Reviewing Veterans’ Claims Assistance Program Matching Requirements

Introduction

Senator Virgil Peck requested this audit, which was authorized by the Legislative Post Audit Committee at its April 24, 2024 meeting.

Objectives, Scope, & Methodology

Our audit objective was to answer the following question:

- How are veteran service organizations meeting the matching obligations of the Veterans’ Claims Assistance Program?

To answer this question, we worked with program officials to understand how the grant works and relevant requirements. We reviewed VCAP contracts, financial reports, and supporting documentation for fiscal years 2022 to 2024 from the Kansas Office of Veterans Services. We compared data from these documents with data from the Kansas Statewide Management, Accounting, and Reporting Tool (SMART) to ensure that all VCAP funds appropriated by the legislature from fiscal year 2022 to 2024 could be accounted for.

We also used the data to determine what types of activities veteran service organizations reported to meet their matching obligations. We conducted an in-depth review of 6 months of activities to determine if the reported activities appeared to meet statutory requirements. This sample was random and not projectable. Allowability was based on whether we could tie the support to the VCAP program with evidence such as payroll reports, invoices and receipts that included names, shipping or billing addresses, or service locations that corresponded with VCAP employees and offices. Follow-up interviews with service organizations were conducted to clarify and request additional documentation when needed.

Although we provide an overview of how Veterans’ Claims Assistance Program (VCAP) grant funds were used, the scope of our audit didn’t include an evaluation of whether the use of grant funds was appropriate or free of waste and abuse.

More specific details about the scope of our work and the methods used are included throughout the report as appropriate.

Important Disclosures

We conducted this performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. Overall, we believe the evidence obtained provides a reasonable basis for our findings and conclusions based on those audit objectives.

Our audit reports and podcasts are available on our website www.kslpa.gov.

The Kansas Office of Veterans Services has allowed participating Veteran Service Organizations to take fundamentally different approaches in reporting VCAP matching obligations, which may or may not comply with state law.

Background

Veteran Service Organizations use various funding mechanisms to provide a variety of services to veterans in the U.S. and Kansas.

- There are 43 congressionally chartered veteran service organizations in the U.S. At least 8 have a presence in Kansas. These service organizations are typically membership-based, non-profit organizations that provide a variety of services to veterans, service members, and their families. These activities include, but aren’t limited to:

- organizing job fairs and sports leagues for veterans

- fundraising for veterans’ programs, such as housing for homeless veterans

- providing education scholarships to veterans and their dependents

- providing veterans’ memorial and funeral services

- helping veterans apply for benefits

- Veteran service organizations rely on a combination of public and private funding to operate. Generally, these include federal or state grants to support specific activities or programs. It can also include funding from membership fees, fundraising, and private investments.

- In this audit, we evaluated a single state-funded veterans program. Our audit objective was specific to the Veterans Claims Assistance Program (VCAP). We did not evaluate other veterans programs or funding mechanisms as part of this audit. The VCAP program is discussed more below.

The state’s Veterans Claims Assistance Program (VCAP) is meant to provide claims assistance to veterans in Kansas through congressionally chartered veteran service organizations.

- Veterans are eligible for a variety of state and federal benefits. Created in 2006, the state’s Veterans Claims Assistance Program (VCAP) was designed to help veterans obtain those benefits, such as disability payments, healthcare, education assistance, and pensions. In 2006, state law (K.S.A. 73-1234) established the state’s VCAP program. The goal of the program was to help ensure veterans in Kansas receive assistance and help filing applications for these benefits.

- Under VCAP, veteran service organizations receive annual state-funded grants to provide claims assistance to veterans. The organizations employ veterans services representatives and support staff in the U.S. Department of Veterans Affairs (VA) Hospitals in Leavenworth, Topeka, and Wichita and the VA Regional Office in Wichita. Each organization operates its own office inside the VA hospitals and Regional Office. They are reimbursed for some of their costs associated with operating the offices with VCAP funds.

- VCAP office staff can help veterans understand and apply for benefits, obtain documents like military service and medical records, and help ensure the accuracy of applications before they’re submitted. This work can be resource intensive, requiring hours or even days of staff time to gather and organize all the necessary documentation.

The Legislature appropriates annual funds for VCAP which is administered by the Kansas Office of Veterans Services.

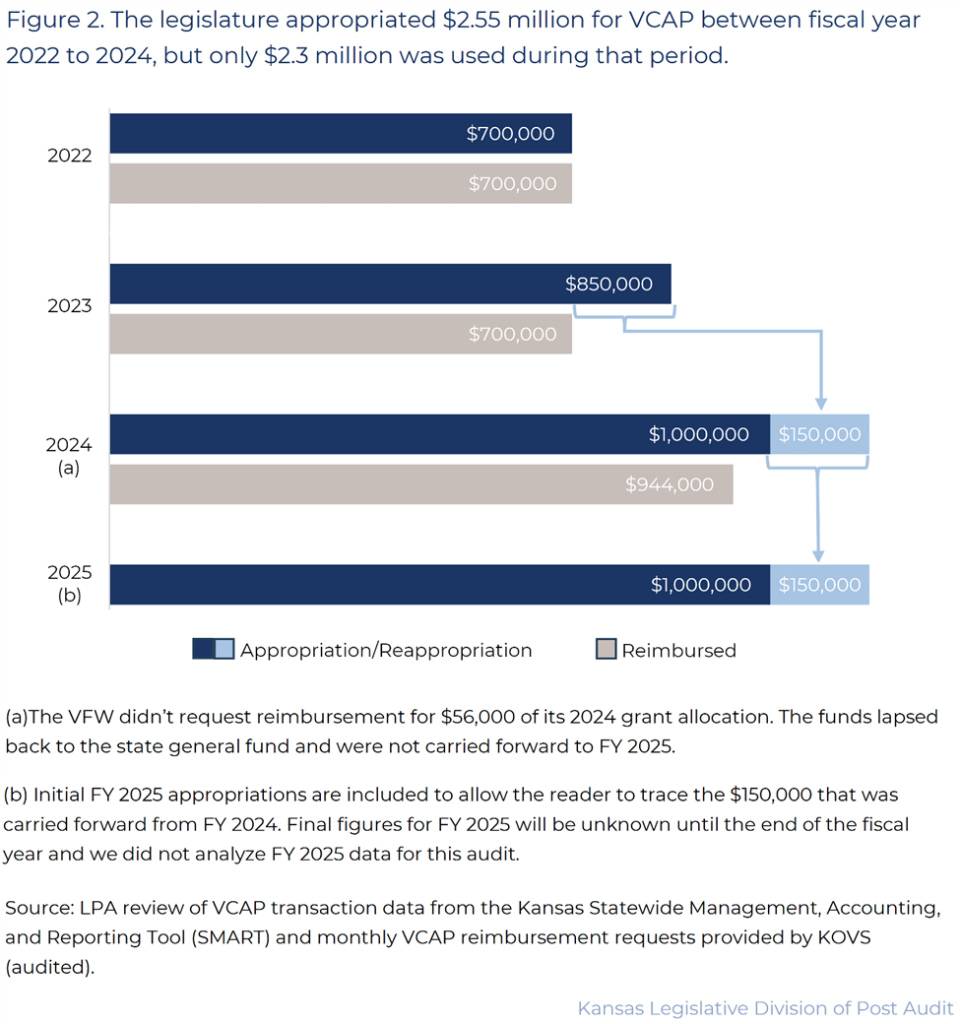

- The Legislature appropriated $2.55 million for VCAP between fiscal year 2022 and 2024. The Kansas Office of Veterans Services (KOVS) administers VCAP and awards grants. Each grant lasts 1 state fiscal year (July 1-June 30).

