Reviewing Tax-Exempt Real Property and Property Donated to Universities

Introduction

Representative Kristey Williams requested this audit, which was authorized by the Legislative Post Audit Committee at its May 12, 2025 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following questions:

- What was the estimated amount of forgone property tax revenue to the state and local governments in 2024 due to property tax exemptions?

- How much real property has been donated to the 7 Kansas public universities and their foundations and is exempt from property tax?

For the first objective, our methods and scope included reviewing the Kansas Constitution, state law, and tax-exempt real property information. We reviewed the Kansas Constitution and state law to identify the real property tax exemptions that exist in Kansas. We also reviewed tax-exempt real property information from the Kansas Department of Revenue for all Kansas counties in 2024. This information included appraised values for all tax-exempt real property in Kansas and mill levies for each county. We used this information to estimate how much real property tax revenue the state and local government didn’t collect in 2024 due to real property tax exemptions.

For the second objective, we collected information from the 7 public universities in Kansas and their foundations about the real property they owned in 2024. This information included the appraised value of their real property, the acreage, its use, and how they acquired the property (e.g., donated, purchased, etc.). We used this information to determine how much of their real property was tax exempt in 2024 and how they acquired those exempt properties.

More specific details about the scope of our work and the methods we used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Audit standards require us to report limitations on the reliability or validity of our evidence. In this audit, we identified reliability concerns with the tax-exempt real property data the Kansas Department of Revenue provided to us. For example, we know the data are missing the appraised value of some exempt properties and does not fully match county records. However, this information is the best and only information that exists that can answer the audit objective. Additionally, there is no data available on the assessment rates and mill levies for tax-exempt real property because county appraisers don’t assess taxes on these properties. We developed informed assumptions to estimate these amounts because that’s the only way to estimate forgone tax revenue. Together, these limitations mean our results should be interpreted as a rough, general estimate of forgone tax revenue. Underlying errors in the data that we couldn’t detect or using different assumptions and methods would generate a different estimate.

For objective 2, we gathered information from the 7 public universities in Kansas and their foundations about the real property they owned in 2024. However, universities don’t maintain much information about whether their tax-exempt real property was donated or purchased. This means we couldn’t draw conclusions about how universities acquired the exempt property they owned. We also know the total appraised value of property owned by the foundations is incomplete because University of Kansas Endowment Association and Kansas State University Foundation didn’t provide information related to some of their taxable property. We tried to collect this information ourselves from county tax records, but we know we are missing some information for those two foundations. These limitations only have a minor effect on our work which we describe in more detail later in the report.

In 2024, real property tax exemptions resulted in counties forgoing an estimated $1 billion in tax revenue and the state forgoing about $12 million in tax revenue.

Background

In Kansas, taxpayers pay taxes on real property and certain types of personal property.

- Article 11 of the Kansas Constitution defines 2 classes of property for taxation.

- Real property includes land, minerals, and improvements on that land such as buildings (K.S.A. 79-102). Taxpayers use real property for many purposes. This includes housing, commercial and industrial space, agriculture, and nonprofit purposes.

- Personal property is every other tangible thing that can be owned that isn’t real property. It includes things like the equipment taxpayers use to do work on or in their real property, motor vehicles, and aircraft (K.S.A 79-102 and 79-1301).

- State and local governments forgo tax revenue when properties are tax exempt. That means they don’t receive the tax revenue they otherwise would have because taxpayers don’t pay taxes on exempt properties.

- The scope of this audit is limited to real property and real property tax exemptions.

Appraised values, assessment rates, and mill levies are used to determine the annual tax amounts for real property.

- The following formula determines the amount of real property tax a taxpayer pays: Real Property Tax = Appraised Value x Assessment Rate x Mill Levy / 1,000.

- Appraised Value: Each county in Kansas has a county appraiser. They are responsible for appraising all real property in their county each year to determine its value. Appraisers have various methods they use to appraise property. For example, they may consider property size, location, recent sales of similar properties, and physical condition of the property they’re appraising.

- Assessment Rate: County appraisers apply assessment rates to the appraised value of real property in their county. This determines how much of the real property’s appraised value is taxable.

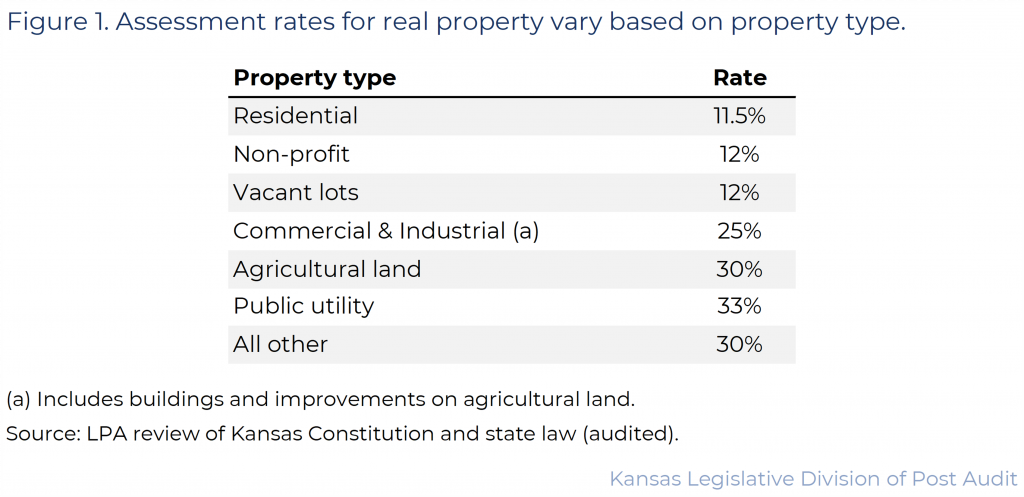

- The state constitution requires county appraisers to assess real property at different rates depending on its use. To do that, the constitution divides real property into 7 subclasses, each with its own assessment rate. Figure 1 shows the assessment rate for each subclass. As the figure shows, real property assessment rates range from 11.5% to 33% (Article 11, Kansas Constitution and K.S.A. 79-1439).

- County appraisers multiply the appraised values of real property in their counties by their respective assessment rates. This determines the assessed values of the real property. The assessed value is the portion of the property that’s taxed. For example, commercial property in Kansas has an assessment rate of 25%. This means a commercial property with an appraised value of $100,000 would have an assessed value of $25,000. The taxpayer would pay taxes on the $25,000 assessed value of the property.

- Mill Levy: State and local governments use mill levies to determine how much tax a taxpayer pays on the assessed value of their property. State and local governments determine the mill levies unless the levy is specified in statute. For every $1,000 of assessed value, a taxpayer pays $1 for each mill levied by a taxing entity. For example, the average mill levy for real property in Kansas in 2024 was about 127. That means, on average, a taxpayer paid about $127 in real property taxes for every $1,000 of assessed value on their real property in 2024. In the previous example, it means the taxpayer would pay about $3,175 in taxes on the $25,000 of assessed value for their commercial property.

- We analyzed tax-exempt real property data for 2024. At that time, state law required certain mill levies and allowed for an optional levy.

- Counties must levy 1 mill for maintaining the buildings of state institutions of higher education (K.S.A. 76-6b01 et. seq.) and 0.5 mill for maintaining the buildings of state institutions caring for disabled persons (K.S.A. 76-6b04 et. seq.). The Legislature repealed these mill levies in 2025. From 2026 onward, the state will use money from the general fund to maintain these buildings.

- School districts must levy 20 mills to pay for a portion of the district’s general fund budget, operating and maintenance expenses, and bond repayments for school redevelopment districts established prior to July 1, 1997 (K.S.A. 72-5142).

- School districts may also apply a capital outlay levy to pay for redevelopment projects within the school district. Generally, statute caps this at 8 mills unless certain conditions are met (K.S.A. 72-53,113).

Real property taxes generated $5.6 billion in 2024, which primarily funded local governments and services.

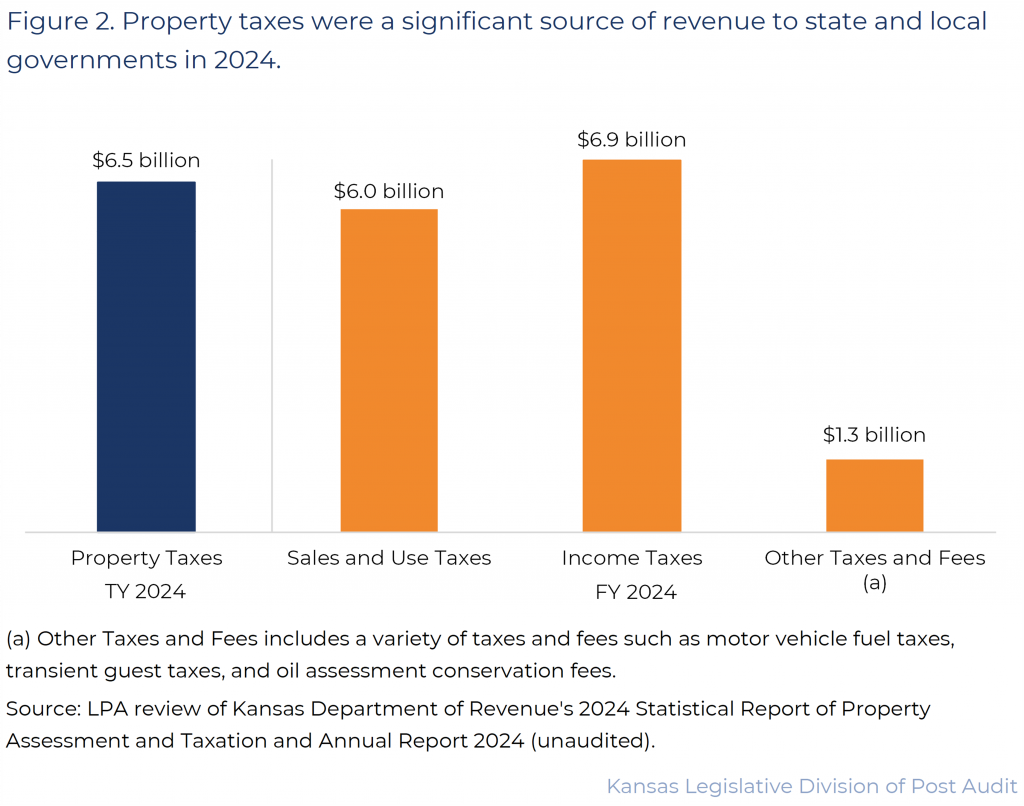

- Figure 2 shows the major sources of tax revenue in Kansas in 2024. As the figure shows, property taxes were a significant source of revenue. They accounted for $6.5 billion or 31% of all tax revenue in that year.

