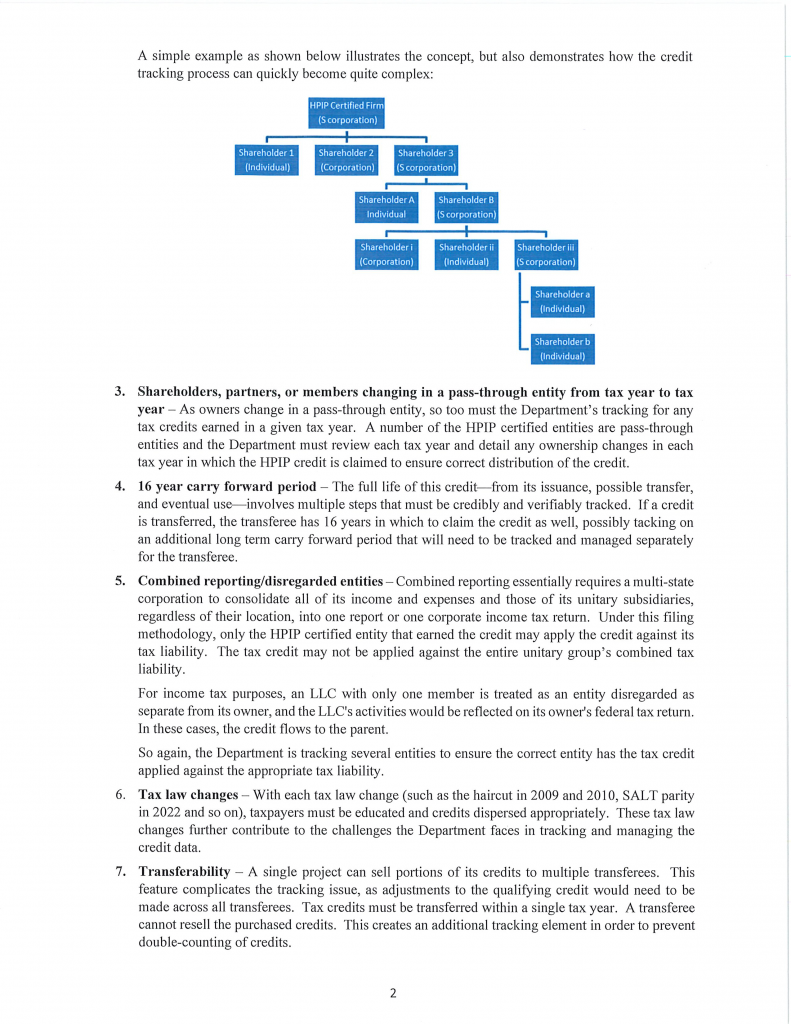

- KDOR officials told us the data issues were caused by data entry errors because of the complexity of the tax credit and the difficulty of tracking and reporting on the HPIP tax credits. They identified the following complexities with HPIP:

- Some corporate filers submit combined tax returns. A combined return may include information for multiple business entities. One business entity may be HPIP-certified when the others aren’t. KDOR must track and ensure only HPIP-certified entities receive HPIP credit.

- Some businesses that participate in HPIP are pass-through entities with large numbers of shareholders. The pass-through entities’ owners or shareholders claim HPIP credits these businesses earn. In other words, the business earns the HPIP tax credit, but the owner(s) or shareholder(s) claims the credit on their individual income tax form. KDOR must track data for both businesses and all their owners or shareholders to account for this. KDOR officials told us the more shareholders a business has, the more difficult it is for them to track HPIP credit use. KDOR staff must adjust tax data to ensure they don’t double-count amounts of credit claimed (i.e., earned) or allowed (i.e., used). KDOR officials acknowledged this wasn’t always happening like it should, which is what caused some of the changes in the data they provided to us for this audit.

- HPIP investment credits can be carried forward for up to 16 years. If a business doesn’t have enough tax liability to use the credit it earns in a year, it can use the remaining credit anytime over the next 16 years. A business must be HPIP-eligible in any year it wants to use carryforward. But it doesn’t have to maintain continuous eligibility. So, a business with unused credits could wait to re-qualify for HPIP only when it wants to use its carryforward. This means KDOR must track data for many years. KDOR can’t know whether or when a business might re-qualify to use its carryforward.