- Veteran service organizations apply each year for VCAP funding. To be eligible for VCAP, veteran service organizations must meet the requirements defined in state law (K.S.A. 73-1234). These requirements include, but aren’t limited to:

- being chartered by the U.S. Congress.

- having headquarters in Kansas and members in 50% or more of Kansas counties.

- employing veteran service representatives in the VA Hospitals in Leavenworth, Topeka, Wichita, and the VA Regional Office in Wichita.

- providing matching resources to support VCAP as defined by KOVS. We discuss this match more below.

- Since 2006, only 2 organizations have participated in VCAP. Those are the Kansas Department of the American Legion (American Legion) and the Veterans of Foreign Wars Department of Kansas (VFW).

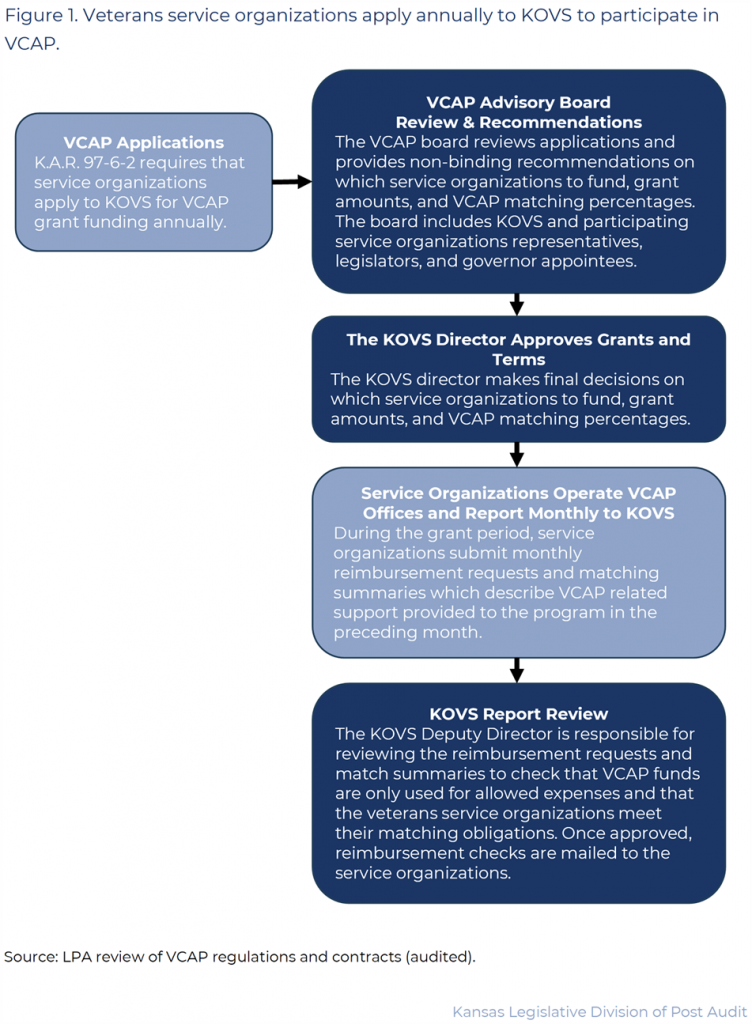

- Figure 1 shows the grant application, approval, and distribution process. KOVS requires the organizations to apply for VCAP grants each year. A board of stakeholders advises KOVS on applications, grant amounts, and VCAP matching percentages. The KOVS Director makes the final decisions. KOVS is responsible for monitoring participating organizations to ensure that they are following program rules.

The VCAP grant program operates under a reimbursement model that’s overseen by KOVS.

- We interviewed KOVS, American Legion, and VFW officials to understand how VCAP funds are distributed, how grant spending is reported, and how grant reports are reviewed. We did this to ensure that only qualified costs defined in state law (K.S.A. 73-1234) are being reimbursed.

- KOVS provides VCAP grant funds to veteran service organizations on a reimbursement basis only. That means the organizations first spend their own funds on VCAP related costs. Then, they request reimbursement from KOVS for qualifying costs.

- State law restricts the types of costs that veteran service organizations can be reimbursed for. State law (K.S.A. 73-1234) defines qualifying costs as salaries and wages, related employer contributions and personnel cost, and operating and capital outlay expenditures for training and equipment, for veterans service representatives and necessary support and managerial staff.

- As Figure 1 above shows, the organizations submit monthly reimbursement requests to KOVS. These reports provide general descriptions of the VCAP costs incurred in the month and the amount of reimbursement requested.

- KOVS is responsible for reviewing the reimbursement requests each month to ensure that VCAP grant funds are only used to reimburse allowable costs. When a reimbursement request is approved, a check is sent to the organization from the State General Fund

To participate in VCAP, veteran service organizations must also meet annual matching obligations.

- State law (K.S.A. 73-1234) requires veteran service organizations to provide matching support for VCAP. The annual match must be equal to a percentage of the VCAP funds the organizations receive. The percentage is set each year by KOVS. Statute does not define what ‘support’ is beyond stating that it should be a combination of monetary and non-monetary support.

- We interviewed KOVS, American Legion, and VFW officials to understand how the organizations meet the matching obligation. We also wanted to understand how KOVS ensures that matching support is related to VCAP as required by statute.

- It’s important to note that the veteran service organizations do not “pay” KOVS in any way for direct or in-kind support. The organizations are supposed to report costs and in-kind support related to VCAP in addition to or outside the grant reimbursement amounts. They then submit this monthly in match summary reports to KOVS along with their reimbursement requests. These reports provide a general description of the support they provided to VCAP in the preceding month.

- KOVS is responsible for reviewing the monthly match summaries to ensure what is listed supports VCAP. They also track the total support to ensure the organizations meet the match percentage by the end of the grant period (fiscal year).

VCAP Reimbursement

We reviewed how much the 2 veterans service organization received in VCAP grant funds from fiscal year 2022 to 2024.

- We reviewed the VCAP grant contracts and reimbursement requests from fiscal year 2022 to 2024 for the Kansas Department of the American Legion (American Legion) and the Veterans of Foreign Wars Department of Kansas (VFW). We then compared financial records in the state’s accounting system (SMART) to reimbursement requests and contract terms. We did this to ensure we could account for all VCAP funding the legislature approved in those years.

- The Legislature appropriated about $2.55 million to the VCAP program between fiscal year 2022 and 2024. Figure 2 shows how much funds were appropriated each year and the amounts that were reimbursed to veteran service organizations. The figure shows that, in total, the 2 organizations received $2.34 million of the $2.55 million in VCAP grant funds:

- The American Legion received $1.2 million.

- The VFW received $1.14 million.

- KOVS has historically provided equal funding to each service organization, and all the reimbursement requests we reviewed were paid in full. The difference between what the Legislature appropriated ($2.55 million) and what KOVS reimbursed the organizations ($2.34 million) was due to 2 factors:

- First, the legislature approved $150,000 in additional funding in April of 2023 and 2024. KOVS officials told us that the organizations didn’t have time to use the funds by the end of the fiscal year. KOVS instead carried them forward into the following years. Thus, $150,000 of the funds appropriated for the program in 2024 were reappropriated in 2025.

- Second, the VFW didn’t request reimbursement for $56,000 of its 2024 grant allocation. The funds lapsed back to the state general fund and are no longer available to KOVS or the VFW for 2025. Unlike the $150,000 in 2024 appropriations that KOVS carried forward to 2025, these funds were ineligible for reappropriation due to state encumbrance policy which does not allow encumbered funds to be reappropriated.

The veteran service organizations reported using VCAP funds primarily for VCAP-related salaries and wages.