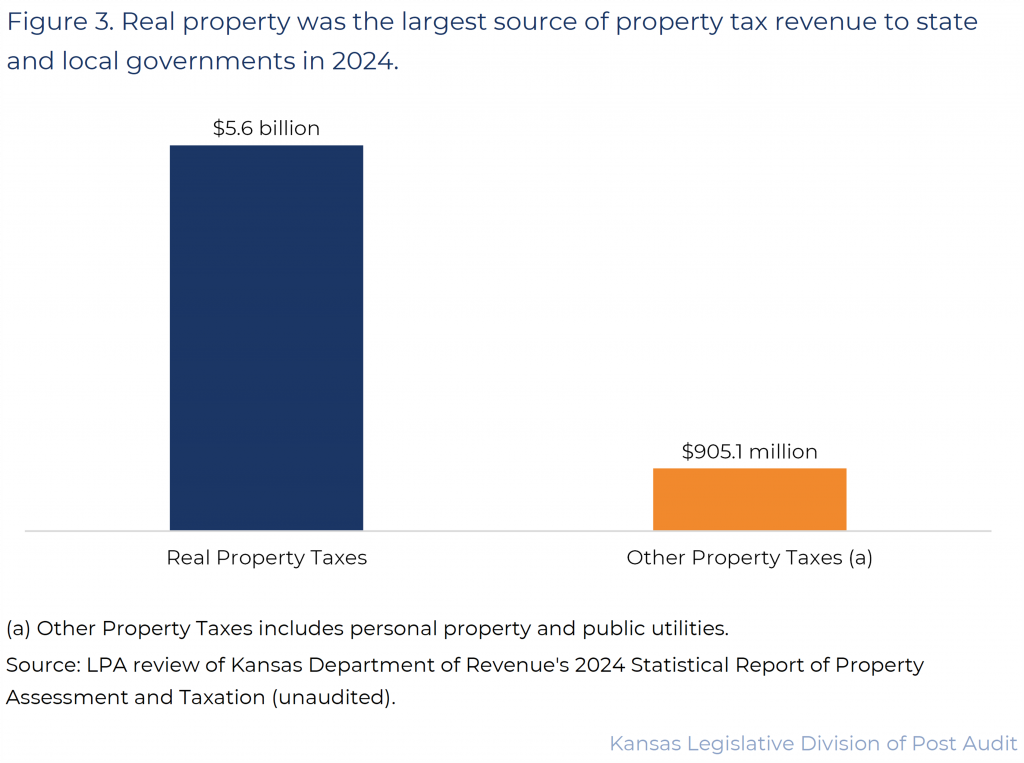

- Real property is a much larger source of property tax revenue for state and local governments than personal property. Figure 3 shows how real property tax revenue compared to personal property tax revenue in 2024. As the figure shows, real property taxes accounted for $5.6 billion of the $6.5 billion (86%) in property tax revenue collected by state and local governments.

- Most property tax revenue goes to local governments to fund local services. According to information from the Kansas Department of Revenue (KDOR), 99% of the property tax revenue state and local governments collected in 2024 went to local governments. Local governments used that revenue to fund services like roads, parks, fire departments, police departments, and public-school districts. The remainder (1%) goes to the state.

The state constitution and state law exempt many types of real property from taxes.

- A real property tax exemption means that the property owner doesn’t pay taxes for the exempt portion of the property. It also means the services that support those properties may receive less funding than they otherwise would. For example, a school district may receive less funding than it otherwise would due to property tax exemptions.

- There are 7 broad categories of real property tax exemptions in Kansas.

- Government exemptions are exemptions for real property owned and used by federal, state, and local governments. This includes things like military bases, the state capitol building, and city halls.

- Education exemptions are exemptions for real property used for educational purposes. This includes institutions like public universities and private religious schools.

- Public service and nonprofit exemptions are exemptions for real property used for the good of the public. Some examples include religious organizations, veterans’ organizations, and other benevolent organizations.

- Energy and utility exemptions are exemptions for real property used for energy production and transmission. It includes real property used for renewable energy production or new power plants.

- Economic development exemptions are exemptions for real property used for certain economic development programs. This includes exemptions for property funded with industrial revenue bonds and property used exclusively for manufacturing, research and development, or storing goods for interstate commerce.

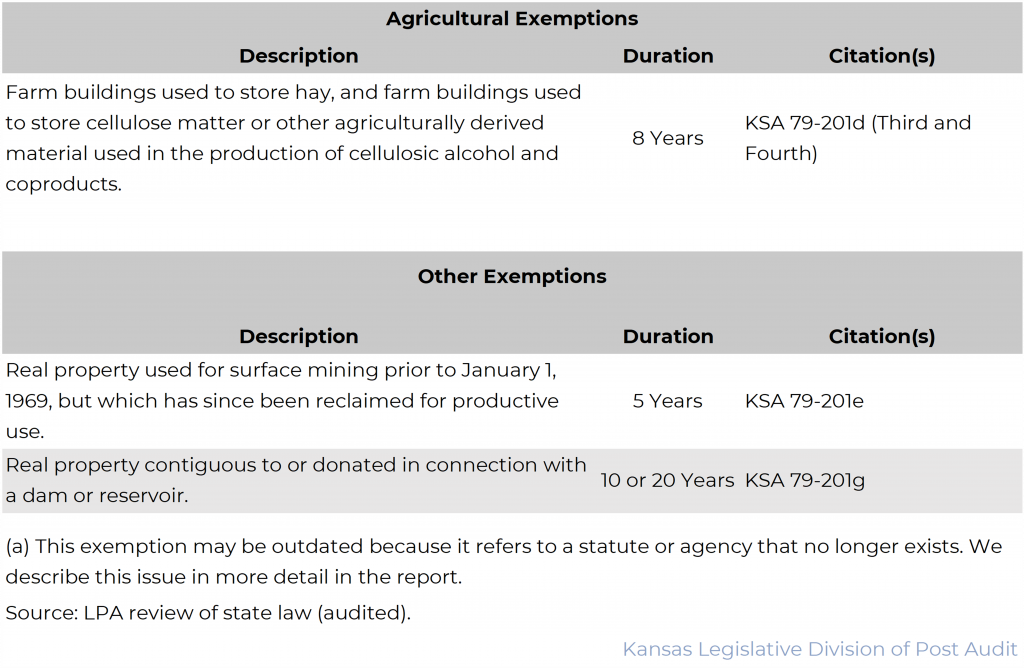

- Agriculture exemptions are exemptions for farm storage buildings. The buildings can primarily store hay. They can also primarily store cellulose matter (e.g., plant material) used in the production of cellulosic alcohol (ethanol).

- Other exemptions are various exemptions that don’t fit in any other category. It includes exemptions for property near dams and exemptions for reclaimed surface mining land.

- Typically, property owners must apply for an exemption with their county evaluator and the Board of Tax Appeals (BOTA). BOTA is an administrative board within the executive branch of the state government. It resolves tax-related issues between taxpayers and the state and local governments. BOTA reviews exemption applications and approves them if the property meets the exemption criteria in the Kansas Constitution or statute. In some cases, such as industrial revenue bond exemptions, local governments must also approve the terms of the exemption.