- HPIP credits earned on projects placed into service on or after January 1, 2021 can be transferred. Transferred credits can be carried forward for up to 16 years after transfer. KDOR officials told us transferring an HPIP credit resets the carryforward period for the recipient. This could greatly extend the total time for which a credit can be carried forward, which further increases program complexity.

- KDOR officials told us these complexities also make it very difficult for them to track the amount of HPIP carryforward available. They said the ATP system wasn’t designed to track credits for pass-through entities with lots of shareholders. They also said ATP wasn’t designed to account for carryforward earned in prior years. To work around these issues, KDOR officials told us they maintain hundreds of individual spreadsheets; one per business. They use the spreadsheets to track each HPIP-certified business’s carryforward. However, this is a manual and labor-intensive process. They said this makes it hard to quickly report on how much HPIP carryforward is available, in total.

- KDOR officials told us they’re reviewing their ATP data, tax returns, and internal spreadsheets to ensure their data is as accurate as possible. Officials told us they hope to have this work done in time for the upcoming legislative session. KDOR officials told us they would continue to track the amount of HPIP carryforward available until they can make more substantial changes to ATP.

- We didn’t evaluate KDOR’s processes for administering HPIP benefits. We also didn’t review the ATP system. That work was outside the scope of the audit.

KAHTC Tax Credits

The Kansas Affordable Housing Tax Credit (KAHTC) subsidizes the creation of affordable rental housing through a state income tax credit.

- The legislature created the KAHTC in 2022. The KAHTC is a state tax credit that matches the federal low-income housing tax credit (LIHTC). The KAHTC mirrors the federal LIHTC and is administered in accordance with federal program requirements. Both credits help subsidize the development of affordable rental housing.

- The Kansas Housing Resources Corporation (KHRC) administers both the KAHTC and the LIHTC. Under state law, KHRC’s state tax credit award to a project must equal the amount of the federal tax credit it awarded to the project. However, due to 2025 legislation, not all projects that receive federal credit awards will also receive state credit awards.

- KHRC awards credits to projects annually through an application process. Housing projects that receive tax credits can sell both the federal and state tax credits to investors. In exchange, investors invest in the housing projects. This helps the project owners reduce costs and allows them to charge tenants lower rents. Projects must operate as affordable housing in compliance with federal requirements for 30 years.

- All projects that receive KAHTC awards must begin as rental housing projects. Projects may include multifamily buildings, single-family dwellings, duplexes, and townhouses. Projects may later be converted to owner-occupied dwellings (e.g., by selling dwellings to the tenants that occupied them).

- Investors who purchase state tax credits can use the credits to reduce their state income, privilege, or premium tax liabilities dollar-for-dollar. This means KAHTC credits represent potential foregone tax revenues for the state. Investors can carry forward unused credits for up to 11 years. The KAHTC is not refundable or transferable.

- Unlike some other tax credits, KAHTC credits can be used every year for 10 years. This is separate from the carryforward provision. For example, if a housing project receives a $1 million KAHTC award, the investors who purchase those credits can use $1 million in state tax credits every year for 10 years. This means a $1 million KAHTC award could result in as much as $10 million in foregone tax revenues over 10 years. This also means the KAHTC has a stacking effect. That’s because KHRC awards new KAHTC credits every year and because investors can use their credit awards every year for 10 years.

- Housing projects that receive KAHTC credits may also participate in other incentive programs. KAHTC rules don’t prohibit projects from participating in other programs. Projects that participate in other programs may have to meet additional requirements related to those programs. According to KHRC, projects that received LIHTC/KAHTC awards sometimes also receive funding from other programs. For example, projects may get funding from the federally funded National Housing Trust Fund. However, other programs may include prohibitions against receiving KAHTC credit. For example, projects that receive KAHTC credits can’t receive Kansas Housing Investor Tax Credits. Commerce officials told us projects that qualify for the KAHTC wouldn’t qualify for HPIP.