- State law (K.S.A. 73-1234) restricts the use of VCAP funds to salaries and wages, related employer contributions and personnel cost, and certain operating and capital outlay expenditures related to training and equipment. All costs must be in support of the VCAP program.

- Based on the reimbursement requests we reviewed, most of the grant fund reimbursement requests for the VFW (85%), and the American Legion (99%) from fiscal year 2022 to 2024 were for salaries and benefits. This included part of their VCAP staff salaries, pensions, health insurance, and employer payroll taxes.

- Both organizations operate their own VCAP offices in the state’s three VA Hospitals and the VA Regional Office. Most of the salary and benefits the organizations claimed for reimbursement were for veterans services representatives and administrative staff who work in these offices. These staff assist veterans in filing claims under VCAP.

- Both organizations also claimed part of the salaries of some of their state headquarters staff in Topeka. These staff supported VCAP by paying bills, managing contracts, preparing monthly reports, conducting trainings, ensuring policies and procedures were followed, and accrediting and cross-accrediting all VCAP veterans service representatives.

- The remaining grant fund reimbursement requests were for a portion of VCAP office costs. This included expenses like office equipment leases, office supplies, phone and internet service, and office support services like document shredding.

- We didn’t conclude on whether the reimbursed costs were appropriate or free of waste and abuse because it was outside the scope of the audit question which focused on the matching obligations.

VCAP Matching Obligations

We evaluated how the 2 veterans service organizations met their matching obligations between fiscal year 2022 and 2024.

- State law (K.S.A. 73-1234) requires veteran service organizations to provide their own matching support to VCAP. The annual match amount is based on a percentage of the grant funds they receive and is set by KOVS. The matching requirement was 33% from fiscal year 2022 to 2023, and KOVS reduced the matching requirement to 25% in 2024. For example, in 2024 each organization had to show it provided $250 in support for every $1,000 in VCAP grant funds received.

- State law requires that the match be in support of VCAP. Veteran service organizations submit monthly match summary reports that provide general descriptions of how the organizations provided matching support for the preceding month. Although the organizations report monthly, they do not have to meet the match percentage until the end of the grant period (fiscal year).

- We reviewed all monthly match summary reports that the American Legion and VFW submitted to KOVS between fiscal year 2022 and 2024. We reviewed these 72 match summary reports (2 organizations, 3 years, 12 months) to understand the type and amount of matching support the service organizations reported.

- For a non-projectable selection of 6 monthly reports from each organization, we also requested and reviewed supporting documentation to determine if the reported matching support appeared to be related to VCAP. We judgmentally selected reports that included a variety of items that we thought reflected the types of costs the organizations typically reported as matching support. We also selected reports that included outlier costs that were noticeably different compared to previous months and annual averages. Although not projectable, this analysis allowed us to understand, in detail, the types of direct and in-kind support veteran service organizations claimed towards their matching obligations.

During this time, the American Legion reported between 28% and 34% in matching support related to the VCAP program.

- In total, the American Legion reported over $375,000 in matching support between fiscal year 2022 and 2024. They reported about $118,000 each year between fiscal year 2022 and 2023, and $139,000 in 2024. Their matching percentages for these years were 34% in fiscal year 2022 and 2023 and 28% in 2024. This was sufficient to meet the required matching obligations in those 3 years.

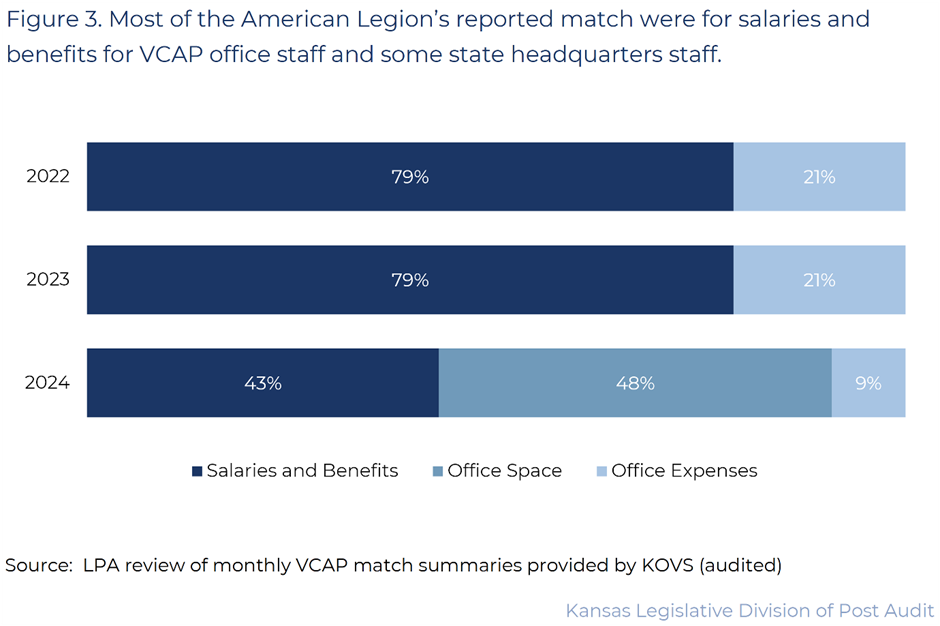

- Figure 3 shows a breakdown of the types of direct and in-kind support the American Legion claimed as a match in the years we evaluated. As the figure shows,

- 43%-79% of the reported support was for direct costs for part of the salaries and benefits of their VCAP office staff and some state headquarters support staff.

- 9%-21% of the reported support was for direct costs for a portion of office costs related to VCAP. This included phone, internet, and document shredding services, business insurance coverage, office supplies and equipment leases, and maintenance costs.

- 0%-48% of the reported support was in-kind support based on the estimated rental value of the VCAP office space that the VA provides for free.

- As Figure 3 shows, the American Legion significantly changed how they reported their match in 2024. The American Legion didn’t claim any in-kind support as part of its match in fiscal years 2022 or 2023. However, in 2024, the proportion of matching support reported for salaries, benefits, and office costs decreased significantly. Instead, the organization reported that almost half of their matching support was for the estimated rental value of the VCAP office space in the VA hospitals. The VA provides this space to VCAP for free. Historically, there have been discussions between KOVS and the service organizations about the allowability of claiming the estimated value of this free rental space as matching support. The VFW has claimed this type of support for at least several years. As of this audit, KOVS and the veteran service organizations had agreed this was allowable. This topic is discussed later in the report.

Most (76%) of the matching support we reviewed in more detail for the American Legion appeared to be related to VCAP, but we couldn’t verify the rest.

- State law (K.S.A. 73-1234) requires veteran service organizations to provide their own matching support to VCAP as a percentage of the grant funds they receive.

- We interviewed American Legion officials and reviewed supporting documentation for a non-projectable sample of 6 monthly matching reports from fiscal year 2022 to 2024 (out of 36 total reports). Our sample included about $87,000 in matching support, or about 23% of the American Legion’s roughly $375,000 in matching support in those 3 years.

- For the 6 months of supporting documentation we reviewed in detail, we saw evidence that about 76% ($66,000) of matching support was directly related to VCAP. This support was for VCAP-related staff time and operations. We were able to review supporting documentation for these costs and connect them to specific VCAP staff and offices. Supporting documentation included payroll records for VCAP employees, and billing invoices and receipts for goods and services that included shipping or billing addresses or service locations that corresponded with VCAP offices.