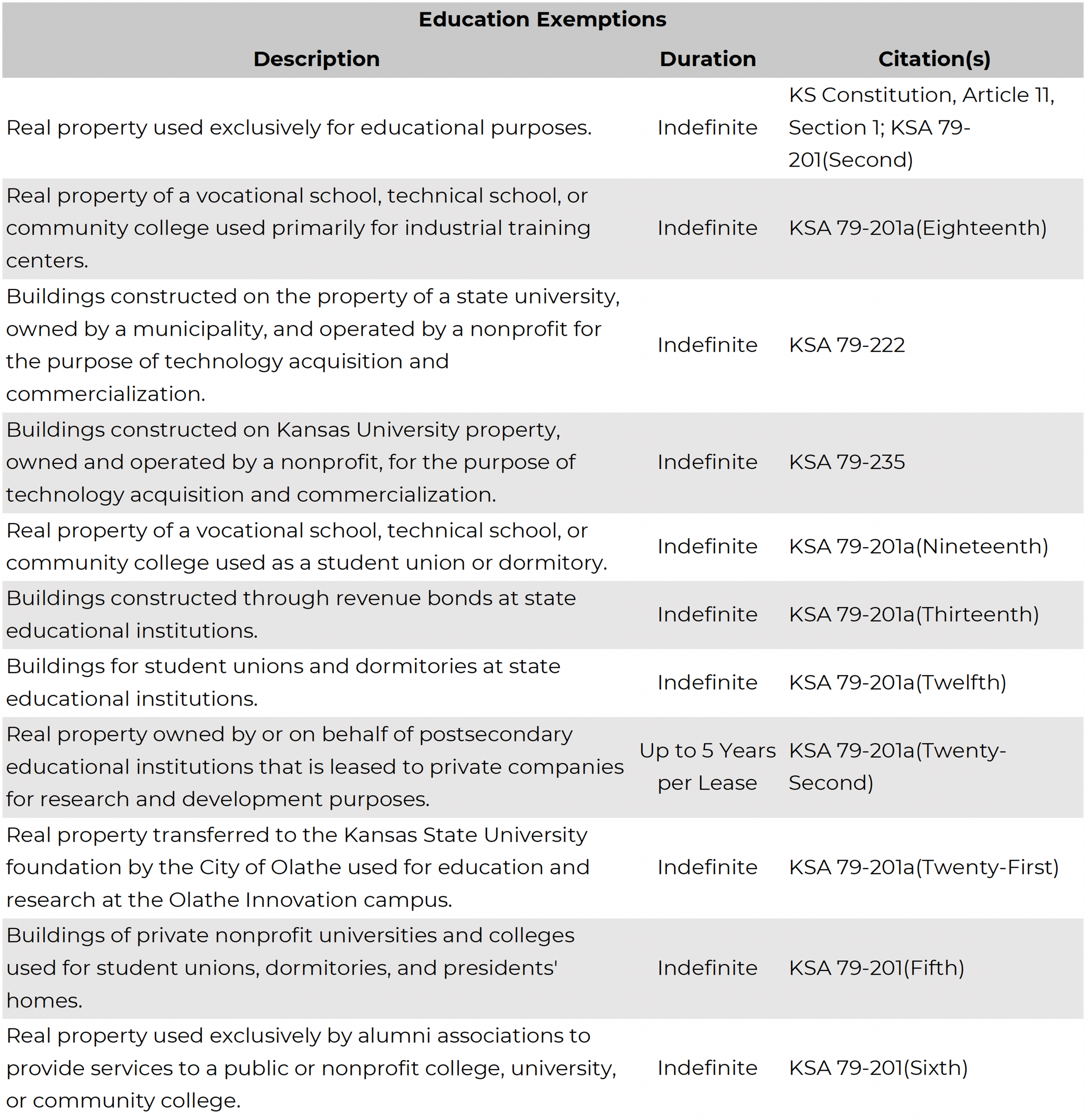

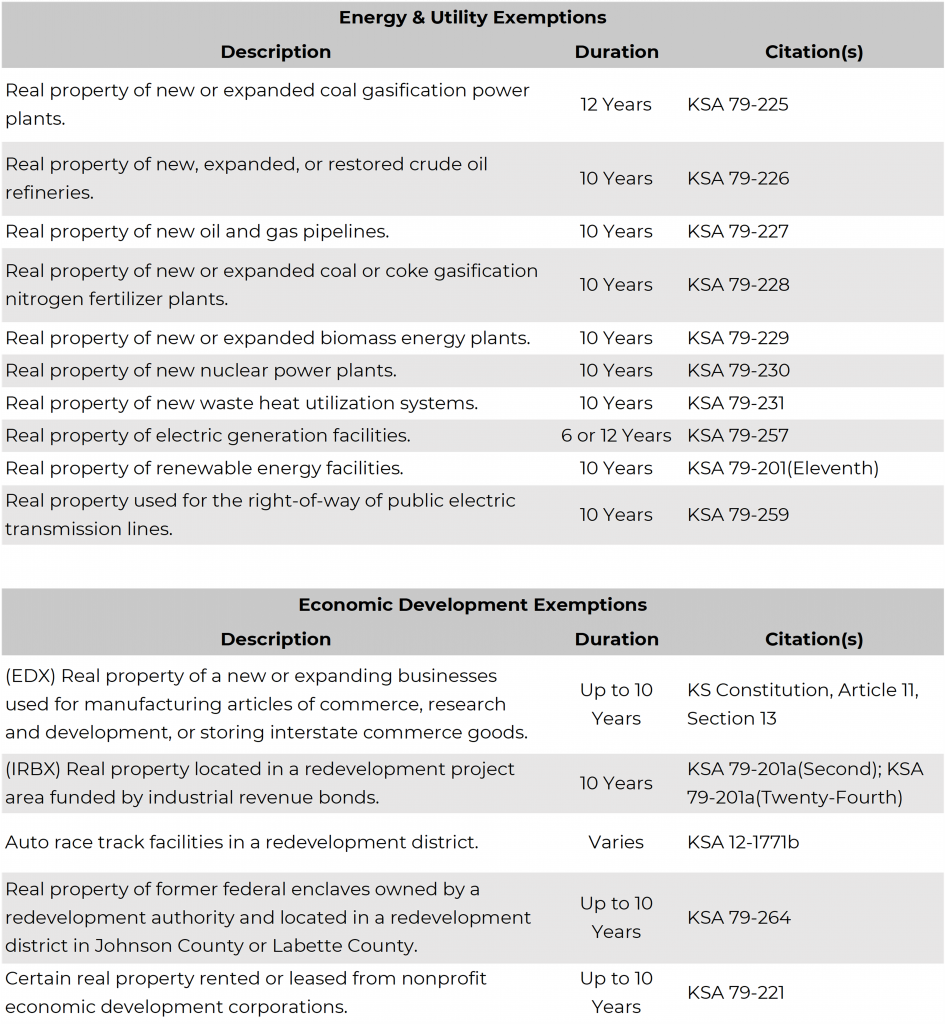

- Appendix A lists the real property tax exemptions in Kansas that we reviewed for this audit. It includes information about their duration and their constitutional or statutory citations. Exemptions may exempt an entire property or only a portion of the property from property taxes for their duration. Exemptions can be for an unlimited duration or for a set number of years.

There are other property tax programs in Kansas that we didn’t review in this audit.

- Kansas has other real property tax-related programs that fall outside of the scope of this audit. That’s generally because they’re not a tax exemption or they exempt property from income or sales tax instead of property tax.

- Property tax refunds, rebates, and credits require taxpayers to pay taxes on their property. However, a refund or a rebate returns a portion of the tax paid back to the taxpayer. Alternatively, a tax credit reduces a taxpayer’s tax liability before the tax is paid. Typically, taxpayers request these refunds, rebates, and credits on their Kansas income tax returns. These programs are available for Kansas residents and businesses. The Kansas Homestead Refund Act (K.S.A. 79-4502) is an example of one refund program for some Kansas residents. There also may be other temporary local refunds that serve similar functions.

- Other economic development incentives require taxpayers to pay taxes on their property, but the programs redirect the taxes to pay for development costs (e.g., bond payments) or to offset property taxes. Many of these incentive programs are administered by local governments. This means there’s no centralized, statewide data on them. Instead, each county and city maintains information for each incentive program. For example:

- Tax Increment Finance Districts (TIF) use the incremental tax revenue from development to help repay bonds or reimburse the developer. However, the property owner pays the full tax liability. TIF focuses on developing property for commercial, industrial, and residential projects.

- Reinvestment Housing Incentive Districts (RHID) operate like TIFs, but they focus on public infrastructure expenses for housing developments.

- Neighborhood Revitalization Program (NRP) provides a tax rebate to qualifying taxpayers in a neighborhood revitalization area. The rebate covers all or part of the incremental increases in the property taxes they paid because of improvements to their property.

- Community Improvement Districts (CID) use revenue from sales taxes, special assessments, or ad valorem taxes to pay for projects in the district. That means property owners still pay taxes on their real property, but the taxes may be used to pay for the projects. Projects are broad and include things like improving or demolishing buildings, creating or maintaining parks, or providing training programs for employees of businesses within the district.

- Some incentives provide a real property tax exemption and an income or sales tax exemption. This audit only includes the property tax exemption component of such incentives because income tax and sales tax exemptions are outside the scope of our audit objectives. For example, properties developed with industrial revenue bonds may receive a temporary property tax exemption and a temporary state and local sales tax exemption for materials and labor used to develop the properties.

- We also didn’t include the $75,000 residential property exemption in this audit. State law (K.S.A. 79-201x) exempts the first $75,000 of appraised value of residential properties from the statewide school district mill levy. Although it’s a property tax exemption, it would require us to review records for every residential property in Kansas, which we couldn’t do because of time limitations. KDOR reported the value of this exemption was $164 million in 2024.

Forgone Revenue Estimates

We estimated forgone revenue from property tax exemptions using county property records aggregated by the Kansas Department of Revenue (KDOR).

- We were asked to estimate the amount of revenue state and local governments didn’t collect due to real property tax exemptions. We had to estimate this amount because exempt properties are not on the tax rolls. Because they’re not on the tax rolls, county appraisers don’t assign assessment rates to the exempt properties’ appraised values. They may also not spend as much time appraising them. This is important because it means that anyone estimating forgone revenue due to property tax exemptions must make substantial assumptions about what the properties’ assessments rates would be if they were taxable. Therefore, our estimates should be viewed as rough indicators and not precise amounts.

- County appraisers keep records about all the real properties in their counties. This information should include the address, owner name, appraised value, acreage, and why the property has an exemption for real property taxes. KDOR aggregates this information to report about real property valuations, revenue, and exemptions. However, the information about why the property has an exemption is limited. This means we can estimate the total amount of forgone revenue, but we can’t break it out by type of exemption (e.g., government, nonprofit, energy, etc.). We discuss this issue later in the report.

- We reviewed property records for all 105 Kansas counties. Then we estimated the amount of property taxes not paid on tax-exempt real property in 2024 by county and for the state overall. To account for differences across counties, we calculated an average assessment rate and average mill levy for each county. We used an average assessment rate because most exempt property doesn’t have an obvious assessment rate. For example, it’s not clear what the assessment rate for a church would be if it wasn’t tax exempt. We subtracted 1.5 mills from each county’s average mill levy to account for the state’s portion of the mill levy.

- For each county, we applied the same average assessment rate and average mill levy to all exempt properties in the county, except for properties with an industrial revenue bond exemption or economic development exemption. For those properties, we applied a 25% assessment rate because that’s the assessment rate for commercial and industrial properties.

- We then estimated the forgone revenue for each county using the formula for calculating property taxes: Forgone Property Tax = Appraised Value of Tax-Exempt Property x County Average Assessment Rate x County Average Mill Levy / 1,000. Then we estimated the state’s forgone revenue by replacing the average mill levy in the above formula with the 1.5 mills that the state requires.

- Finally, we used KDOR reports to account for fees that some taxpayers may pay on their real property to partially offset the revenue loss from the property tax exemption. Local governments and taxpayers or developers may have a written agreement that requires taxpayers to pay certain fees in lieu of paying property taxes. These payments are called payments in lieu of taxes (PILOTs) and contribution agreements. These types of payments offset revenue lost from property tax exemptions, so we accounted for them in our estimates.

We estimated local governments didn’t collect roughly $1 billion and the state didn’t collect roughly $12 million in revenue in 2024 due to real property tax exemptions.

- We used property tax statistics provided to us by KDOR to determine how much real property was taxable in 2024. Then we compared those statistics to exempt property estimates we made using exemption data KDOR aggregates from counties.

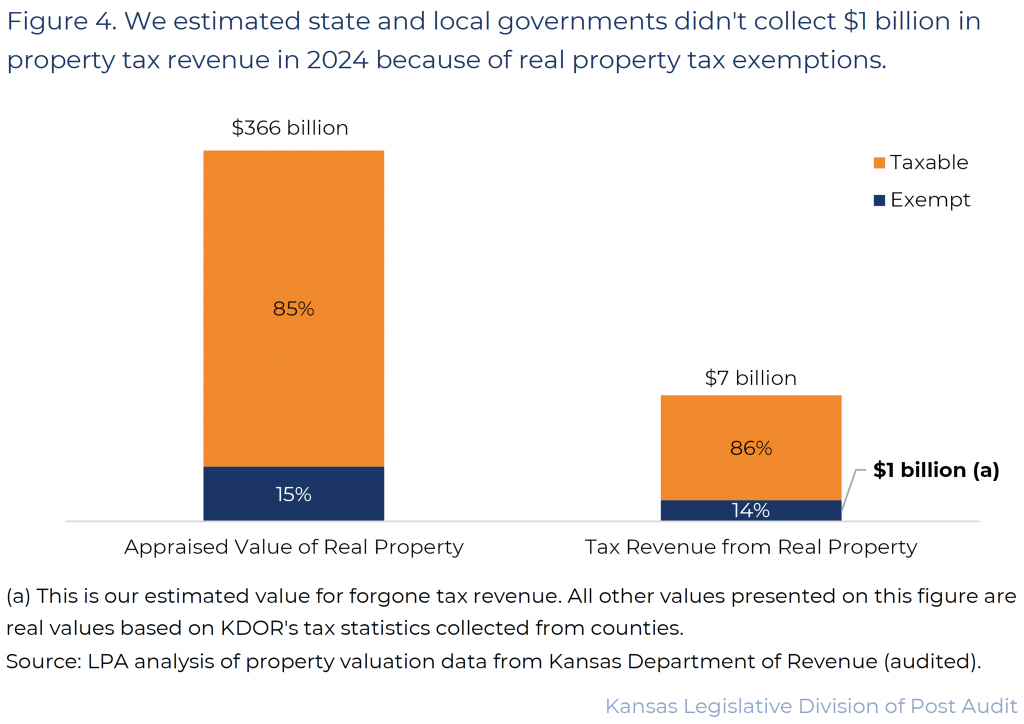

- Figure 4 shows the amount of real property that was taxed and the estimated amount that was exempted in 2024. As the figure shows, the total appraised value of real property was $366 billion that year but $54 billion (15%) of that amount was exempt from property taxes.