KHRC has awarded almost $73 million in KAHTC tax credits to 67 housing projects since 2023, which could amount to $730 million in foregone revenues.

- We reviewed the KAHTC awards KHRC made to housing projects between 2023 and August 2025. Under state law, 2023 was the first year the KAHTC was allowed.

- Figure 1 shows how much credit KHRC awarded each year. As the figure shows, since 2023, KHRC awarded about $72.8 million in KAHTC tax credits to 67 housing projects. Appendix A summarizes each of those projects in more detail.

| Figure 1. KHRC has awarded about $73 million in KAHTC credits to date. | ||

| Calendar Year | # of Project Awards | Credit Awarded |

| 2023 | 22 | $25.3 million |

| 2024 | 27 | $30.6 million |

| 2025 | 18 | $16.9 million |

| Total | 67 | $72.8 million |

| (a) 2025 data is current as of August 2025. KHRC may award up to $8.1 million in additional credits later in 2025. | ||

| Source: LPA analysis of KHRC’s KAHTC awards. | ||

| Kansas Legislative Division of Post Audit | ||

- This means investors’ use of the KAHTC could result in as much as $728 million in foregone income tax revenues. That’s because investors may use their credits annually for 10 years. Thus, $72.8 million in credit awards means as much as $728 million in potential foregone state income tax revenues.

- KHRC will make additional 2025 KAHTC awards in November. Qualified allocation plan year 2025 has a cap of $25 million, so the total amount of KAHTC credits awarded may increase by up to $8.1 million for plan year 2025. A qualified allocation plan explains how KHRC will award state and federal tax credits to projects. Qualified allocation plan years are generally synonymous with calendar years.

No investors have used the KAHTC credit to date.

- Investors can’t earn or use KAHTC credits until the projects they invested in are complete and available to be rented by tenants. At the time we did our work, KDOR officials told us no taxpayers have reported using KAHTC credits. This means the KAHTC hasn’t resulted in any foregone tax revenues for the state yet. However, KHRC officials told us 2 projects were recently completed and received allocation certificates from KHRC. This means investors may soon begin using credits awarded to those projects.

- It’s unclear exactly when investors will use their KAHTC credits. KHRC officials told us they monitor housing projects and can estimate when they’ll be completed and when investors may use their credits. Various factors may influence whether or when investors use their credits. For example, if investors don’t have enough tax liability to fully use their credits, they can carry them forward for future use. This makes it hard to say exactly when investors’ use of KAHTC awards may result in foregone revenues. However, KHRC officials told us it’s likely investors will use their KAHTC credits before they expire.

KAHTC use may result in as much as about $1 billion in foregone income tax revenues over the next couple decades.

- We estimated the tax revenues the state may forgo due to investors’ use of KAHTC awards to answer the audit question. The scope of this audit is limited to the potential cost of investors using the KAHTC. It does not include an evaluation of the KAHTC’s benefits or effectiveness, which would be required to determine the program’s total fiscal impact to the state. For example, KHRC officials told us the KAHTC results in economic benefits like job creation and capital investment that offset at least some of the credit’s costs. We didn’t evaluate the potential benefits of the KAHTC due to the limited scope of this audit.

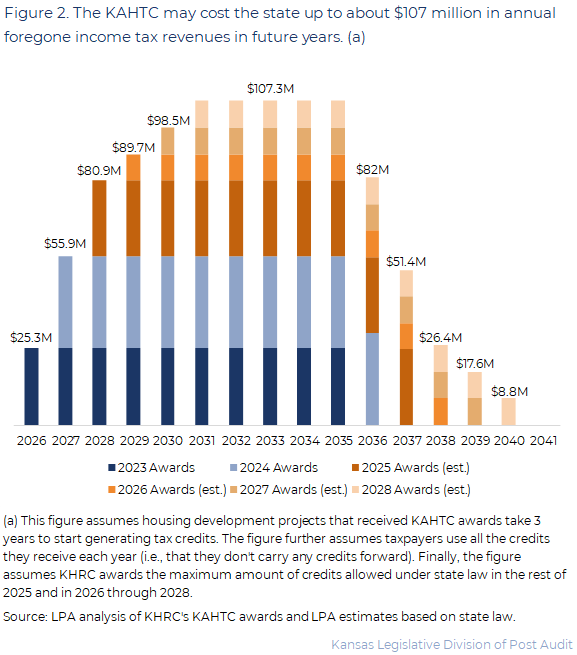

- KHRC may award a total of about $107.3 million in KAHTC credit through the end of 2028.