- We were unable to confirm the remaining 24% ($20,700) of support in our sample because they were based on American Legion estimates. About 13% ($11,500) was related to estimated office costs and staff time, primarily for the state headquarters in Topeka. This included an estimated portion of salaries, benefits, copy machine leases, and shredding services. Officials explained that headquarters staff pay bills, manage contracts and payroll, prepare monthly reports for VCAP, and provide other services. As such, a percentage of those expenses are allocated to VCAP and reported as matching support. The remaining 11% ($9,200) in match support was related to the estimated value of VCAP office space in the VA Hospitals. We couldn’t review any of these estimate calculations because there was no documentation to support the methodology used to create them.

- Overall, we couldn’t determine with certainty whether the American Legion met their matching obligations in the years we looked at. Although we were able to verify most of the matching support in the sample of months we reviewed, some relied on unverifiable estimates. Without standardized tracking, we can’t conclude if the estimated office rents and headquarters costs reasonably represent the support provided to VCAP. Further, we can’t conclude with certainty that the costs in the months we didn’t look at would’ve been similar because our sample was not projectable.

The VFW reported that it greatly exceeded its matching obligations between fiscal year 2022 and 2024.

- The VFW reported almost $2 million in matching support between fiscal year 2022 and 2024. The amount they reported each year varied significantly. They reported about $642,000 in fiscal year 2022, $772,000 in 2023, and $530,000 in 2024. These amounts equated to matching percentages of 183% in fiscal year 2022, 221% in 2023, and 119% in 2024. As reported, this far exceeded the minimum requirements.

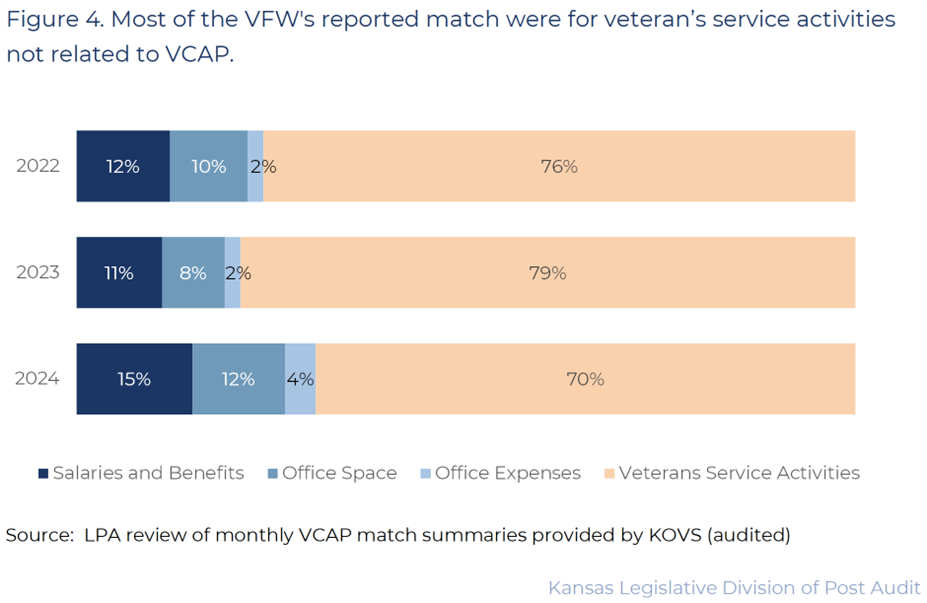

- Although the total matching support fluctuated significantly over the years we looked at, the proportions and types of costs and activities claimed were similar year to year. Figure 4 shows a breakdown of the types of costs and activities the VFW reported as matching support across the 3 years we evaluated. As the figure shows,

- 70%-79% of the support was for direct costs and in-kind volunteer work for veteran’s service activities in general. These reflected work by volunteers that benefit veterans in ways other than the VCAP program. We discuss this more below.

- 11%-15% of the reported support was related to costs for part of the salaries and benefits for the state headquarters staff who support VCAP activities.

- 8%-12% was in-kind support based on the estimated rental value of the VCAP office space that the VA provides for free.

- The remaining 2%-4% of support each year were for a portion of state headquarters office costs. This included phone and internet service, office supplies and equipment leases, utilities, and maintenance costs.

More than half (55%) of our sample of VFW matching support was not related to the VCAP program, and we couldn’t verify the rest.

- State law (K.S.A. 73-1234) requires veteran service organizations to provide their own matching support to VCAP as a percentage of the grant funds they receive.

- We interviewed VFW officials and reviewed supporting documentation for a non-projectable sample of 6 monthly match summary reports from fiscal year 2022 to 2024 (out of 36 reports). Our sample included about $185,000, or 9% of the VFW’s roughly $2 million in matching support in those 3 years.

- For the 6 months of supporting documentation we reviewed in detail, we identified about 55% ($101,000) of matching support that was not related to VCAP. VFW officials explained that they routinely report non-VCAP related costs and in-kind support as part of their matching obligations. This is largely done through the reporting of “Veteran’s Service Activities” that volunteers do to support veterans. VFW officials regularly include the direct costs and estimated value of volunteer hours associated with these broader veterans’ services as part of their matching support. These activities included things like veteran funeral services, meals, and other community activities. In total, “Veteran Service Activities” accounted for about 55% of the monthly match reports we sampled.

- This practice seems contrary to state law (K.S.A. 73-1234) which requires matching support to be in support of VCAP. VFW officials told us they do this because it’s their understanding that any veterans service activity can be matching support regardless of its connection to VCAP. They told us that they were advised of this by previous agency officials. But, neither the VFW nor KOVS was able to provide documentation of this guidance.

- We were unable to confirm if the remaining 45% ($84,000) of reported matching support was related to VCAP because it was based on VFW estimates. About 28% ($52,000) was related to estimated office costs and staff time, primarily for the state headquarters in Topeka. This included an estimated portion of salaries, benefits, copy machine leases, and office supplies and utilities. Officials explained that headquarters staff pay bills, manage contracts and payroll, prepare monthly reports for VCAP, and provide other services. As such, a percentage of those expenses are allocated to VCAP and reported as matching support. The remaining 17% ($32,000) of support was related to the estimated value of VCAP office space in VA Hospitals. We couldn’t review any of these estimate calculations because there was no documentation to support the methodology used to create them.

- Overall, we couldn’t determine if the VFW met their matching obligations in the years we looked at. Over half of the reported support was related to veteran’s service activities not related to the VCAP program specifically. The remaining matching support reported by the VFW rely on unverifiable estimates. Without standardized tracking, we can’t conclude if the estimated office rents and headquarters costs reasonably represent the support provided to VCAP.

KOVS Program Oversight

KOVS hasn’t provided sufficient guidance to participating veteran service organizations to ensure they understand the requirements related to matching support.

- KOVS oversees VCAP under state law (K.S.A. 73-1234), setting and enforcing program rules. Participating veteran service organizations are expected to understand their obligations. KOVS sets regulations and signs contracts with VSOs for each grant, but the contracts only specify the match percentage without clear guidance on allowable items. Neither organization could recall receiving written guidance from KOVS regarding what could be included as matching support.

- Statute says the match must be in support of VCAP but does not define what qualifies as VCAP support. Over the years, KOVS, veteran service organizations, and the Kansas Attorney General’s Office have discussed what is allowable as matching support. KOVS has adopted a policy of permitting any match unless explicitly prohibited. The statute only effectively bans support that does not support VCAP, without defining what that means.

- We found that the American Legion and VFW report matching support very differently. The American Legion reports only VCAP-related support as its match, while the VFW includes any veteran-related activity or expense. Our sample findings reflect these differing views.

- Without clear oversight, the participating veteran service organizations in effect are operating very differently regarding meeting their matching obligations.

KOVS’s oversight may be inadequate to ensure the veteran service organizations are meeting their matching obligations.