- The figure also shows that we estimated state and local governments didn’t collect roughly $1 billion in property tax revenue in 2024 due to real property exemptions. Nearly all $1 billion was forgone revenue for local governments. We estimated the state didn’t collect roughly $12 million (1%) in property tax revenue that would have been used for building construction and maintenance at state educational and institutions serving juveniles (K.S.A. 76-6b01 et. seq. and 76-6b04 et. seq).

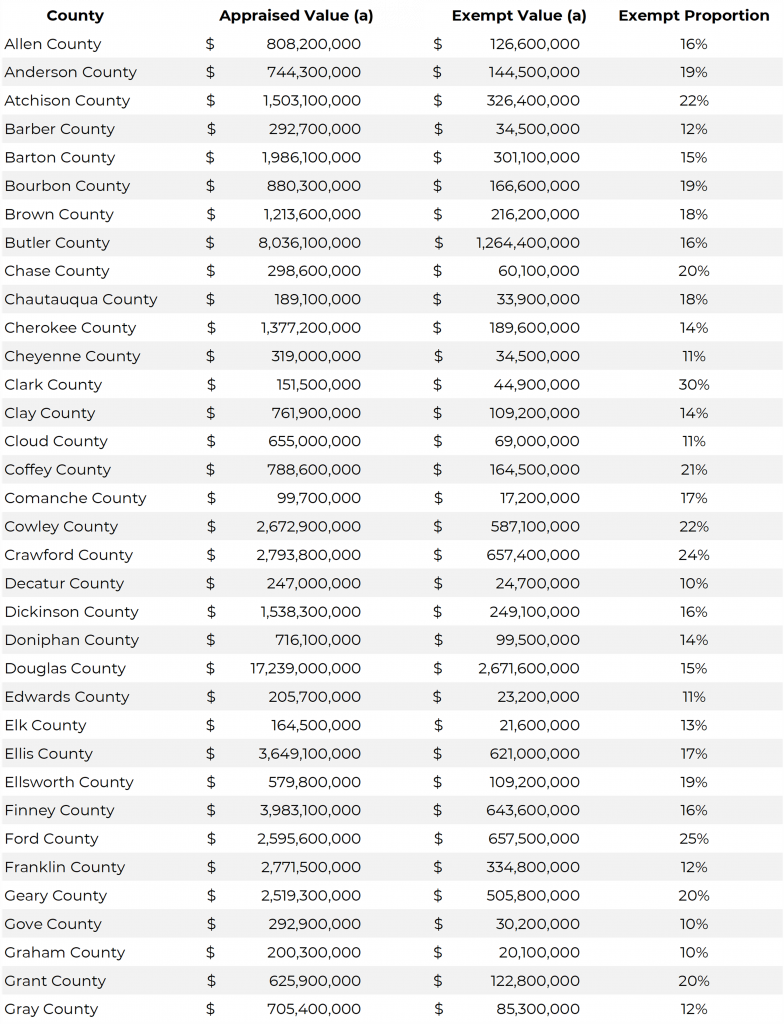

Kansas counties are impacted differently by property tax exemptions.

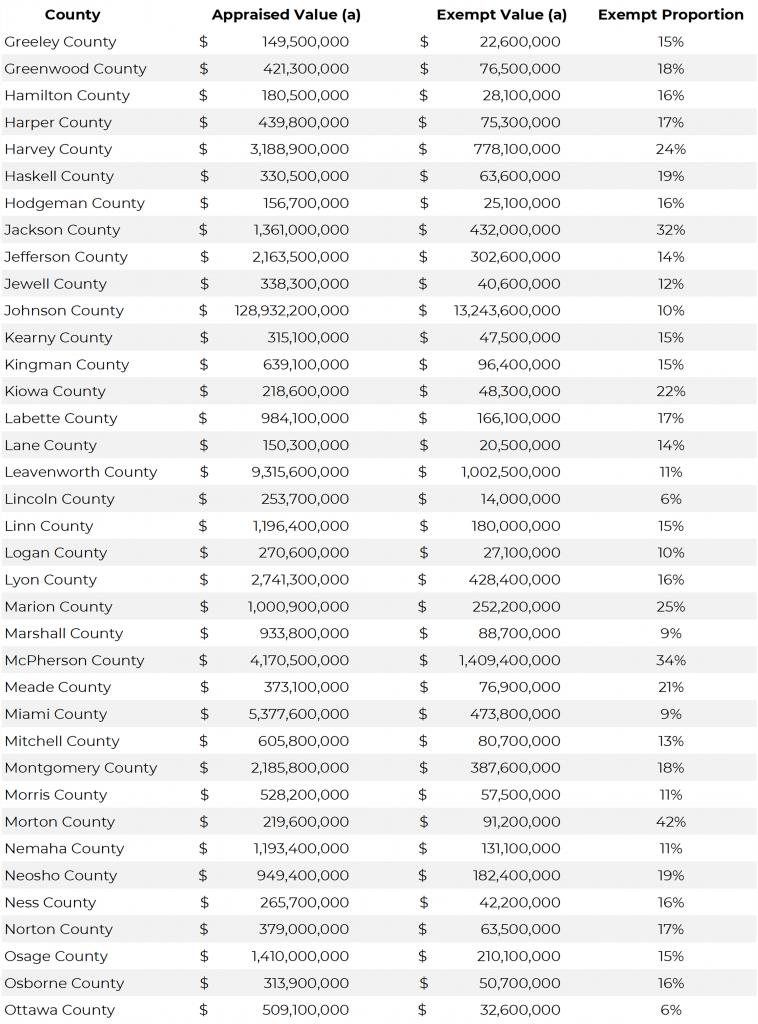

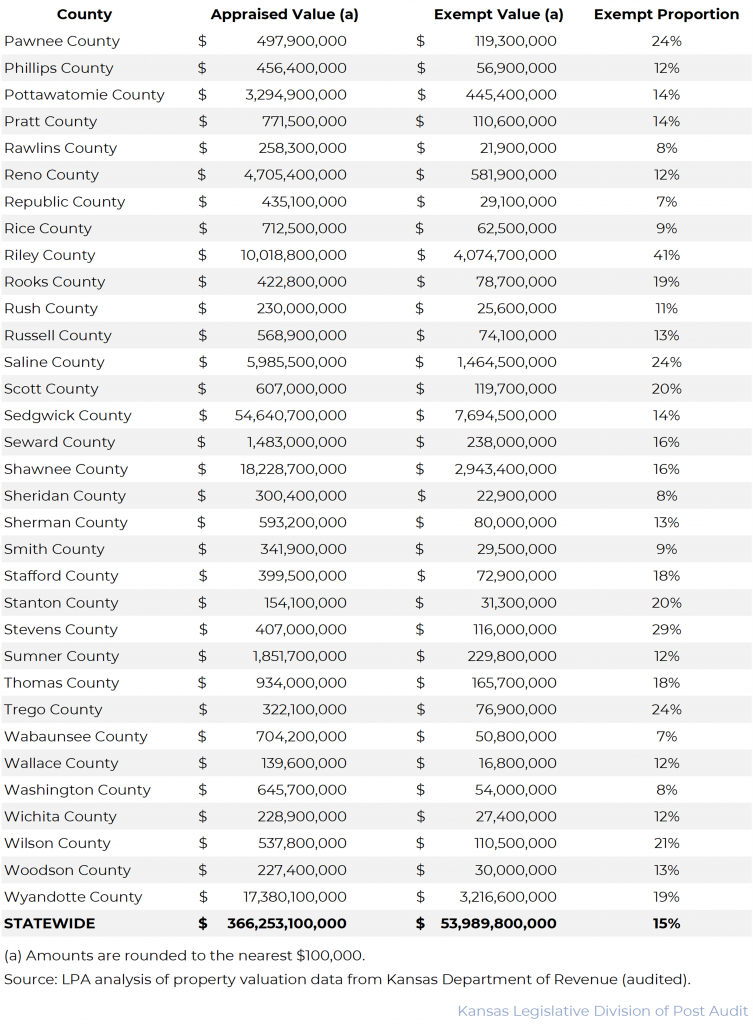

- We estimated the proportion of each county’s total property that was tax exempt to get a sense of how property taxes may impact counties differently. For example, counties that have more properties that qualify for tax exemptions may collect less local property tax revenue. Appendix B lists the appraised values for all real properties, estimated exempt values, and the resulting estimated proportion of the real property that was tax exempt in each county in 2024.

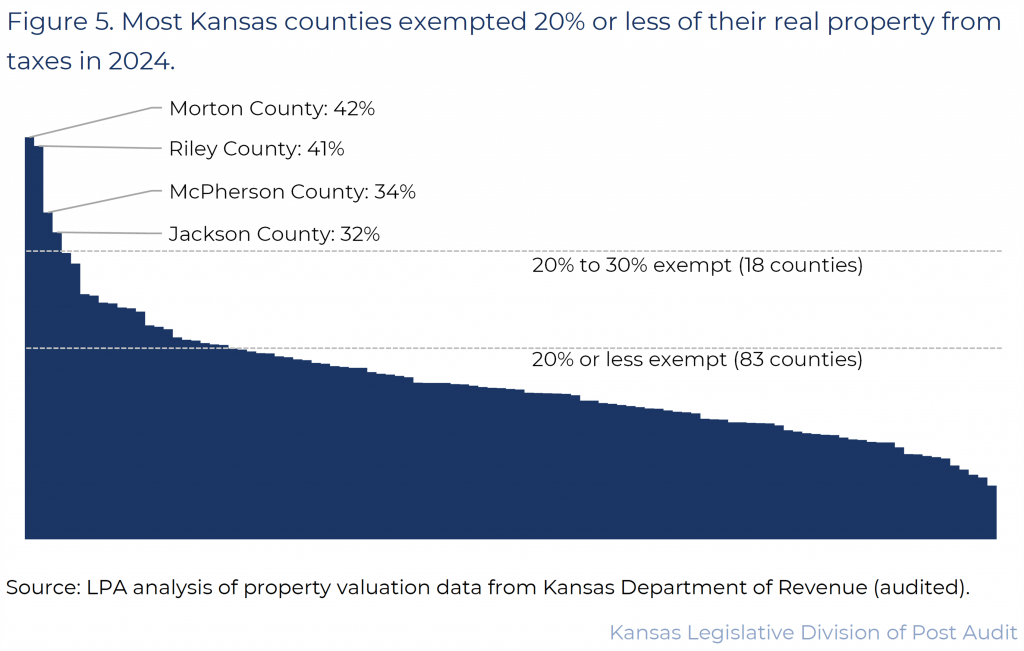

- Figure 5 shows the estimated percentage of exempt property for all 105 Kansas counties in 2024. Between 6% and 42% of Kansas counties’ real property was exempt. As the figure shows, 83 counties had 20% or less of their real property exempt from property taxes.