- KHRC has already awarded about $72.8 million to date.

- KHRC may award up to $34.5 million in KAHTC credit between now and when the KAHTC sunsets in 2028. State law allows KHRC to award an additional $8.1 million in 2025 and up to $8.8 million each year through the end of 2028.

- That would translate to a maximum of $1.07 billion in potential foregone income tax revenues across the next approximately 15 years. That’s because investors can use the full amount of their KAHTC credit awards every year for 10 years. It’s also because investors may carry unused credits forward for up to 11 years. However, the 11-year carryforward period starts the tax year after KHRC certifies a project is complete. It applies to all 10 years of investors’ credit use. For example, if an investor first uses their credit in 2025, they could carry it forward and use it as late as 2036. By contrast, if that investor uses their credit for the tenth and final time in 2034, they can still only carry it forward to 2036. Even though the KAHTC sunsets in 2028, investors will continue to use credits they previously purchased. And because KHRC awards new KAHTC credits every year, the KAHTC has a stacking effect. This effect causes potential foregone revenues due to investors’ use of the credit to ramp up over time.

- Figure 2 shows how the state may experience the potential foregone revenues due to investors’ use of the KAHTC over the next 15 years under certain assumptions. The figure also illustrates the stacking effect of KAHTC awards. As the figure shows, annual foregone tax revenues due to the KAHTC might peak at about $107 million in 2031. Foregone revenues would then begin decreasing in 2036 until they reach $0 in 2041. KHRC provided a similar forecast to the Division of the Budget earlier this year to help show when investors may use their credits.

- However, there are many reasons the actual foregone revenues due to investors’ use of the KAHTC may be less or happen in different years than the figure shows. Such reasons include but are not limited to the following:

- KHRC might not award the maximum amount of KAHTC credit allowed under state law. This would reduce potential foregone tax revenues.

- Projects that receive KAHTC awards may return their awards. KHRC officials told us projects may return awards for a variety of reasons. For example, projects may return awards due to unanticipated expenses, not getting zoning changes from local governments, or discovering problems with the project site. Projects that return their awards won’t proceed and don’t result in investors using KAHTC credits. This would reduce the total potential foregone tax revenues. Based on data we reviewed, 4 projects to which KHRC previously awarded KAHTC credits returned their awards. Those awards totaled about $3.7 million (which would have resulted in $37 million in foregone tax revenues over the 10 years investors would have used their awards). They aren’t included in the totals in this report.

- Projects must be complete and have units available to rent for investors to use their credits. It generally takes a few years for this to happen. If some projects take a long time to complete, it will delay how long it takes for investors to begin earning and using their credits. This would extend the time over which the state experiences the foregone revenues due to investors’ use of the KAHTC.

- Investors may carry KAHTC credits forward for use in future years. This would be because investors don’t have enough tax liability to use all their credits every year. This could extend the time over which the state forgoes tax revenues. Figure 2 assumes investors don’t carry forward any of their KAHTC credit. If investors often carry credits forward, the state may experience fewer foregone tax revenues in earlier years (e.g., 2026 through 2031) but more foregone tax revenues in later years (e.g., 2035 through 2040).

Recent legislation will limit the future use of the KAHTC and sunset it in 2028.

- During the 2025 session, the legislature made several changes to the KAHTC. These changes limit the credits KHRC can award each year. They also end credit awards after 2028. These changes limit the potential cost of the KAHTC.

- The 2025 Legislature limited the KAHTC credits KHRC can award in qualified allocation plan years 2025 through 2028. Qualified allocation plan years are generally the same as calendar years.