- By state law (K.S.A. 73-1234) KOVS administers VCAP. This includes overseeing the participating veteran service organizations to make sure they are adhering to the rules of the program.

- The main tool KOVS uses to determine if the veteran service organizations are meeting their matching obligations is the monthly match summary. But these monthly reports don’t provide adequate information to understand the matching support. In our sample work, we found that these reports only include a business name or a general category like ‘salaries’ ‘supplies’ or ‘utilities’. They don’t provide details about what the support is or how it’s related to VCAP.

- KOVS officials told us that the match summaries are usually similar month to month and that the types of matching support claimed have generally remained the same since VCAP was created. KOVS officials told us that they often rely on the match summaries and staff’s professional judgement to determine if the reported matching support is allowable. The organizations are required to maintain more detailed supporting documentation. But they’re not required to submit it unless requested. KOVS officials told us that they call the veteran’s service organizations if they have questions, but they rarely request or review the supporting documentation.

- Without reviewing the supporting documentation, KOVS cannot verify that matching support is allowable. We reviewed the supporting documentation for a sample of monthly reports and identified several significant issues which we discussed in the sections above.

Lax KOVS oversight in other areas may cause additional misunderstandings between KOVS and the veteran service organizations and their supporters.

- KOVS officials appeared to misunderstand how much VCAP funds were available to them in fiscal year 2025.

- When we asked KOVS about the $56,000 in unspent VFW funds from the fiscal year 2024 grant, they told us that the funds were carried forward and still available to the VFW in fiscal year 2025. However, the funds lapsed back to the state general fund and were no longer available to use.

- Additionally, KOVS officials appeared to have made an error on the fiscal year 2025 VCAP contracts that resulted in veteran service organizations being allocated less funds than they should have been. The Legislature appropriated $1.15 million to KOVS for VCAP grant funds at the beginning of fiscal year 2025. But KOVS only allocated $1 million ($500,000 each) to the organizations. KOVS is not required by statute to distribute all appropriated grant funds each year. Yet, KOVS told us that this was a mistake, and that the grants should have been larger.

- KOVS also didn’t properly document a fundamental change to the terms of the fiscal year 2024 grant contract that occurred mid-year. In December of fiscal year 2024, KOVS and the VCAP board decided to lower the match percentage from 33% to 25%. Statute gives KOVS the power to set the match percentage and does not prohibit mid-year changes. But KOVS didn’t amend the grant contract to reflect this change. They told us that the veterans service organization representatives on the VCAP board informed their leadership about the change and that a contract amendment was not necessary. Yet, this does not adhere to state contract procedures which require changes to be documented with contract amendments.

- We did not evaluate the effects these missteps may or may not have had on the budgets or functioning of the veteran service organizations or the VCAP program. Yet, these errors can create confusion over how the program operates and how it is managed. In fact, one of the concerns behind the audit question was that KOVS was not distributing the correct amount of VCAP funds to the organizations, and that KOVS couldn’t account for the funds.

Other Findings

It’s unclear whether statute allows veteran service organizations to use the estimated rental values of the offices provided by the U.S. Department of Veterans Affairs as their own in-kind matching support.

- The 3 Veterans Affairs hospitals provide free office space for the VCAP program. The veteran service organizations employ veteran service representatives as part of the VCAP program in these offices. The veteran service organizations estimate the rental value of these offices based on what they think they’d have to pay for similar offices. They then report this estimated value as in-kind matching support.

- We agree that the provision of free office space for veteran service representatives is in-kind support related to VCAP. But statute (K.S.A. 73-1234) states that matching support shall be provided by the veteran service organizations. It is unclear whether statute allows the veteran service organizations to claim VA support of VCAP as their own. KOVS has allowed this practice for at least several years with the VFW and they recently advised the American Legion in 2023 that they could do the same thing.

- KOVS officials told us that they consulted with the Kansas Attorney General’s Office (AG) in 2023. In an email exchange AG officials advised KOVS that the practice was ethically questionable, but not technically prohibited due to broad legal interpretations of what in-kind support can be.

Conclusion

Only two veteran service organizations—the American Legion and the VFW—have been participating in the state’s VCAP program. VCAP is a grant program that operates on a reimbursement basis. The service organizations incur costs related to VCAP, and the state grants provide reimbursement for a portion of their expenditures. Additionally, the service organizations must report additional direct or in-kind costs related to the VCAP program to meet the required “match” obligations.

The Kansas Office of Veterans Services has allowed the two participating veteran service organizations to take fundamentally different approaches to reporting VCAP matching obligations, which may or may not comply with state law.

For example, the VFW reported the costs of several broader veterans’ activities (e.g., funeral services, meals, etc.) as part of its match. Although these activities are related to serving veterans in general, they are not directly related to VCAP, as required by state law. Furthermore, both organizations regularly reported matching support based on estimates that lacked verifiable documentation or methods. These reporting practices create confusion about whether and how the two service organizations met the state’s VCAP matching obligations. Additionally, inadequate guidance and oversight from the Kansas Office of Veterans Services contribute to misunderstandings and confusion about program operations. To ensure transparency and accountability, clearer guidelines and stronger oversight are necessary to standardize reporting methods and ensure compliance with program requirements.

Recommendations

We made several recommendations for this audit.

1. KOVS should provide written guidance to the veteran service organizations that define what activities or costs are allowable as matching support of the VCAP program. This should include how to estimate and report on shared office staff and resources (i.e., state headquarters).

- Agency Response: The Kansas Office of Veterans Services (KOVS) concurs with this recommendation. At the inception of the Veterans’ Claims Assistance Program (VCAP) through K.S.A. 73-1234, K.A.R. 97-6-l et seq., and contracts between the KOVS and veteran service organizations (VSOs), monetary and in-kind services have been used for matching support. The KOVS administers the program consistent with the applicable statutes and regulations. KAR. 97-6-l defines “in-kind contributions” as “any noncash input that can be given a cash value. In FY23, the KOVS conducted a meeting with the Veterans of Foreign Wars (VFW) Kansas Department Quartermaster and the American Legion Kansas Department Adjutant to address this topic. In an effort to clarify allowable activities or costs for the match support, the Deputy Director of Veteran Services issued a memo to both grant participant organizations, VFW and American Legion, explaining the appropriate items that can be claimed as a monetary and in-kind match under the grant. The KOVS will revise K.A.R. 97-6-6, “Grant agreement requirements,” to codify definitions of activities or costs that are allowable as matching support under the VCAP. The KOVS intends to include calculations and standardized methodology on how to estimate and report on shared office staff and resources. These regulation amendments will be coordinated with legal counsel to ensure we are operating within the intent and authorization of the applicable statutes.

2. KOVS should require the organizations to provide documentation with their match summary reports that’s sufficiently detailed to allow officials to determine what the amounts are and how they support the VCAP program directly.

- Agency Response: The KOVS concurs with this recommendation. Under the current annual contract between our agency and each VSO, the VSOs are required to submit invoices monthly for reimbursement by the State. The provisions of the contract in paragraph 5. (D) address how the organizations will submit their matching amounts. It further addresses which types of matching amounts VSOs may submit. In paragraph 5. (E) the contract states “[T]he Contractor agrees to maintain on site at their state headquarters all supporting documentation of expenditures of grant funds, and ‘match’ available for audit by the Agency or their representatives”. It is the opinion of the KOVS that the VSOs are providing adequate documentation. The VSOs utilize an attachment labeled “F” which is a VCAP Grant Match Form. This form requires VSOs to list any cash or in-kind payment under the categories of Office Space, Utilities, Facilities, Meeting Space, Staff Support, Professional Services, Non-Professional Services, Volunteer Services, Supplies, Outreach, Training, Administrative Costs, and Travel. Pending regulatory amendments anticipated under Recommendation l, the agency will ensure detailed services rendered are compliant with any updates. The KOVS will update forms as necessary and ensure the VSOs are adhering to the requirements set forth in the statutes and regulations. The KOVS agrees to request supporting documentation for each category listed above.