- However, 4 counties stood out (Riley, Jackson, Morton, and McPherson) because over 30% of the real property in those counties was tax exempt. We reviewed county property records from KDOR, and population estimates for 2024 from the U.S. Census Bureau to try to determine why these counties had such high percentages of exempt property. Large government exemptions in less populated, rural counties appear to be the primary cause for these higher exempt proportions in most cases.

- In total, 3% of Kansas residents lived in Riley, Jackson and Morton County in 2024. These counties all have large federal exemptions in them. For example, Riley County has parts of large federal properties in the county such as Fort Riley military base and Tuttle Creek reservoir (34% of 2024 exempt value in Riley County). Jackson County has large exemptions for tribal lands (65% of 2024 exempt value). Morton County has exemptions for the Elkhart Forest service (Cimarron National Grassland, 47% of 2024 exempt value).

- 1% of Kansas residents lived in McPherson County in 2024. There was one large energy exemption that accounted for 43% of the county’s exempt value in 2024.

Assumptions and Caveats

Our results should be interpreted as rough estimates because they rely on several significant assumptions and methodological choices.

- The numbers in this report are rough estimates which depend on many substantial assumptions. We did thorough and considerable research to develop reasonable assumptions. However, different people could make different assumptions. This would lead to different estimates of forgone tax revenue.

- We assumed that exempt property, if taxed, would be used in a way that resembles the property makeup of the county it’s located in unless it was a property with an industrial revenue bond exemption or an economic development exemption. To apply this assumption to our estimates, we calculated an average assessment rate for each county, which ranged from 12.5% to 22.2%. The average differs from county to county based on the concentration of property types in the county.

- For example, counties that had more commercial property than residential property had higher average assessment rates. Conversely, counties with more residential property than commercial property had lower average assessment rates.

- We did this because there is no data for assessment rates for most exempt properties. We also don’t know how those properties would be used if they were taxable. This assumption has a major influence on the estimated amount of forgone tax revenue. For example, if we had assumed all exempt property would be assessed as commercial and industrial property at 25%, it would almost double the estimated amount of forgone tax revenue in 2024. It would increase our estimate of forgone revenue by about $700 million.

- We calculated an average mill levy for real property for each county based on county statistics in KDOR’s 2024 statistical report. Our method assumes that the average total mill levy for taxable real property in each county is similar to what the total mill levy would be for exempt properties in that county if they were taxable. We did this because there is no data for mill levies for exempt real property. It is possible that the actual mill levy for some exempt properties could be higher or lower than the average (if they were to be taxed). This would also affect our estimate of forgone tax revenue.

- We made 2 assumptions about the appraised values of all properties as of January 1, 2024.

- We assumed all values were current. This is because our estimates will apply to properties exempt in 2024, and appraisals must be updated by January 1 of each year. KDOR officials told us that counties have processes in place to update the appraised value of all property based on inflation and other market adjustments.

- We also assumed all values were accurate. About 11,250 (16%) of the exempt properties in the exemption data had an appraised value of $0 or were left blank. We treated all properties that were left blank as having an appraised value of $0. We don’t think this assumption had a substantive impact on our estimate of forgone property tax revenue because 92% of these properties were marked as streets and roads. It makes sense streets and roads would have no appraised value because these properties aren’t usually sold or taxed. However, if the remaining $0 values or blank values should be greater than $0, it would increase our forgone revenue estimate.

Other Findings

The exemption codes that county appraisers use were sometimes missing, inconsistent, or incorrect, which means they weren’t reliable for estimating forgone revenue by exemption type.

- In Kansas, county appraisers document tax-exempt real property using the same real property software across the state. In this software, county appraisers assign exemption codes to properties that describe why the properties are exempt. For example, they are supposed to record if the property is exempt because it’s government-owned property, nonprofit property, or property that’s used for educational purposes. KDOR compiled the exemption codes for each tax-exempt property statewide as part of the aggregated property tax data we used in our analysis.

- However, real property exemption codes in the data provided by KDOR were sometimes missing, inconsistent, or incorrect. This means they were not reliable enough for us to estimate forgone revenue by exemption type.

- About 7% of the total exempt properties statewide (4,800 properties, $1.2 billion in appraised value) had a blank exemption code in the county data KDOR provided. This means we couldn’t determine why these properties were tax exempt.

- 10% of the small number of properties we reviewed in detail had inconsistent or incorrect codes. We reviewed a random selection of 100 exempt properties out of the 72,000 properties in the population to determine if the exemption code seemed reasonable. 10 of the properties appeared to have an incorrect code. We selected these properties randomly, but they can’t be projected to the population because we don’t have enough information about the properties to know if those codes are incorrect. Because our selection wasn’t projectable, we don’t know the full magnitude of these types of errors in the population. However, we saw these issues frequently enough when reviewing the data that it’s indicative of issues beyond the properties we reviewed.

- University properties serve as a clear example of these issues. 15 properties Kansas State University owned were coded as exempt educational property, but 5 other properties were coded as exempt state-owned property. Both codes may be valid, but the inconsistency means the same property would be counted differently in an analysis of exemption types. Additionally, another property that we reviewed was owned by Fort Hays State University. Instead of being coded as exempt educational or state-owned property, the county appraiser or their staff coded the property as exempt agricultural property. Exempt agricultural property only has an 8-year exemption, yet the appraiser assigned the incorrect code in 1993. This means the exemption code has been incorrect for more than 30 years.

- Exemption codes should be complete, accurate, and consistent across counties to reliably estimate the amount of revenue forgone because of each exemption type. To estimate forgone revenue by specific exemption in statute, the properties must be coded with the correct statute from the exemption orders.

The issues with exemption codes appear to be caused by systemic problems that may not be feasible for KDOR and county appraisers to resolve.

- Some exemption statutes are very broad and likely contribute to inconsistent codes across counties. That’s because some properties may qualify for tax exemptions under multiple statutes. For example, the university properties we previously discussed could be a government exemption or an education exemption.

- The way that KDOR groups statutory exemptions into codes in the property management software that county appraisers use is confusing and likely contributes to inconsistent codes across counties. When BOTA approves an exemption, they send an order to the county that includes the statute granting the exemption. However, county appraisers can’t assign individual statutes to the exempt property in the property management software. Instead, they must select a higher-level code that encompasses multiple statutes in most cases. The problem is the same statute, or similar statutes appear under multiple higher-level codes. For example, the statutory exemption for state and local government-owned property appeared under 4 different codes in the property software.

- There’s no monitoring process to ensure county appraisers and their staff assign consistent and accurate codes. We talked to the county appraisers in 10 counties, and we learned that different offices have different standards for determining what codes to use. They also had different understandings of what the codes are supposed to be based on. For example, some offices thought the code was supposed to denote how the property was used while others coded properties based on what they thought was the appropriate exemption statute. KDOR officials said they don’t review county property records to ensure counties use exemption codes consistently. Furthermore, KDOR told us some counties have added to or changed the list of exemption codes in the past.

- We don’t have a recommendation to resolve these issues because they’re systemic issues that would require rethinking the broader system, which was outside the scope of this audit. For example:

- The process for assigning property tax exemption codes involves multiple systems and entities. Our audit objective did not include evaluating the overarching system design or implementation. That means we don’t know what all the root causes are for these issues or how to best address them.

- Several significant changes would likely have to be made across these multiple systems and entities to address the causes we identified (e.g., changes to statute, changes to KDOR’s data review process, and changes to state and county controls). It is likely unreasonable to expect that everything could be adequately addressed to fix the problems. Implementing changes to future processes also wouldn’t correct historical coding inaccuracies that are already present in the real property data.

- Finally, this problem relates to exempt real property. KDOR and county appraisers prioritize taxable real property. Therefore, it may not be efficient or feasible for KDOR and county appraisers to invest the time and money to correct their systems.

KDOR’s 2024 Statistical Report of Property Assessment and Taxation presents inaccurate totals for exempt real property.

- The Statistical Report of Property Assessment and Taxation is a publication that KDOR uses to report annually on property tax exemptions in the state. Counties report their information to KDOR and KDOR compiles their information for reporting. The information presented in this report should be accurate and include all relevant information.

- Our data reliability work during this audit showed the 2024 report includes inaccurate total appraised values for industrial revenue bond exemptions and economic development exemptions in many counties. This issue is separate from the data issues we just described in the previous section.

- The total appraised values of exempt property in the 2024 report are often lower than the values in counties’ records. We estimated the report excludes about $3.6 billion in property exempted by industrial revenue bonds and economic development. This means anyone using this report would have an inaccurate understanding of how much property was exempt due to industrial revenue bond exemptions and economic development exemptions.

- The incorrect industrial revenue bond and economic development exemptions in the 2024 report appear to be a mistake made by KDOR staff. In 2017, KDOR added new codes for industrial revenue bond exemptions and economic development exemptions to the list of exemption codes. However, KDOR officials told us that they have not included these new exemption codes in the report totals since they made that change. They said this was an oversight because the report was originally developed to include only the previous codes for those exemptions.

State law includes at least a couple of exemptions that are outdated and no longer make sense.

- During our review of the property tax exemptions authorized in the Kansas Constitution and state law, we identified at least two exemptions that the legislature may want to consider eliminating.

- State law (K.S.A. 79-201a(Eleventh)) specifically exempts the Docking State Office building from property taxes. However, the exemption references a statute (K.S.A. 75-3607 et. seq.) that was repealed in 1988.

- State law (K.S.A. 74-99b12) also exempts property owned by the Kansas Bioscience Authority from property tax. However, the Kansas Bioscience Authority was privatized about a decade ago and is no longer a quasi-state agency.

- We did not do a comprehensive review of the statutory language for each property tax exemption. That means it’s possible there may be additional exemptions that are outdated. These outdated exemptions may add to the exemption code issues we identified and may allow entities to apply for exemptions that aren’t intended by the Legislature.

About 98% of the appraised value of Kansas’s 7 public universities’ and their foundations’ real property was tax exempt in 2024, but we don’t know how much of that real property was donated to universities because most universities don’t keep that information.

Background

Public universities in Kansas and their foundations own a variety of tax-exempt and taxable real property.

- There are 7 public universities in Kansas that serve national and international students. The 7 universities are Emporia State University, Fort Hays State University, Kansas State University, Pittsburg State University, University of Kansas, Wichita State University, and Washburn University.