- In plan year 2025, KHRC can award up to $25 million in state KAHTC credits. Previously, there was no cap on the amount of KAHTC credits KHRC could award. The amount was limited only by the amount of federal credit KHRC was allowed to award.

- In plan years 2026 through 2028, KHRC can award up to $8.8 million in state KAHTC credits.

- Beginning November 15, 2025, KHRC will no longer be allowed to award KAHTC credits to projects financed by federally tax-exempt bonds. Projects that are at least 50% (25%, beginning in 2026, due to changes in federal law (P.L. 119-21)) financed by federally tax-exempt bonds automatically receive the federal LIHTC. This change explains why not all projects that receive the federal tax credit will also receive the state tax credit.

- The 2025 Legislature also set the KAHTC to sunset in 2028. KHRC won’t be allowed to award any KAHTC credits after December 31, 2028. However, investors may earn and use credits they were previously awarded past 2028.

Recommendations

- The Kansas Department of Revenue (KDOR) should continue correcting its HPIP data to ensure its accuracy by reviewing HPIP-certified businesses’ tax returns and ensuring data from the returns are captured in ATP. KDOR should report the corrected HPIP data to the Legislature. As part of correcting its data, KDOR should evaluate whether the ATP system is capable of processing HPIP data. If it’s not, KDOR should consider working with the Legislature to identify ways to upgrade or replace ATP.

- Agency Response: The Department agrees that complete and accurate data is essential for effective oversight and program evaluation. To that end, the Department has dedicated a staff member to review each individual HPIP-certified entity to ensure all information is current, accurate, and complete. The Department’s goal is to complete this review by the beginning of 2026. The Department has also documented system enhancements to the ATP system to improve tracking capabilities. However, any corrective measures must be carried out within an extremely narrow window, so as not to disrupt the processing of tax returns during the regular and extended filing seasons. As a result, there is limited flexibility to undertake such a significant system update, given the demands of other legislative priorities.

Potential Issues for Further Consideration

We identified an issue that might be worth evaluating in more detail, but because of the limited scope of the audit, we did not have time to fully develop the issue. Although we had unresolved questions about the following issue, more audit work would be needed to determine the extent of the problem.

- KDOR provided us inconsistent data about the amounts of HPIP credits businesses claimed (i.e., earned) and were allowed (i.e., used to reduce their state tax liabilities). KDOR officials told us they were reviewing the HPIP data for accuracy and had identified errors with some amounts being double counted in their tax processing system. To determine if KDOR’s revised HPIP data is correct, it would require a broader audit to review KDOR’s tax processing system and manual processes for tracking the HPIP carryforward.

Agency Response

On August 28, 2025 we provided the draft audit report to KDOR and KHRC. Both departments provided feedback. We made minor changes based on their feedback. Both agencies also provided written responses to the audit. Their responses are below. Agency officials generally agreed with our findings, conclusions, and recommendation, but KHRC officials had questions about the limited scope of this audit.

KDOR Response

KHRC Response

Kansas Housing Resources Corporation (KHRC) appreciates this opportunity to respond to this limited-scope audit of the Kansas Affordable Housing Tax Credit (KAHTC) and again work with the Legislative Post Audit Committee and Kansas Legislative Division of Post Audit (LPA). In the three years since its inception, the KAHTC program has been audited three times without findings or recommendations, demonstrating KHRC’s successful administration and the impact of the program. Please find below KHRC’s concern with this audit’s incomplete picture of the KAHTC program and suggestion that the Legislature deserves the full picture before making any policy decisions:

Concern: This Limited-Scope Audit Paints an Incomplete and One-Dimensional Image. The audit objective was very narrow, aiming to answer the question: What is the total amount of KAHTC tax credits the state awarded and businesses used in the last five years? To answer the question posed, LPA examines data regarding the KAHTC credits awarded and claimed to date, as well as the amount of credits that may be awarded moving forward, and then makes projections regarding the credit’s future fiscal cost. This focus on the potential foregone tax revenue caused by credits being claimed paints an incomplete picture.