3. KOVS officials should review this documentation and request clarifications or additional information as needed prior to approving grant reimbursements or future grant applications.

- Agency Response: The KOVS concurs with the recommendation to review each VSO’s request for grant reimbursements. Each participating VSO provides detailed invoices that reflect operational expenses directly related to Veterans claims assistance services occurring at both their field offices (including itinerant operations on occasion) and organization headquarters. All invoices and documentation are reviewed when received. The Deputy Director of Veterans Services does request clarification when required. When the Deputy Director first assumed responsibility for the VCAP in 2078, there was uncertainty regarding the VSO’s documentation. The Deputy Director directly discussed the documentation needed for reporting with the VSO to determine what would comply with Kansas law. Any issues with documentation are discussed and requests for clarification are made with the VSOs.

4. KOVS should ensure that they understand what their annual VCAP allocations are and extend grant contracts that are correct when they are signed. Furthermore, KOVS should follow proper state contract procedures when changes are needed and make sure that any changes to the contracts are properly documented.

- Agency Response: The KOVS concurs with this recommendation. The agency understands the VCAP grant allocation amounts. All participating VSOs understood the amounts available to them for the years in the scope of the audit. The issue was the lapse of encumbered dollars which prevented those dollars from carrying forward into the subsequent fiscal year. We intend to unencumber any amounts remaining in the VCAP account on June 1st to alleviate this issue from happening in the future.

Agency Response

On February 10, 2025, we provided the draft audit report to KOVS, the VFW and the American Legion. We made minor changes to the draft based on officials’ feedback. Because we only made recommendations to KOVS, they were the only auditees required to respond. KOVS generally agreed with our recommendations and agreed to make changes based on them. American Legion didn’t submit an official response. However, in their responses, KOVS and the VFW disagreed with a few of our findings. We reviewed the information officials provided in their response but did not change our findings for the following reasons:

KOVS and the VFW disagree with our interpretation of statute in terms of how the matching requirement should work.

- VFW officials expressed that non-VCAP-related veteran service activities can be counted as in-kind matching support. However, based on a plain language review of statute, this interpretation is not supported. K.S.A. 73-1234 (f)(13) and(g) state that the match shall include both monetary and nonmonetary support for the Veterans Claims Assistance Program (VCAP).

- KOVS officials asserted that Post Service Officers across Kansas counsel veterans and refer them to VCAP offices and KOVS field offices. KOVS further states that a portion of the VFW’s match is derived from service officer reports and believes this practice aligns with Kansas law. We agree these activities would support the VCAP program. However, we saw no evidence of these activities in the reports we reviewed. The activities we called into question were not related to VCAP (e.g., lawn care, meals, and funeral services). While these activities provide meaningful support to veterans, they do not appear related to VCAP.

The VFW contends we ignored certain VCAP documentation.

- The VFW official states that LPA staff ignored community service records. This is not the case, we reviewed a sample of 54 randomly chosen service records obtained from the VFW. After evaluating each record, it was determined that none described activities supporting the VCAP program.

- Additionally, we reviewed six months of match summary reports and supporting documentation. We reviewed journal entries, receipts, invoices and payroll records and found that much of the support was related to costs incurred by the state headquarters. This included estimated portions of staff and office costs that the VFW attributed to VCAP. The report acknowledges that some of these costs likely contribute to VCAP, as staff members assist the program in various ways. However, this matching support was calculated using percentages based on undocumented estimates. As such, we were unable to verify how much of these activities were related to VCAP.

KOVS Response

Thank you for the opportunity to respond to the audit report on reviewing the Veterans’ Claims Assistance Program (VCAP) matching requirements. We appreciate the diligent data collection efforts by the audit team to understand all the comprehensive processes completed by our agency to provide Kansas Veterans the best services possible through the administration of the program. The questions regarding Kansas law as well as federal code and regulation were instrumental in painting a full picture for the Legislative Post Audit Committee to understand how the VCAP grant participants advocate for Veterans and families.

The specific objective of the audit was to answer the following question: “How are veteran service organizations meeting the matching obligations of Veterans’ Claims Assistance Program?” As demonstrated in the audit report, the audit team delved into processes outside the scope of the audit. However, we believe this offers greater context to the VCAP grant program and better describes the relationship between the grant reimbursement and matching obligations for the grant participants.

K.S.A. 73-1234(a) states the purpose of the VCAP which is “to improve the coordination of veterans benefits counseling in Kansas to maximize the effective and efficient use of taxpayer dollars and to ensure that every veteran is served and receives claims counseling and assistance.” The advocacy efforts by the grant participants are particularly important for building trust and confidence not only in the VCAP veterans service organizations (VSOs) but also the Kansas Office of Veterans Services (KOVS) and services that are provided to Veterans in Kansas. These relationships resulted in the total amount disbursed to grant participants being approximately $2.3 million during the period covered in this audit. This was used, in part, to fund the American Legion and Veterans of Foreign Wars (VFW) activities directly supporting Veterans and their family members. This included advocacy efforts at three Department of Veterans Affairs (VA) Medical Centers in Leavenworth, Topeka, and Wichita, as well as the VA’s Wichita Regional Office. During the same timeframe, these two grant participants were responsible for helping Veterans receive almost $600 million in direct benefits from the federal VA.

Overall, the KOVS agrees with the audit recommendations. We are proposing logical actions to make the program more standardized for all grant participants and collectively identify areas for improvement. With the unified support of the Governor and the Legislature, through the approved increases in the VCAP grant amount in two of the previous three years, the KOVS and the VSOs will continue to provide the best advocacy for Veterans hard earned benefits and bring hundreds of millions of dollars back into the State improving Kansan’s livelihoods.

In the next section, we have identified statements made by the audit team that require some additional context and explanations by the KOVS team. The KOVS responses to the statements in the audit report are italicized.

Introduction

“Although we provide an overview of how Veterans’ Claims Assistance Program (VCAP) grant funds were used, the scope of our audit didn’t include an evaluation of whether the use of grant funds was appropriate or free of waste and abuse.”

The KOVS can assure the LPA Committee that all funds received by the VSOs are being used appropriately. The KOVS ensures the funds received by the VSOs are used to pay for allowable costs under Kansas law.

Background

“The Kansas Office of Veterans Services has allowed participating Veterans Service Organizations to take fundamentally different approaches in reporting VCAP matching obligations, which may or may not comply with state law.”

With regard to the VSOs taking fundamentally different approaches in reporting their VCAP matching obligations, that statement is accurate. However, it is of this agency’s opinion that this practice does comply with all applicable statutes and regulations. The methodology of invoicing varying expenses and claiming of monetary and non-monetary match items are compliant with K.S.A. 73-1234 and K.A.R. 97-6-1 et seq.

“It is important to note that the service organizations do not ‘pay’ KOVS in any way for direct or in-kind support. . .”

The KOVS team appreciates the auditors bringing this to light and would like to reiterate we do not receive any money from the grant participants.

VCAP Reimbursement

“We didn’t conclude on whether the reimbursed costs were appropriate or free of waste and abuse because it was outside the scope of the audit question which focused on the matching obligations.”