- Most of the real property owned by these universities is tax exempt because it’s used for educational purposes. This includes purposes like student housing, lecture halls, and land used for agricultural and other biological research. Education exemptions are typically permanent exemptions. That means public universities in Kansas don’t ever pay property taxes for most of their real property. Appendix A describes other education exemptions we found during our review of state law for this audit.

- Each university has a foundation or endowment organization. These organizations support the universities by receiving financial or property donations on behalf of the university. They also acquire property for the university for special projects or future development and use financial donations or revenues from the taxable property they own to provide scholarships to university students.

- Universities and foundations generally acquire real property through grants, donations, and purchases. For example, a single individual donated the land for Washburn’s main campus, whereas Congress granted land to Fort Hays State for their main campus.

- When a university or foundation acquires a new property, it’s considered taxable until they apply for an exemption and are approved by the Board of Tax Appeals (BOTA). Universities and foundations must apply for exemptions through BOTA for any property they acquire to become tax exempt. BOTA approves exemption applications for property that’s used for an exempt purpose.

The amount and type of property universities and foundations need varies based on their student population and their research and educational focuses.

- Kansas State, the University of Kansas, and Wichita State serve more students than the other universities and have a strong focus on research that advances science (e.g., agriculture), medicine, technology (e.g., aerospace), and business. Thus, they may need more land or specialized facilities to support their work.

- For example, Kansas State was established as a land-grant university in 1862. Land-grant institutions emphasize agriculture-related education and research. This means Kansas State owns a lot of undeveloped land for agriculture education and research.

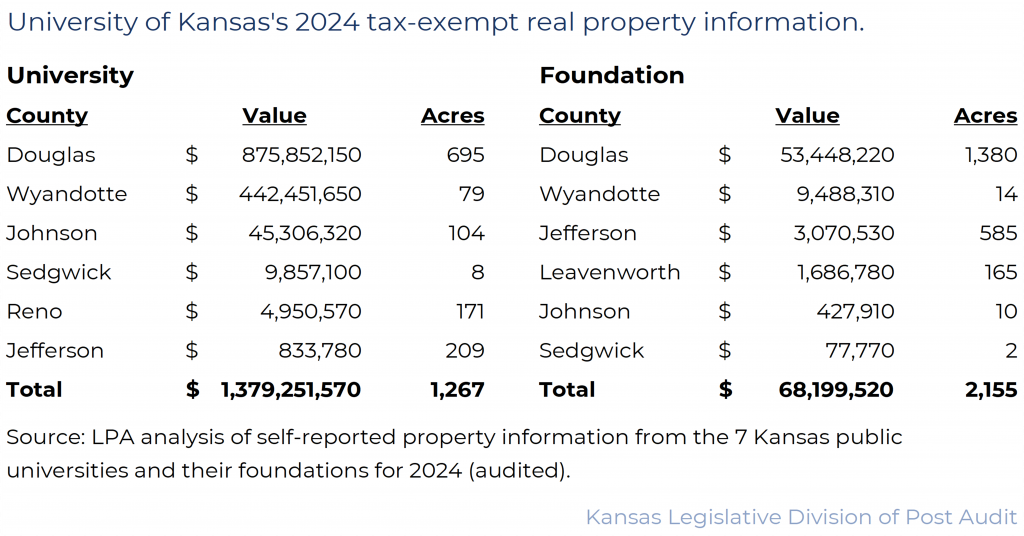

- Conversely, the University of Kansas owns more developed facilities dedicated to health and medicine-related education and research because of its school of medicine. These properties may have smaller acreages but high property values due to development.

- These 3 universities are also located in more populated areas of Kansas. For example, the cities of Wichita (Wichita State), Lawrence and Kansas City (University of Kansas), and Manhattan (Kansas State) are among the largest cities in Kansas. This means the appraised values of university and foundation properties in these cities tend to be higher than those in other cities.

We analyzed self-reported information from the 7 universities and their foundations to determine how much real property they owned in 2024 and how they acquired it.

- We collected information from the 7 public universities in Kansas and their foundations about the real property they owned in 2024. This information was self-reported by the universities and foundations.

- We requested general information about their real property including owner name (e.g., the university or foundation), the address, the value, and the acreage.

- We also asked for more specific acquisition information about their tax-exempt real property. It included how and when they acquired the property, how they use the property, what funding source they used to purchase property, and whether an individual or a business donated the property.

- We compared this self-reported data to the county exemption data the Kansas Department of Revenue (KDOR) provided. We also compared county appraiser records and public tax records to the information universities and foundations reported. We made minor corrections to the values and acreages universities and foundations reported to us, as needed. While we attempted to validate what universities and foundations reported to us, any errors in KDOR’s or county records could limit our ability to identify all relevant property.

- We were also limited in the information we could report about taxable real property owned by the University of Kansas Endowment Association and Kansas State Foundation. These foundations didn’t provide their taxable property to us, stating that information was outside the scope of this audit (which focuses on tax-exempt property). Instead, we gathered as much information on the foundations’ taxable properties as we could from public records. We think we identified all the taxable property that was titled to the University of Kansas Endowment or Kansas State Foundation from county appraisers records across the state. However, we know the foundations have separate entities that also own taxable properties. We couldn’t identify taxable properties owned by those entities.

Total Real Property

The 7 universities and their foundations owned about $4.5 billion of appraised value real property in 2024.

- The 7 universities and their foundations owned real property in Kansas appraised at about $4.5 billion in 2024. This included real property that was tax exempt and taxable. The properties covered about 80,000 acres across 66 counties. Some universities and foundations also reported future real property donations and out-of-state real property which we discuss later in the report.

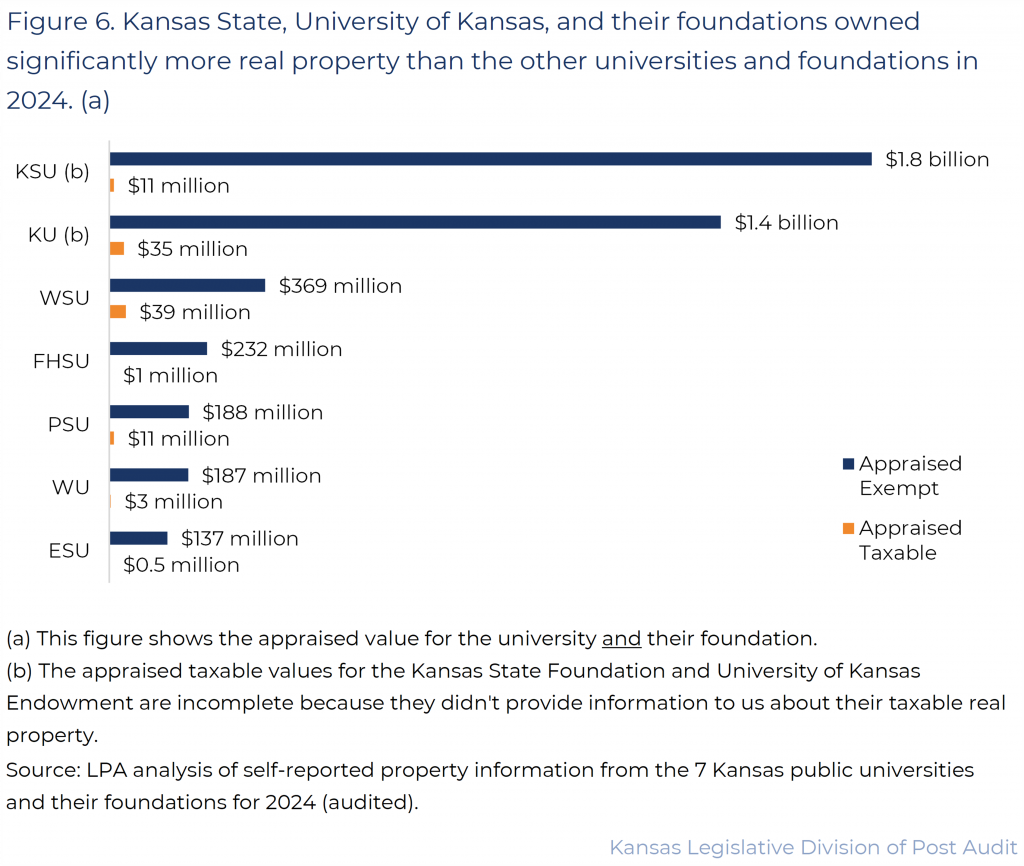

- Figure 6 shows how much real property universities and their foundations owned in 2024 in terms of appraised value. As the figure shows, Kansas State, the University of Kansas, and their foundations owned significantly more real property than the other universities and foundations. They owned about 74% of the total value across all universities and foundations in 2024. Appendix C breaks out this summary information into more detail for each university and foundation.

- Universities generally owned more real property than their foundations in terms of value and acreage.

- For example, all 7 universities owned more than 90% of the total value of the university and foundation’s combined real property.

- 5 universities also owned more than 50% of their combined total acreage. The University of Kansas Endowment and Wichita State University Foundation were the exceptions. They owned larger proportions of the combined acreages than their universities (96% and 58% respectively). That’s because the University of Kansas Endowment owns a lot of taxable agricultural land and Wichita State Foundation owns a biological reserve that’s used for ecology research and conservation.

Tax-Exempt Real Property

About $4.4 billion (98%) of the appraised value of the universities’ and foundations’ real property was tax exempt in 2024.

- The universities and foundations reported that about $4.4 billion (98%) in real property covering about 27,000 acres were tax exempt. This is the appraised value of the property, not an estimate of the forgone revenue. We didn’t estimate the forgone revenue for university property in this question because the audit objective didn’t ask us to. The remaining 53,000 acres, valued at $101 million (2%), were taxable. This was a high acreage but low value when compared to the exempt property. The reason the taxable property is comprised of such high acreage and low value is because a lot of foundations have taxable agricultural land. Agricultural land is typically of a high acreage but low value because it’s valued based on productivity rather than market value.

- Universities and foundations reported using most of their exempt property for education and research purposes ($2.1 billion, 49%) and residential purposes ($1.2 billion, 28%). Foundations also reported using their exempt property in some unique ways. For example, Kansas State Foundation reported leasing 33% of its exempt property ($15.0 million) to the Kansas Department of Agriculture for lab and office space. The University of Kansas Endowment reported using 11% of its exempt property ($7.6 million) for fire and rescue services for the University of Kansas and the City of Lawrence.