Suggestion: The Kansas Legislature Deserves the Comprehensive Picture, Including KAHTC’s Many Benefits. KHRC’s position is that the Legislature, as the policymakers, deserves the comprehensive picture of the KAHTC in order to have the information necessary to make informed policy decisions. The full picture includes how the KAHTC has:

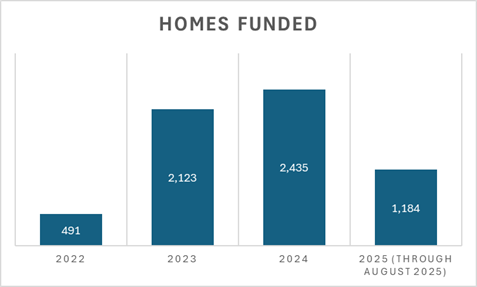

- Tripled the state’s rate of affordable housing development. In 2022, before the KAHTC, the federal low-income housing tax credit funded 491 homes here in Kansas; however, since the KAHTC become available to pair with that federal credit in 2023, 5,742 homes have been funded, made possible solely because of the KAHTC.

- Generated short-term economic development and tax revenues for communities and the state. The aggregate development budgets for the homes funded through the KAHTC total $1,504,209,000. Those are dollars that would not have been spent, for developments that would not have been built, without the KAHTC. Due to the KAHTC’s investments, however, those dollars have been flowing through local communities for the last three years, before any credits may be claimed and without any initial cost to the state. Construction generates income, property, and sales tax revenues that communities and the state are already receiving and enjoying. Without the KAHTC, this short-term economic development and the accompanying revenues would not have occurred.

- Generated long-term economic growth and tax revenues for communities and the state. The KAHTC funds homes that will remain affordable for at least 30 years, creating long-term economic growth. Quality, affordable homes allow for expanded and retained jobs for employers, a larger tax base, stronger neighborhoods, and healthier communities that will not require as many costly social or emergency services. Most KAHTC developments pay property taxes, and their residents will pay income and sales taxes, as well as spend their incomes throughout the local economy. Without KAHTC, this long-term economic growth and additional revenue would not happen.

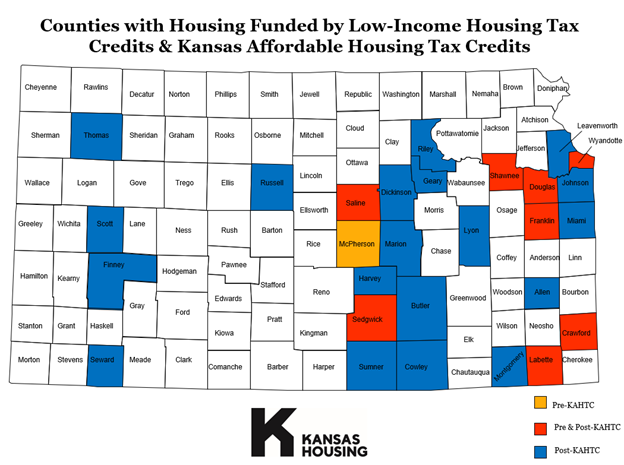

- Allowed more counties and communities to be reached, particularly in rural areas. In 2022, before the KAHTC became available, the federal low-income housing tax credit financed 491 homes in 9 counties. Now, from 2023 to date, with the KAHTC to pair with that federal tax credit, the program has served 27 counties, greatly broadening KHRC’s reach and impact. Without the KAHTC, rural communities had been and would have continued to be left behind.

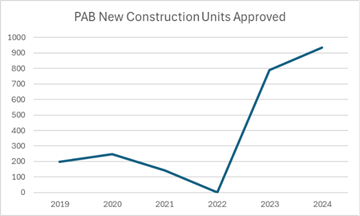

- Leveraged underused federal resources. For decades, Kansas has not used its federally allocated Private Activity Bond (PAB) authority, leaving hundreds of millions of federal resources on the table each year. Since KAHTC, PAB usage for housing has dramatically increased, from $5M before the credit was enacted to $251M in 2024. The elimination of the KAHTC for housing projects utilizing PABs will severely restrict PAB usage, diverting Kansas’ fair share of federal resources.