This comment re-enforces our previous assertion regarding the objective of this audit. Many of the comments and findings do not relate to the original question: “How are veteran service organizations meeting the matching obligations of the Veterans’ Claims Assistance Program?” However, the KOVS does conclude all reimbursed costs were appropriate and free of fraud, waste and abuse. The grant match is the portion of the veteran service organization obligation towards the program. It must be a percentage of the reimbursement, which is currently 25%. The grant reimbursement is the amount the participating veteran service organization invoices us and we pay monthly to cover the costs of salary, wages, training, travel, supplies, and other authorized expenses.

VCAP Matching Obligations

“Most (76%) of the matching support we reviewed in more detail for the American Legion appeared to be related to VCAP, but we couldn’t verify the rest.”

The agency reviews the monthly invoices from the grant participants. The KOVS confirms that all matching obligations are verifiable monetary and nonmonetary in-kind payments prior to paying the requested VCAP grant reimbursement amount.

“More than half (55%) of our sample of VFW matching support was not related to the VCAP program, and we couldn’t verify the rest.”

The opinion expressed by the auditor in the comment above requires more explanation which we presented to the auditors during our interview. Advocating for State and Federal Veterans benefits is a complex endeavor. This goes beyond simply waiting for someone to come into an office and help fill out forms. It requires years of training to become proficient as a case manager in advocacy and representing a Veteran or family member in front of the VA. The VSOs have a network of Post Service Officers throughout the State who counsel Veterans and refer them to the accredited VSO representatives in the Veterans Affairs Medical Centers (VAMCs) or United States department of Veterans Affairs Regional Office (VARO) as well as the 16 KOVS field offices. A portion of the Veterans of Foreign Wars (VFW) match obligation is derived from service officer reports that are completed by the Post Service Officers. These reports are sent to the VFW headquarters who monetize the volunteer hours worked, and travel conducted by the service officers and other post individuals. The practice of allowing this report as an in-kind contribution has been in place since the inception of the VCAP Grant in 2006, well before the current leadership team has been administering the program. Further, the KOVS administers the VCAP grant program in accordance with Kansas law and does not find this practice to be in conflict with Kansas law.

KOVS Program Oversight

“KOVS hasn’t provided sufficient guidance to participating veterans service organization to ensure they understand the requirements related to matching support.”

“KOVS’s oversight may be inadequate to ensure the veterans service organizations are meeting their matching obligations.”

“Lax KOVS oversight in other areas may cause additional misunderstandings between KOVS and the veterans service organizations and their supporters.”

This entire section deals with the perceived “lax oversight” of the VCAP grant program by the KOVS. All grant participants receive an annual contract which lists all detailed explanation matching requirements as prescribed in K.S.A. 73-1234. The VCAP Advisory Board holds quarterly meetings, and both grant participants, American Legion and VFW, have membership who attend. All changes and any other pertinent information are distributed at the quarterly meetings. The complete VCAP Advisory Board consists of the Deputy Director of KOVS, two members nominated by the participating veterans service organizations and approved by the Governor, and legislative representatives from both the House and Senate.

The current methodology used for the invoicing of varying expenses and the claiming of monetary and non-monetary match items, although they are different between the VSOs, are in compliance with Kansas law.

The KOVS fundamentally disagrees that the agency has “lax oversight” of the program. The KOVS meticulously manages and tracks this program to ensure compliance with Kansas law while also enabling maximum flexibility with the VSOs to engage Veterans in their communities. We will continue to work with the VSOs involved, the VCAP Advisory Board, and the KOVS Director to update regulations, contracts and agency policy and procedures to explain in detail the definition of monetary and non-monetary in-kind payments, the matching requirements and spending authority of dollars received by the state.

In regard to the $56,000 in unspent funds, the Deputy Director of the KOVS took the necessary measures to encumber unspent funds, in good faith, in FY24 to apply against FY25 as would be needed by the VSOs to be supported by the VCAP program. The agency’s long-standing procedure to encumber the entire amount of the grant is where the confusion arose. Due to supplemental funds that were released to the KOVS in June of the given fiscal year and were not expended, FY24 was the first year either VSO did not use the entire grant award amount. At no time was there any shortfall of grant disbursement to the VSOs for the services they requested funding for. We conferred with the Division of Budget and Department of Administration, Accounts and Reports, they provided the following explanation:

“Policy Manual 13,002 – Statewide Encumbrance Policy does currently exempt grant payments from the encumbrance requirement. The agency is not required to set up a Purchase Order for grant payments so they can be paid from a prior year purchase order or against current year funds. However, the situation you have is more complicated.

The legislature approves a budget bill every year that establishes an appropriation amount for agency funds that can be spent during that fiscal year. The appropriation language also typically addresses what happens with any unspent or unencumbered balances at the end of the fiscal year. Below is the section of the appropriation bill (SB 28) that addresses fund 1000-0903. It shows an authorized amount of $1,000,000 that could be spent in FY 24 (July 1, 2023 through June 30, 2024) from fund 1000-0903. The highlighted area states that any unencumbered balance (meaning unspent and not encumbered on a purchase order) that is in this fund on June 30, 2024 in excess of $100 will reappropriate to FY 25. The problem you have is the appropriated fund balance you are asking about from FY 24 was encumbered on a FY 24 purchase order on June 30, 2024 so they remained in FY 24 and did not reappropriate to FY 25. Since the PO was then closed after June 30, 2024 those funds are lost because there is no way to go back after June 30 and reappropriate them to FY 25.

What is in the appropriation bill language is the law established by the legislature when the budget bill is approved. There is no authority for the Department of Administration or the Division of Budget to go back and get the FY 24 funds without legislative approval. If your agency is now short funding in FY 25 and there are outstanding invoices that need to be paid, your budget analyst indicated you will need to apply for a GBA – Governor’s Budget Adjustment to request approval for additional funds.

To avoid this situation in the future, your agency will need to close the purchase order prior to June 30th so the funds will reappropriate to the new fiscal year if you do not have an outstanding obligation to cover from the prior fiscal year.”

We intend to release any encumbered amounts remaining in the VCAP account on June 1st to alleviate this issue from happening in the future.

Other Finding

“It’s unclear whether statute allows veterans service organizations to use the estimated rental values of the offices provided by the U.S. Department of Veterans Affairs as their own in-kind matching support”.

KOVS officials told us that they consulted with the Kansas Attorney General’s Office (AG) in 2023. In an email exchange AG officials advised KOVS that the practice was ethically questionable, but not technically prohibited due to broad legal interpretations of what in-kind support can be.

The KOVS did have discussions with the Attorney General’s Office. However, the Attorney General’s Office did not advise the practice was ethically questionable. The exact wording which was provided to the audit team was “As far as whether it is appropriate or ethical to report non-monetary support as part of the match, it is permitted and specifically contemplated by statute. That makes it appropriate, at least to some measure. Ethical views on the matter are up to the individual.” Stating that “the practice was ethically questionable” is an inaccurate and unfair characterization of the advice provided by the Attorney General’s Office.

Sincerely,

_______________________________________

William Turner, BG(R)

Executive Director, Kansas Office of Veterans Services

VFW Response

Provided by Kansas VFW A/Q Herbert Schwartzkopf

VCAP History

In 2005, George Webb, Director of the Kansas Commission of Veterans Affairs, (KCVA), decided that all service officers for the State of Kansas whether they were assigned to a Service Organization or as KCVA employees should be KCVA employees since they were being paid by the state of Kansas. Those Service Officers that were assigned to Service Organizations were also paid a small stipend by the Veteran Service Organizations, (VSO’s), and most of the equipment and supplies were paid for by the VSO’s.