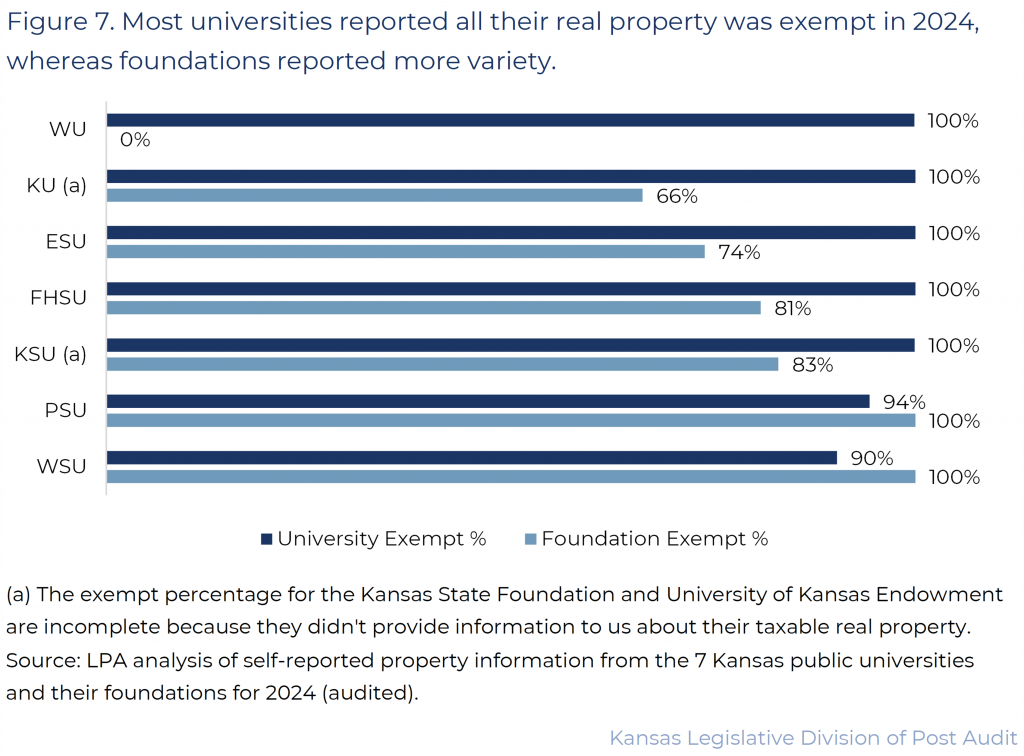

- Figure 7 shows the percentage of universities’ and foundations’ property that was exempt in 2024. As the figure shows, most university property was exempt, but foundations varied greatly in the amount of property that was exempt. For example, universities’ real property ranged from 90-100% tax exempt. But their foundations’ real property ranged from 0-100% exempt.

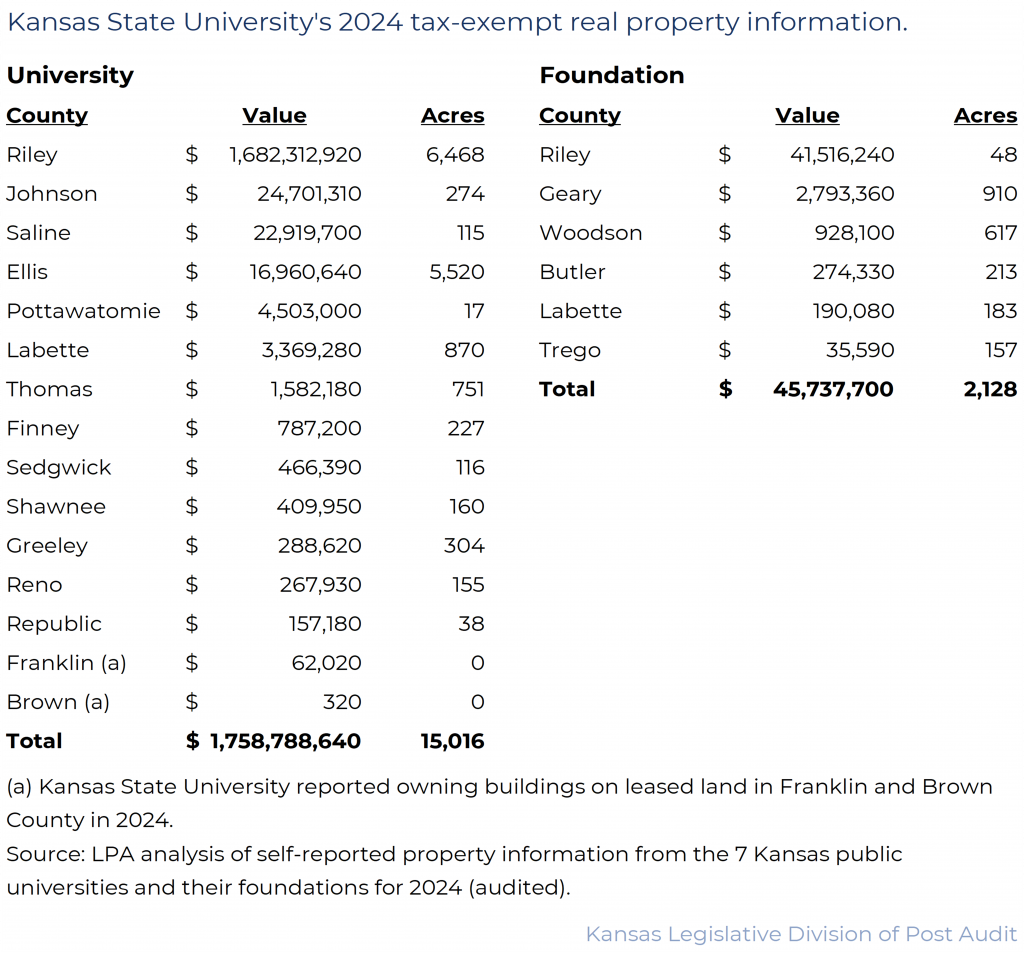

- Figure 8 shows the 30 counties where universities and foundations had exempt real property in 2024.Asthe figure shows, most of it ($2.7 billion, 61%) was in Riley and Douglas counties. These counties are where the main campuses of Kansas State and University of Kansas are located. All 7 universities and their foundations owned the most tax-exempt real property in the county where their main campus was located.

- Kansas State and its foundation owned exempt property in more counties across the state than the other universities and foundations (19 counties). Most only owned exempt property in a few counties. Appendix C provides more information about the location of each university and foundation’s real property.

We don’t know how the 7 universities acquired their tax-exempt property because most universities don’t maintain this information, but foundations reported purchasing most of their property.

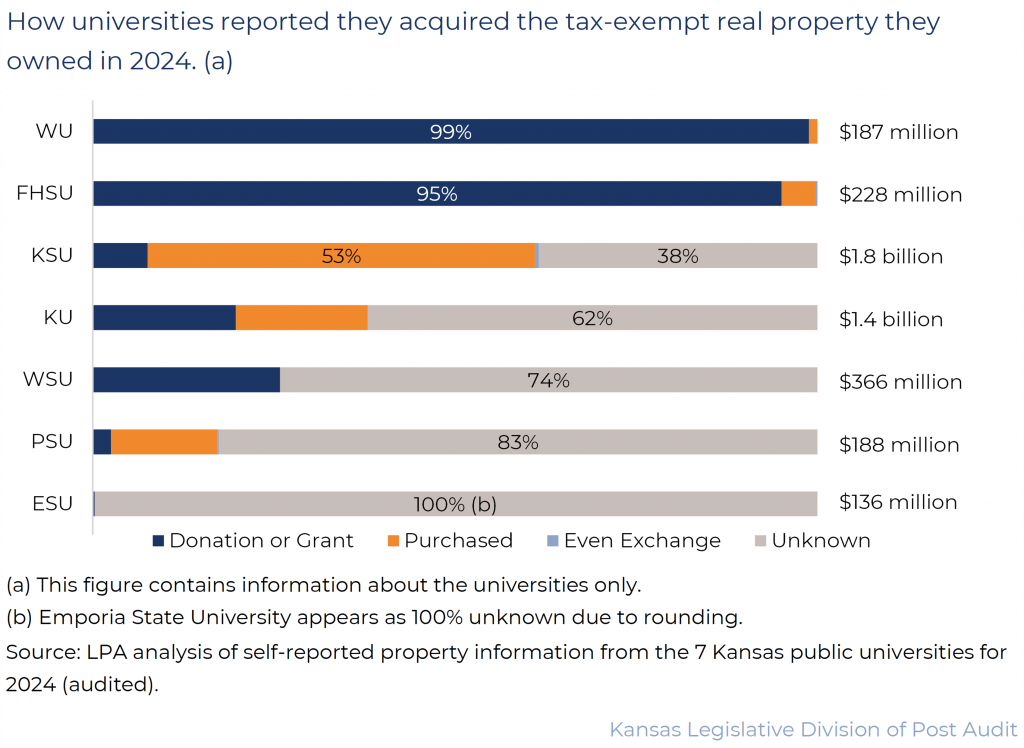

- Most universities could not provide information about how they acquired the real property they own. This means we can’t draw overarching conclusions about how universities acquired their tax-exempt property. We also can’t make comparisons across universities. Appendix D compiles the information universities reported. As the appendix shows, only two universities had complete information about how they acquired their properties. Therefore, our conclusions are limited to comparisons across foundations.

- The differences in reporting acquisition information between universities and foundations may be because universities don’t use or report this type of information. Thus, they have no reason to maintain it. Additionally, universities acquired some of their property over 100 years ago. Property lines may also change over time. That means asking how a university acquired a property they own today may not make sense if those property lines changed significantly since they acquired the property.

- The foundations reported they owned about $123 million of tax-exempt real property in 2024. This is only 3% of the total exempt property reported by universities and foundations. Universities owned the other 97% ($4.2 billion).

- The foundations reported purchasing 73% of their property.

- They reported another 18% of their property was exchanged with their university for equal property which happens occasionally with legislative approval. This usually occurs when a university needs a specific property and they have another property they aren’t currently using.

- They reported the remaining 8% of their property was donated or they couldn’t determine how they acquired the exempt property.

- However, the amount of exempt property that foundations owned and the way they acquired it varied. Figure 9 shows how much tax-exempt real property each foundation owned in 2024 and how they acquired it. As the figure shows, the University of Kansas Endowment and Kansas State Foundation owned the largest amounts of tax-exempt real property. The two foundations owned 93% of the total exempt value across all foundations. As the figure shows, they purchased most of the tax-exempt property they owned. The other foundations owned very little exempt property by comparison, which they generally received through donations and exchanges with their university.

Other Real Property

Few universities and foundations reported life estates in Kansas and other out-of-state properties.

- We also asked universities and foundations to report information about life estates and out-of-state property to us. We asked for this information to get a complete picture of university and foundation property and to provide appropriate context for our findings. In most cases, life estates and out-of-state property were small for the universities and foundations who reported this information to us.