Conclusion: The Comprehensive Picture of KAHTC is a Successful Program Making Historic Impact Addressing Kansas’ Housing Needs. KAHTC is making historic success addressing the state’s housing problems, generating economic growth, expanding jobs, increasing tax revenue, financing thousands of affordable homes for our neighborhoods and communities, and utilizing previously underused federal resources. KHRC would encourage the Legislature to capture and view the full picture in making future policy decisions related to this important resource and tool for housing, economic, and community development in Kansas.

Appendix A – KAHTC Award Recipients

This appendix lists the low-income rental housing development projects to which the Kansas Housing Recourses Corporation (KHRC) has awarded Kansas Affordable Housing Tax Credits (KAHTCs).

| Award Year | Award Recipient | County | # Low-Income Units | # Market Rate Units | KAHTC Award |

| 2023 (a) | Cross-Lines Developer, LLC | Wyandotte | 88 | 0 | $265,000 |

| 2023 | Housing Opportunities, Inc. | Scott | 16 | 0 | $296,000 |

| 2023 | Dalmark Development Group, LLC | Sedgwick | 46 | 0 | $402,700 |

| 2023 | Midwest Housing Initiatives | Thomas | 18 | 0 | $448,656 |

| 2023 | IRC Manager, LLC | Butler | 48 | 0 | $463,000 |

| 2023 | Overland Property Group, LLC | Cowley | 100 | 0 | $532,691 |

| 2023 | 3 Diamond Development, LLC | Labette | 100 | 0 | $552,867 |

| 2023 | Steele Properties, LLC | Sedgwick | 78 | 0 | $601,084 |

| 2023 | Mennonite Housing Rehabilitation Services, Inc. | Dickinson | 32 | 0 | $695,000 |

| 2023 | Zimmerman Properties, LLC | Leavenworth | 50 | 0 | $795,000 |

| 2023 | RR Jennings Developer, LLC | Geary | 29 | 7 | $837,000 |

| 2023 | Green Park 2023, LLC | Geary | 100 | 0 | $874,000 |

| 2023 | AMD Partners LLC | Johnson | 48 | 0 | $880,000 |

| 2023 | Flint Hills Holding Group, Inc. | Douglas | 49 | 0 | $1,025,000 |

| 2023 | Overland Property Group, LLC | Saline | 137 | 0 | $1,193,915 |

| 2023 | Tier One Development | Wyandotte | 123 | 0 | $1,393,005 |

| 2023 | Eagle Pointe Development | Wyandotte | 104 | 0 | $1,677,619 |

| 2023 | Wichita OPCO | Sedgwick | 114 | 0 | $1,795,000 |

| 2023 | TWG Victory Hills GP, LLC | Wyandotte | 152 | 0 | $1,951,466 |

| 2023 | Clarion Park Housing I, LLC | Johnson | 220 | 0 | $2,244,304 |

| 2023 | The Annex Group | Sedgwick | 240 | 0 | $2,896,413 |

| 2023 | MRE Capital, LLC | Johnson | 224 | 0 | $3,521,948 |

| 2024 | Homestead Affordable Housing, Inc. | Geary | 32 | 0 | $146,141 |

| 2024 | Merak Development, LLC | Lyon | 24 | 0 | $422,000 |

| 2024 | Housing Opportunities, Inc. | Russell | 24 | 0 | $441,729 |

| 2024 | Detroit Affordable Homes, Inc. | Seward | 110 | 0 | $489,683 |

| 2024 | Mennonite Housing Rehabilitation Services, Inc. | Marion | 24 | 0 | $543,000 |

| 2024 | Silo Crossing Senior, LLC | Montgomery | 64 | 0 | $550,000 |

| 2024 | Tier One Development | Wyandotte | 40 | 0 | $607,843 |

| 2024 | Chalet Manor, L.P. | Wyandotte | 64 | 0 | $699,140 |

| 2024 | Cerebral Palsy Research Foundation of Kansas | Sedgwick | 40 | 0 | $700,000 |