This left the VSO’s in a severe dilemma as in most cases, their individual By-laws stated that they would have state Service Officers to assist veterans file Service Connected Disability Claims free of charge, and these VSO’s did not have enough money to hire them on their own. So the officers of two of the VSO’s, VFW and American Legion, contacted Kansas House of Representative members Candy Ruff of Leavenworth and Ralph Ostmeyer of Grinnell and within a short amount of time had drafted a bill which would be the Veterans Claims Assistance Program, (VCAP), bill. Some of the legislators in Committee felt the bill should have some type of limited payback or matching funds. The VSO’s told them that they had no money to pay back or match funds with so the idea of one way to do matching funds would be for the VSO’s to do service work for Veterans in the respective communities where VFW and American Legion Posts were located. This service work was to be done to assist veterans and to assist the communities in which these veterans lived which would essentially also be helping the veterans and their families. The full intent was for the legislation to not only assist veterans file service connected disability claims for free but to also improve the way of life for them by helping their communities improve by the service work done in those communities by the local VSO’s Posts members. Unfortunately, the way the legislation was worded is interpreted by todays standards in a totally different way than intended. This was to be achieved by doing the Service Work and then reporting it to a state officer of that VSO for approval and submission to the approving agency. The agency assigned to oversee the VCAP program was the KCVA headed by George Webb. Mr. Webb did everything in his power to see this bill was defeated and when it was obvious it was going to pass, he demanded that his agency be paid for managing the VCAP with money provided for this program itself. That is why there is a sentence in that bill that prohibits that from happening and that the money initially provided for will be divided equally by the participating VSO’s. Rules were drawn up as to the qualifications to be a participating VSO and when it was done, the two VSO’s that were eligible were Kansas VFW and Kansas American Legion. They, to this day, are the only VSO’s that have participated. Fast forwarding to the 2012 fiscal year the amount of money allocated for the VCAP program was $500,000.00 or $250,000.00 for each VSO. Shortly into that fiscal year Governor Sam Brownback decided to help balance the budget he was going to cut most state agencies by 10% which equaled $25,000.00 for each VSO. In February of 2012, Herbert Schwartzkopf was elected as interim Quartermaster of Kansas VFW to fill out the unexpired term which ran until June of 2012. In late February of 2012 the Governor decided to cut those same agencies by an additional 10% of the original amounts which now brought the respective amounts to $200,000.00 for each VSO. The VFW did not have enough money to finish the year if they had to pay all of the obligated salaries and contracts. Quartermaster Schwartzkopf went to see Wayne Bollig, Deputy Director of the KCVA who was in charge of the VCAP legislation. The two visited with the American Legion Leadership and then Wayne and Herb went to meet with the Governor and his staff. Herb took the documentation, especially that of the service work done by the VFW, to show what Kansas VFW was doing to assist veterans and their communities. After discussing the situation the Governor agreed to restore both VSO’s to their full Grant amount of $250,000.00 each, but said to Herb, your service work is just what this bill was intending to happen, the improvement of Kansas communities. He added, “I am restoring the Grant to it’s original amount, but, you keep up that good service work!” Speaking for the VFW, the reports that report this service work are scrutinized by a line officer of the VSO, (usually the Junior Vice Commander), and once they approve the project it is submitted to the state Quartermaster for compilation and documented as matching funds. Kansas VFW has four categories of reporting Community Service and they are: 1. Community Activities, 2. Veterans Service, 3. Legislative Action, and 4. Youth Activities. Although the Legislature at that time, felt that all four could be reported, the VFW chose to only report the Veterans Service category as the VFW felt it was a Veterans Grant. In the beginning the VFW along with some members who spent their own money to come up with a viable, reliable, and secure way to compile these reports. Eventually a company that does this for organizations nationwide provided a program that is used today. They monitor it as well as our own officers so only viable reports are accepted.

This is a very brief history of the VCAP from the VFW point of view.

Facts

Wayne Bollig was the Deputy Director of the KCVA and he went to Kansas VFW Headquarters and met with Quartermaster Herb and explained to him the different parts of the contract and how to properly fill out a reimbursement form and the matching funds report form, (Attachment F). Herb had questions on how to assign values to the different items on the report so Mr. Bollig made an appointment with the Attorney General’s staff to have them give us guidance on what was an acceptable value for the different items, especially the hours and mileage items. Herb asked if $10.00 an hour which was easy to figure and well below the value set nationally for a volunteer hour which was between $21.00 and $22.00 per hour and the rate for mileage at 14 cents per mile which is the rate used by the VFW for it’s prior reporting. Both Mr. Bollig and the A.G. staff thought that both figures were low, but if the VFW was satisfied with those figures, it was a fair and equitable amount. The VFW still uses those same amounts today and we know that the state reimbursement for mileage is much higher and the national average for a volunteer hour in 2023 was $33.49. Kansas VFW feels that the amounts shown in the matching funds are equitable and fair and we have followed this practice since the inception of VCAP in 2006.The items in Attachment F were made by Mr. Bollig under the direction of the legislature and the A.G. office. He trained Qm Herb and he in turn trained the members of Kansas VFW as to what was and was not acceptable to report.

Quartermaster Herb was asked to meet with the staff of the Legislative Post Audit of VCAP to explain to them the history of the Grant which he was told would take about an hour and the whole afternoon was spent covering the events of VCAP.

Kansas VFW has been very frugal in it’s use of VCAP monies and has on several occasions either paid for VCAP employee training expenses for the KCVA or not used the full amount of the program because the organization did not believe in wasteful spending of the tax payers dollar.

The KCVA was later changed to the KCVAO, (Kansas Commission on Veterans Affairs Office), and then in 2024 the name was changed to KOVS, (Kansas Office of Veteran’s Services).

Rebuttal

On page 5 the audit states that not enough documentation is available when on several occasions Quartermaster Herb asked the auditor that was working the Kansas VFW side of it if he wanted to look at printed documentation on file and we opened our reporting system storage on our computer program for him to verify the reports. This documentation of reports is kept by the Posts in a Community Service record book which documents each project and has receipts and pictures of the projects. Quartermaster Herb showed our auditor the record book his Post was keeping for the 2024-2025 Program year and he showed no interest in it. Deputy Director Bollig instructed the VFW to keep the projects well documented and clear and concise. He did come by several times to spot check the documentation and one time he brought a Kansas State Legislator with him to show him how it was being done. The Legislator was well satisfied when he left.

KOVS has been accused of not properly monitoring the program nor giving the participants proper training when in fact, on the VFW side they have done as required. If there was anything on the Reimbursement or matching funds report they were not clear on, they contacted us immediately for verification. Case in point: one of the financial employees of the KOVS in about 2014 was having trouble deciphering the coding used by the VFW so Quartermaster Herb started color coding each item so it would be more easily understood and interpreted. The VFW still uses this coding today.

Although Kansas VFW has explained the 2006 intent of the VCAP Grant over and over to the auditors they seem to want to form their own opinion of what it means now in their opinion. My question is this: Why would the VFW waste the money they have spent improving their reporting system to make it more accurate and reliable and continue to do the same reporting of these Service Hours for nineteen plus years spending countless hours compiling and verifying the reports if that was not the original intention of the Grant. Kansas VFW feels like the organization and it’s members are being branded as liars as all of our words have fallen either on deaf ears or they truly feel we are lying. Countless hours given by Kansas VFW Headquarters staff as well as the Quartermaster’s Office was open to the audit staff to use plus the Quartermaster’s computer was openly given for several days so the audit staff could scrutinize several years of documentation of the matching funds. The personal, office space, and equipment time given up for this audit was an obvious waste of time and resources. The opinion of Kansas VFW is that the Legislative Post Audit of the VCAP Grant is not worth the paper it is written on, and is at its best, a work of fiction. We feel it was an immense waste of the tax payer’s money!