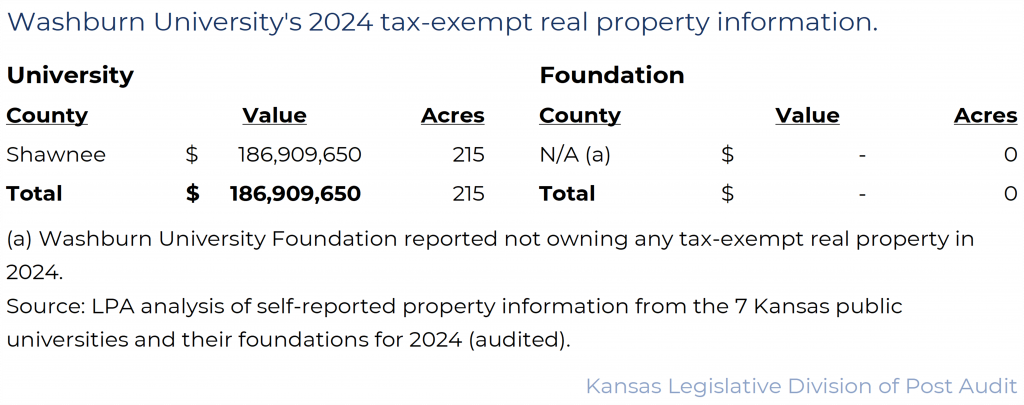

- Life estates are a unique way universities and foundations acquire property through donations. They are taxable and the taxes are paid by the current owner until the estate fully transfers to the university or foundation. The property remains taxable unless the university or foundation uses the property for an exempt purpose and receives exemption approval from BOTA. None of the universities reported having any life estates in Kansas and only 2 foundations reported having them. However, the University of Kansas Endowment and Kansas State Foundation didn’t provide us with detailed information about life estates.

- Finally, 1 university and 3 foundations reported owning out-of-state property valued at $4.7 million in 2024. The University of Kansas reported owning about $2.6 million or 71,500 acres of mineral rights in other states. Fort Hays Foundation reported owning property valued at $1.3 million in another state, and Washburn Foundation reported owning a small amount of out-of-state property. The University of Kansas Endowment and Kansas State Foundation didn’t provide us with information about out-of-state property.

Conclusion

The Kansas Constitution and state law provide for many property tax exemptions, but it’s difficult to estimate how much state and local governments aren’t receiving because of the nature of this property. There’s little detailed information available about the exempt properties and the information that is available is less reliable. That’s likely because taxing entities may devote less resources to tracking these properties because they’re not being taxed. As a result, trying to estimate forgone tax revenues from these properties relies on making significant assumptions. In all, we estimate local governments have forgone roughly $1 billion in real property tax revenue in 2024, but that varies significantly from county to county. Regardless of the amount, it’s important to keep in mind that a lot of the real property tax exemptions are for government-owned properties or properties that are used for educational and charitable purposes. Few property tax exemptions are for more discretionary-type programs like economic development.

Universities and foundations own a significant amount of real property across the state that is exempt from property tax because of educational uses. The educational uses can vary widely and include classroom buildings, student housing, and undeveloped land for biological research. Universities and foundations can purchase property or receive donations of real property to be used for future development and research or generating income. However, universities and foundations must follow the same process as every other entity requesting real property tax exemptions regardless of whether the property was donated or purchased.

Recommendations

- Kansas Department of Revenue (KDOR) should include the values for the new industrial revenue bond and economic development property tax exemption codes in the totals they report in the Statistical Report of Property Assessment and Taxation. Generally, KDOR should ensure the statistical report correctly compiles all relevant information and that the totals presented in the report are an accurate representation of the exempt value of property in the state.

- Agency Response: The Division of Property Valuation (PVD) is currently working to create reports that will address the missing data in the statistical report. PVD plans to incorporate the Industrial Revenue Bond (EIC, EIR & EIV) and the Economic Development (EXC, EXR, & EXV) exemption groups to the 2025 Statistical Report of Property Assessment and Taxation. This will expand the number of exemption tables in the publication from three to five. Both the 2024 and 2025 years will be included in the 2025 report published at the end of January or early February 2026.

- The Legislature should consider reviewing exemption statutes and eliminating ones that are outdated. This could include the exemptions cited in K.S.A. 79-201a(Eleventh) and K.S.A. 74-99b12.

Agency Response

On December 22, 2025, we provided the draft audit report to the Kansas Department of Revenue (KDOR), the Kansas Board of Regents (KBOR), and the 7 public universities and their foundations.

Agency officials generally agreed with our findings, conclusions, and recommendations. KBOR’s response is below. KDOR officials chose to respond to the recommendation only and not submit a formal response. University and foundation officials chose to not submit formal responses.

Kansas Board of Regents Response

Appendix A – Real Property Tax Exemptions

This appendix lists the 64 real property tax exemptions we reviewed for this audit

Appendix B – Appraised Value, Estimated Exempt Value, and Exempt Proportion of Real Property for 2024

This appendix shows the appraised value, estimated exempt value, and the percentage of real property that was tax exempt in 2024 by county and statewide.

Appendix C – University and Foundation Exempt Property by County

This appendix lists exempt real property information for each university and foundation by county for 2024.

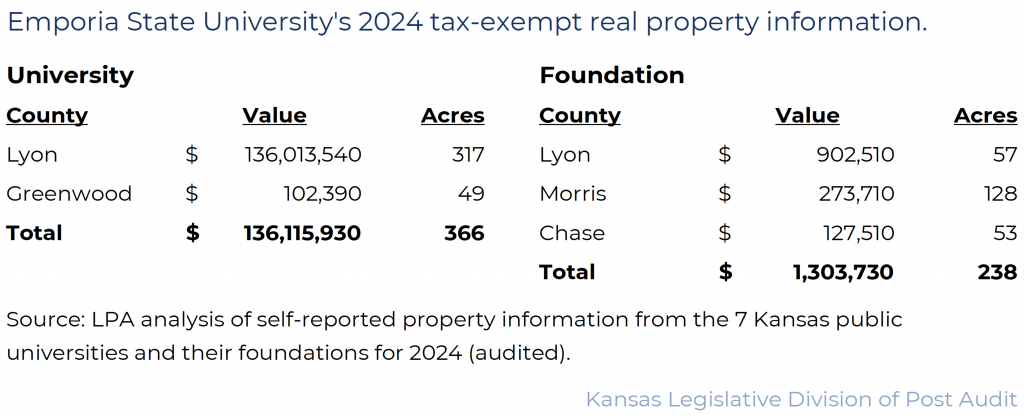

Emporia State University

Main campus location: Lyon County

Student population (2024): 5,886

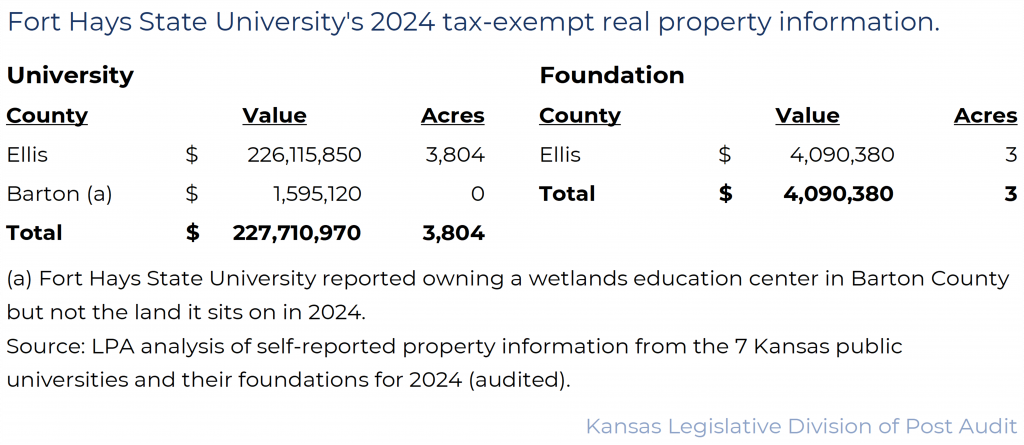

Fort Hays State University

Main campus location: Ellis County

Student population (2024): 16,922

Kansas State University

Main campus location: Riley County

Student population (2024): 22,270

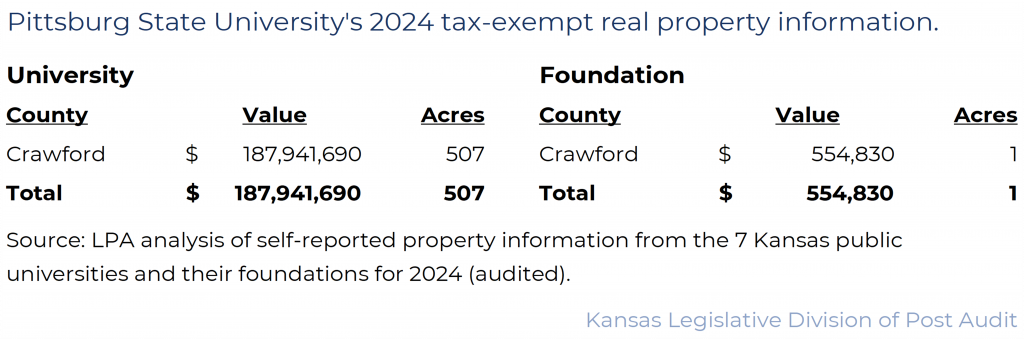

Pittsburg State University

Main campus location: Crawford County

Student population (2024): 6,895

University of Kansas

Main campus location: Douglas County

Student population (2024): 32,153

Washburn University

Main campus location: Shawnee County

Student population (2024): 6,517

Wichita State University

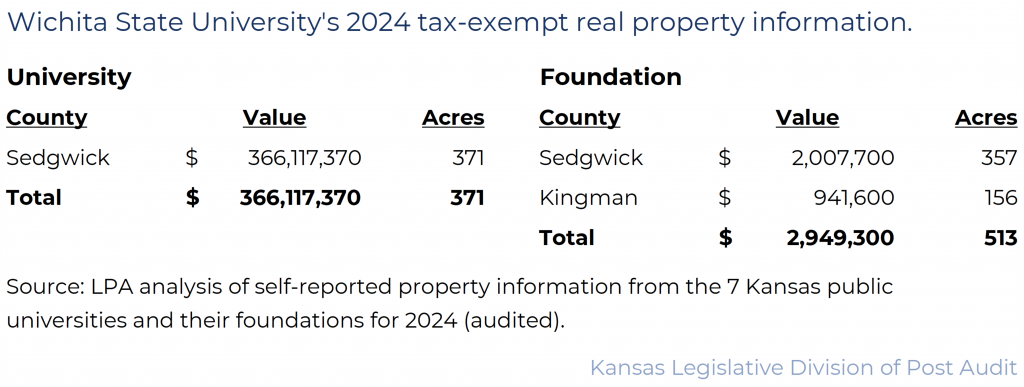

Main campus location: Sedgwick County

Student population (2024): 20,429

Appendix D – Acquisition Information for Universities’ Tax-Exempt Real Property in 2024

This appendix shows how the 7 public universities in Kansas reported acquiring the tax-exempt real property they owned in 2024.