| 2024 | Manhattan Area Housing Partnership, Inc. | Riley | 30 | 0 | $745,000 |

| 2024 | Flint Hills Holdings Group, LLC | Saline | 49 | 12 | $798,000 |

| 2024 | EmberHope, Inc. | Harvey | 38 | 0 | $810,000 |

| 2024 | Resource Housing Group, Inc. | Douglas | 34 | 8 | $812,500 |

| 2024 | AMD Partners LLC | Wyandotte | 48 | 0 | $830,000 |

| 2024 | JCM Ventures, LLC | Butler | 60 | 0 | $840,000 |

| 2024 | Sunflower Flats BP, LLC | Riley | 62 | 0 | $845,000 |

| 2024 | Timothy Schulte | Douglas | 30 | 6 | $850,000 |

| 2024 | Overland Property Group, LLC | Butler | 42 | 18 | $850,000 |

| 2024 | Glanville Towers, LP | Wyandotte | 108 | 0 | $1,026,526 |

| 2024 | CPP East, LLC | Crawford | 128 | 0 | $1,037,232 |

| 2024 | Wheatland Investments, LLC | Douglas | 121 | 0 | $1,353,443 |

| 2024 | Chelsea Plaza 2023, LLC | Wyandotte | 121 | 0 | $1,413,134 |

| 2024 | Gateway Plaza 2023, L.L.C. | Wyandotte | 147 | 0 | $1,585,610 |

| 2024 | Unger Housing, LLC | Riley | 110 | 0 | $1,591,000 |

| 2024 | Union Development Holdings, LLC | Shawnee | 250 | 0 | $2,890,928 |

| 2024 | Bison Affordable Housing | Douglas | 250 | 0 | $3,299,916 |

| 2024 | Wheatland Investments, LLC | Johnson | 341 | 0 | $4,414,362 |

| 2025 | Mennonite Housing Rehabilitation Services | Harvey | 28 | 0 | $436,000 |

| 2025 | AMB Development, LLC | Sumner | 33 | 0 | $488,000 |

| 2025 | Overland Property Group, LLC | Saline | 37 | 0 | $528,497 |

| 2025 | KETCH | Sedgwick | 32 | 0 | $610,000 |

| 2025 | Ottawa Sunflower, LLC | Franklin | 60 | 0 | $655,000 |

| 2025 | JCM Ventures, LLC | Miami | 25 | 0 | $660,000 |

| 2025 | Commonwealth Development Corp. of America | Sedgwick | 42 | 0 | $780,550 |

| 2025 | Inclusion Connections, Inc. | Johnson | 43 | 0 | $800,000 |

| 2025 | Mennonite Housing Rehabilitation Services | Sedgwick | 50 | 0 | $800,000 |

| 2025 | Flint Hills Holding Group, LLC | Shawnee | 38 | 9 | $850,000 |

| 2025 | Iola Redevelopment LLC | Allen | 33 | 16 | $850,000 |

| 2025 | NuJEN Preservation Housing, Inc. | Wyandotte | 34 | 0 | $850,000 |

| 2025 | Overland Property Group | Sedgwick | 40 | 20 | $850,000 |

| 2025 | Zimmerman Properties, LLC | Finney | 48 | 0 | $850,000 |

| 2025 | AMD Partners, LLC | Shawnee | 48 | 0 | $850,000 |

| 2025 | OP Legacy Housing, LLC | Johnson | 180 | 0 | $1,463,000 |

| 2025 | Messner-Hoppe JV Development, LLC | Shawnee | 176 | 0 | $2,194,749 |

| 2025 | Marian Development Group, LLC | Wyandotte | 192 | 0 | $2,364,146 |

| (a) This project originally received a federal LIHTC award in 2022. KAHTC officials told us they adjusted the project’s award after the creation of the KAHTC. KHRC officials said this meant they had to award KAHTC credits equal to the amount of the adjustment they made to the federal award. | |||||

| Source: LPA review of KHRC’s KAHTC awards. | |||||

| Kansas Legislative Division of Post Audit | |||||